Summary:

-

Boris Johnson delivers Tory party address

-

Little further detail on Brexit proposals announced

-

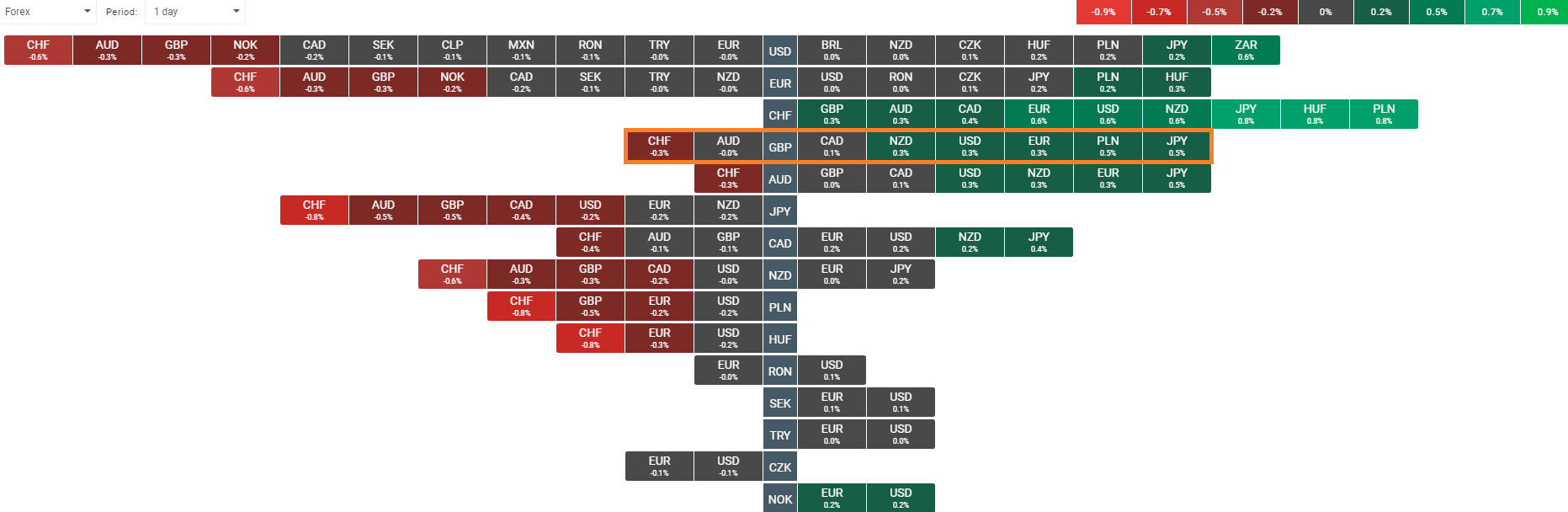

GBP remains mixed on the day

A keynote speech to close the Tory party conference from Boris Johnson has seen the PM double down on his prior stance and claim that the UK will be leaving the EU by October 31st “come what may”. The prime minister was typically flamboyant in his address with numerous soundbites and humorous references thrown in, but in keeping with allegations often levelled against him, also thin on the ground in terms of any real details as to how he hopes to secure a new and improved withdrawal agreement or solve the contentious backstop issue.

The pound trades fairly mixed on the day with little reaction seen from the PM’s speech. Perhaps the EU response which is expected later this afternoon will provide some market moving news. Source: xStation

The main substance of the latest proposal has been described as “two borders for four years” whereby Northern Ireland will remain in regulatory alignment with the EU - and presumably accept the freedom of movement of people within the island of Ireland - until 2025. This is far from a perfect solution to what appears an impossible problem but could well be about as good as it gets as far as a compromise is concerned.

While there’s not expected to be an official response from Brussels until later this afternoon when a phone call between Juncker and Johnson is scheduled, the noises coming out of Europe this morning suggest that these proposals may not be enough to forge a major breakthrough. The bloc have said that they will examine these objectively before making a decision and that they want to enter a constructive discussion with the UK.

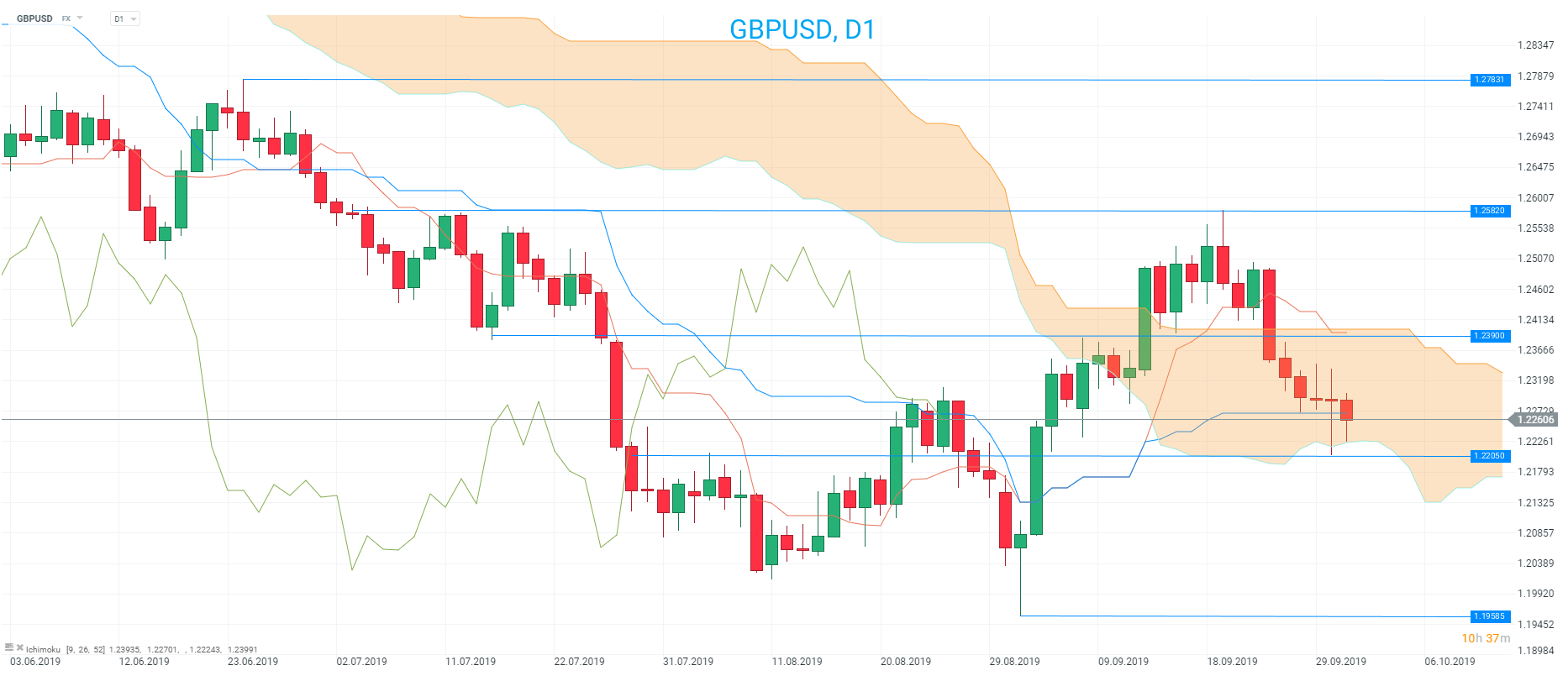

Given that much of this had been widely distributed beforehand there has been a minimal reaction in the markets with the pound little changed on the day after the GBP/USD rate fell to a 4-week low during Tuesday’s session. To summarise, despite all the headlines and bluster very little has changed and until there’s greater clarity on what actually lies ahead on the Brexit front the markets will likely remain in a wait-and-see mode and therefore be largely range bound.

GBPUSD bounced from its lowest level in 4 weeks yesterday at 1.2205 - a level that coincides with the bottom of the D1 cloud. Source: xStation

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.