The Chinese economy showed signs of stabilization in October as retail sales and industrial production rebounded from weak September figures and outperformed analysts' estimates.

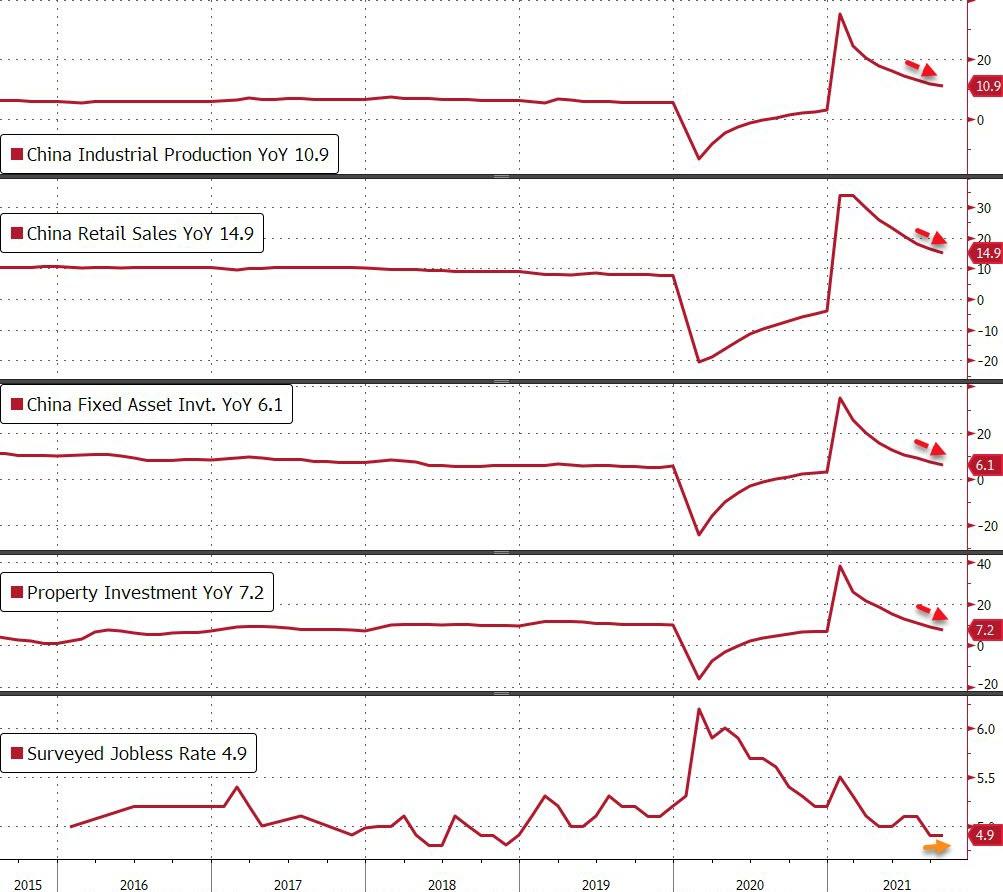

Industrial production increased 3.5% YoY in October (exp. 3.0% YoY) from 3.1% in the previous month. Retail sales jumped to 4.9% YoY higher (exp. 3.5% YoY) from 4.4% in September which on the first sight showed the country’s economy stabilizing as spending improved and power supply picked up. On the other hand, fixed asset investments fell to 6.1% YoY from 7.3% in September and below economists' projections of 6.3% YoY. Property investments dropped to 7.2% YoY from 8.8% YoY in September and below market estimates of 7.8% YoY.

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile app China's industrial output and retail sales grew more quickly than expected in October, but the slowing property sector weighed on the economic outlook. Source: Bloomberg via ZeroHedge

China's industrial output and retail sales grew more quickly than expected in October, but the slowing property sector weighed on the economic outlook. Source: Bloomberg via ZeroHedge

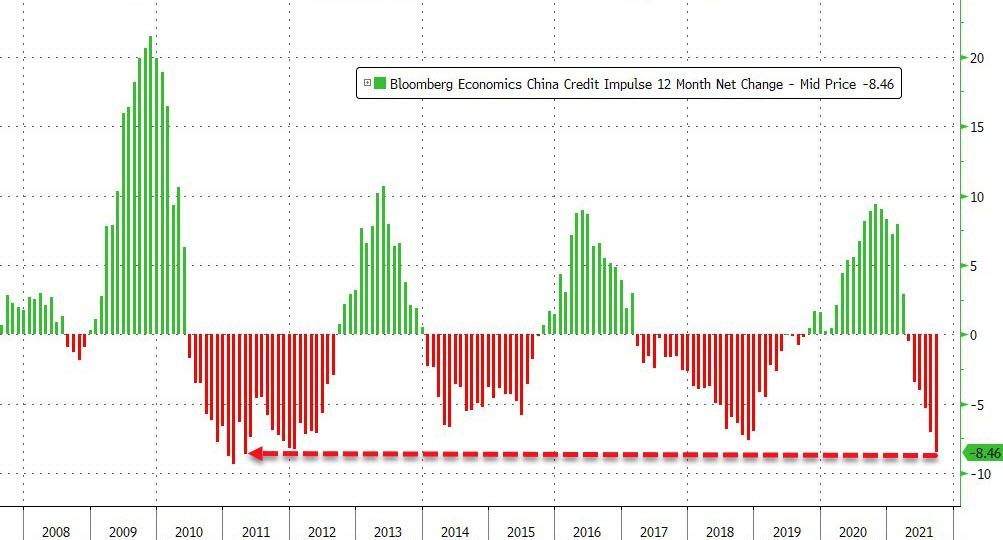

Despite relatively good data, officials and experts warn of bleak recovery prospects amid pandemic uncertainty and global supply chain problems. The main risk factor is weakening credit action. Credit impulse, defined as new funding provided by government, banking and other sources (e.g. issue of bonds and shares) in relation to GDP, has been in a downward trend since the beginning of this year. This indicator predicts not only the dynamics of GDP in China, but also the pace of growth of activity in global industrial processing. In order to maintain rapid growth in China, it will be necessary to increase support from fiscal and / or monetary policy.

This year China's credit impulse contracted at its highest pace since April 2011. Source: Bloomberg via ZeroHedge

This year China's credit impulse contracted at its highest pace since April 2011. Source: Bloomberg via ZeroHedge

However, according to Bloomberg's Chief China Markets Correspondent, Sofia Horta e Costa PBOC needs to be cautious. If liquidity tightens too much, there could be a repeat of the credit squeeze a year ago when the central bank injected excessive cash to the financial system and only a few months later, Chinese officials had to reduce the excessive leverage and warned investors of the risk of asset bubbles.

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.