The world's largest container ship operator, Denmark's Maersk (MAERSKA.DK) faces a number of logistical challenges, which led the company to recently issue a special warning on supply chains disruptions. Maersk warned of bottlenecks in the supply chain and unprecedented logistical challenges, related to the Gulf of Bab-el Mandeb and the Red Sea more broadly and also to the congestion that has formed on the west coast of the US (Oakland, California), through which ships cannot sail for goods from China at a satisfactory rate.

- Maersk's ships are circumnavigating the Cape of Good Hope, lengthening the freight from Asia to Europe, negatively affecting delivery times and business profitability; the company is trying to counteract this and has increased the cargo capacity of vessels by 6%

- Longer freight times have also negatively affected the company's ability to handle shipments from the US East Coast

- Maersk warned large customers like Nike and Walmart to prepare for higher logistics costs

- The giant indicates that companies should book deliveries in advance and be ready for problems in the second half of the year. The company stressed that some companies may not be ready for higher product prices

- The company's biggest threat appears to be the prospect of reduced consumer demand, which could put it in a difficult financial position, given logistics costs and problems in timeliness and liquidity of deliveries.

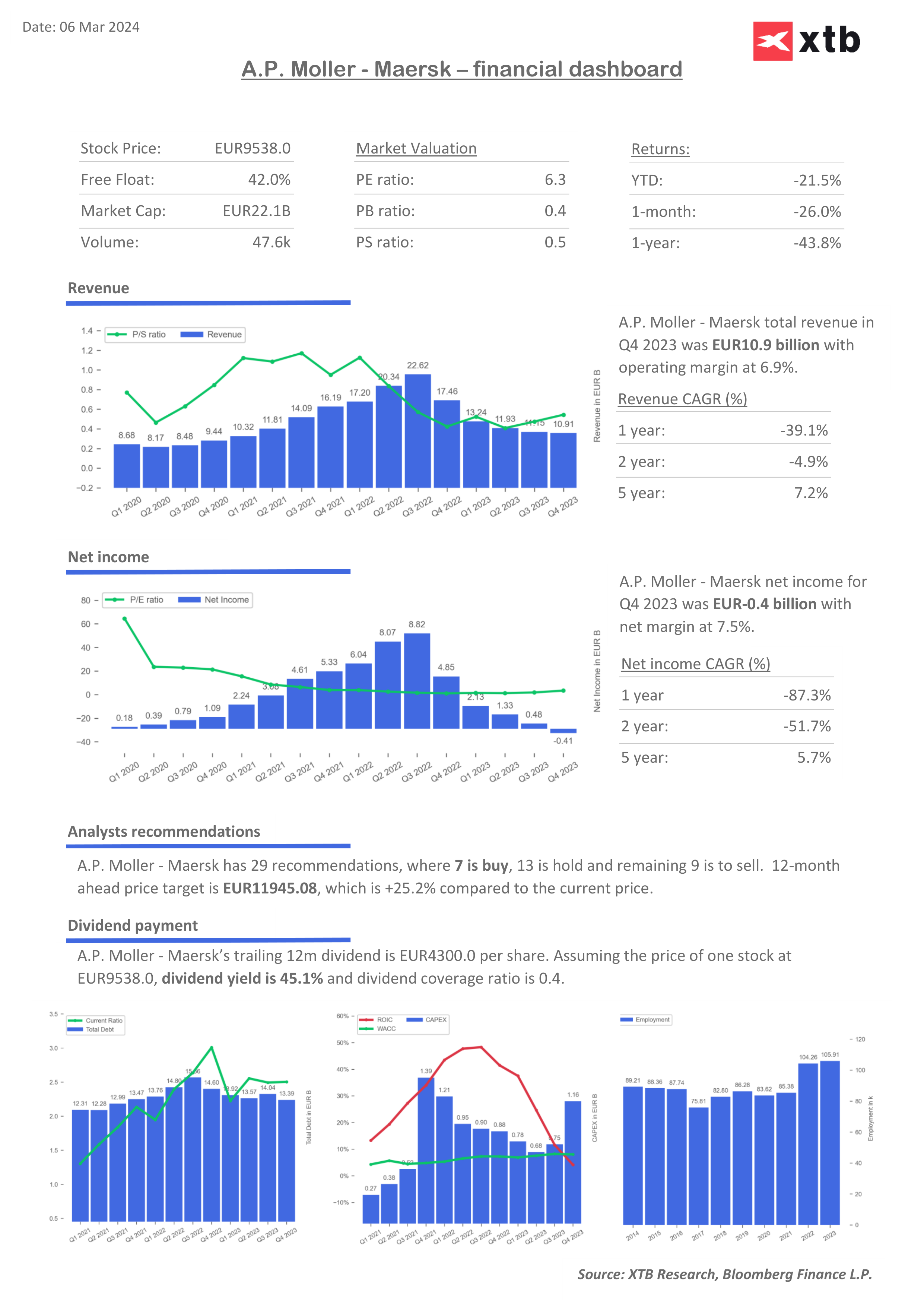

Interestingly, despite the still precarious situation in freight (where rate increases alone do not offset all costs for companies and do not guarantee an improvement in profits), shares of rival Hapag Lloyd (HLAG.DE) have not seen a decline comparable to Maersk, illustrating that part of the problems may be related to Maersk's logistical challenges. The company presented a net loss of €410 million in Q4, against which even Q1 2020 (covid) looks good, recording a €180 million profit at the time.

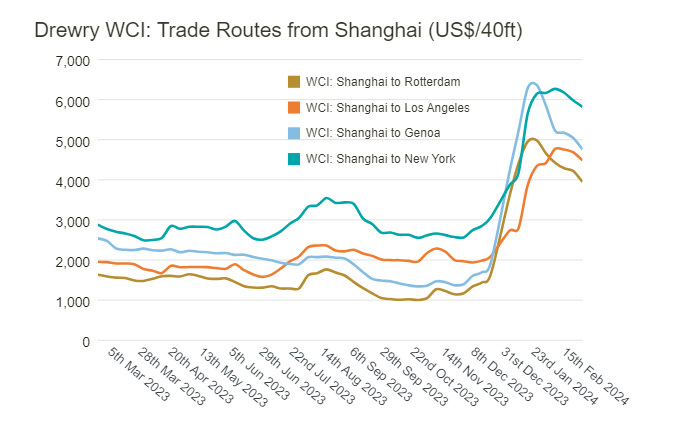

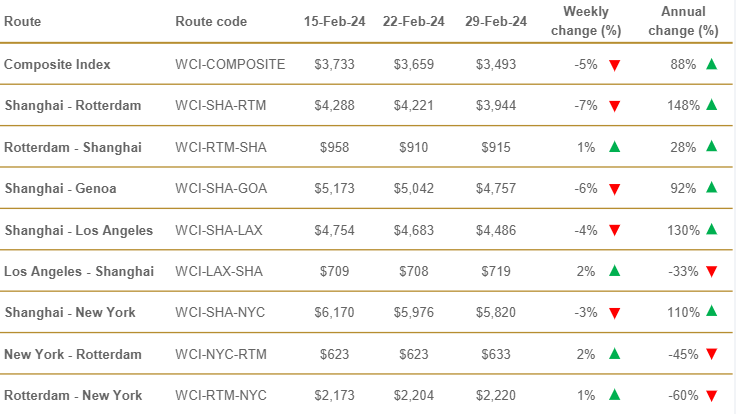

Freight costs for a standard 40-foot container have recently fallen, following a powerful rally fueled by concerns around the Red Sea. Source: Drewry Shipping

Year-on-year freight prices for a 40 ft container have risen most sharply on routes from Asia to Europe and Asia to the US; the benchmark index has rebounded 88% year-on-year, although it has seen nearly 10% declines in recent weeks. Last week, average shipping prices from Shanghai to Rotterdam fell 7%. Source: Drewry Shipping

Maersk shares (MAERSKA.DK), D1 interval

Source: xStation5

Source: xStation5

Return on invested capital (ROIC) has tumbled mightily from the very high levels of nearly 50% achieved in 2022 to less than 10% today, slipping below the weighted average cost of capital (WACC). This situation justifies the falling valuation. A price-to-sales ratio of 0.5, as well as almost 60% discount from book value (interestingly, without significant debt, which in relation to Maersk's 'equity' is about 8%) may seem attractive, but they reflect the high cyclicality of the shipping industry.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.