The US job market remains in the spotlight as the economy recovers from the pandemic slump and the NFP report could be absolutely crucial for the markets. Read this analysis to learn why.

Election Time!

Yes, that’s it – this is the final straight of the presidential campaign and Donald Trump needs a strong number to bolster his case of brisk recovery. Trump is seen in polls as more qualified to run the economy but is trailing Biden overall so he needs to show that he was able to restore solid economic conditions quickly. Nothing is more important for the voters than jobs and this is the last report before the Election Night. A good reading would therefore be welcome for markets for 2 reasons – it would confirm that the economy really improves and it would boost chances of Trump who is investors’ favorite in the Elections.

Employment growth to slow

After collapse in April, employment has been recovering at the pace exceeding one million per month. The market consensus doesn’t see it continued at least officially (expected number is +850k). This is partly because consensus workers are no longer being hired in significant numbers but also because the reservoir of ready-to-return workers from temporary layoffs is more and more depleted and the number of permanently unemployed increases as companies cut their costs. However, after upbeat ADP number (150k above the consensus) and against generally upbeat flow of US data, actual expectations might be higher and in our view a reading below 1 million would be seen as a bit of disappointment.

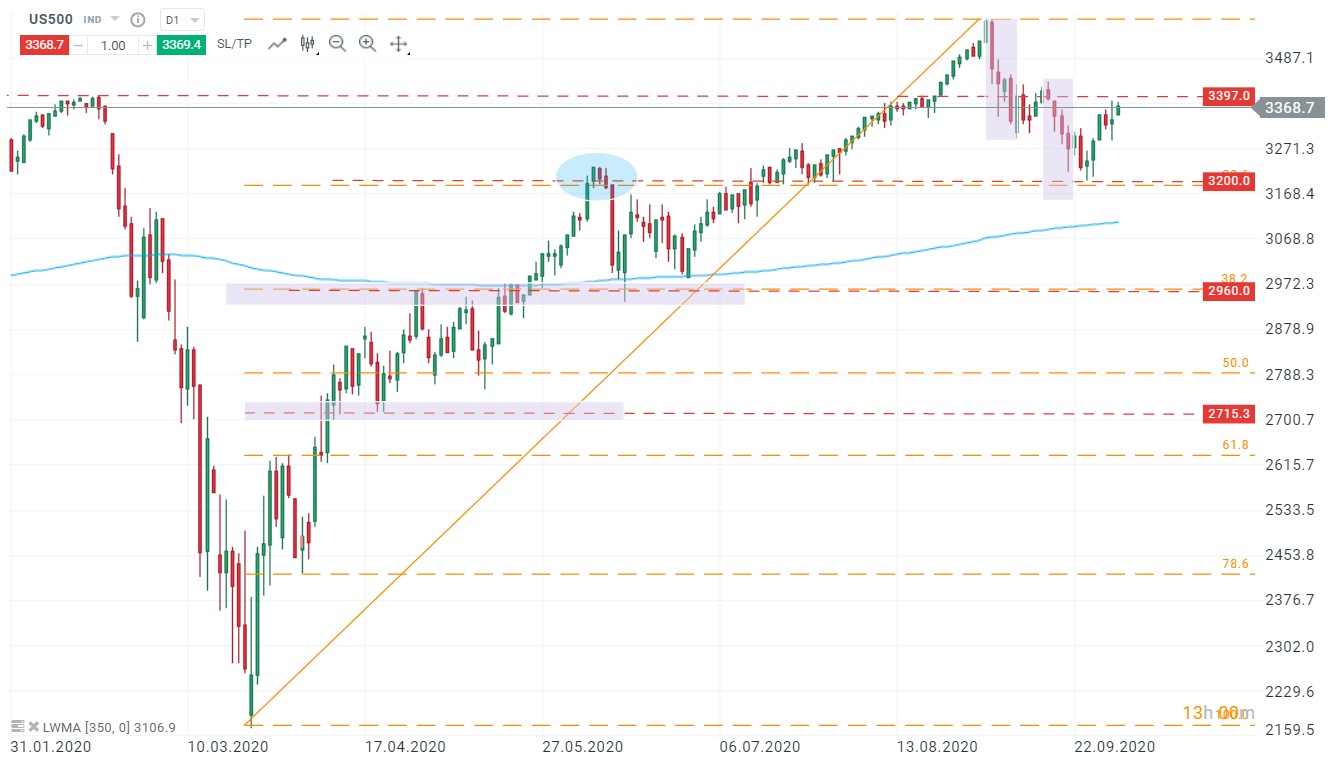

Market to watch : US500

We already mentioned why this reading is so important for the equities and the broad US500 is the market to be watched here. After the September correction the index managed to recoup some of the losses and looks to return to the upwards trend. A strong NFP would greatly help.

Economic Calendar - All Eyes on NFP (06.03.2026)

Morning Wrap - Oil price is still elevated (07.03.2026)

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.