-

Another strong NFP report expected

-

Lower ADP, higher ISM employment subindex, drop in jobless claims

-

EURUSD bounce off a key support, yields remain relatively low

-

Wall Street fears that Fed will start tapering, US100 near important support

NFP report for April is eagerly awaited by investors, especially after the latest release showed an over 900 thousand increase in US employment. Market expects a similar report for April, what can be reasoned with further reopening of the economy. What should we expect from Friday's report? How will EURUSD and yields perform? Will Wall Street recover from a recent sell-off triggered by concern of possible increase in interest rates?

High expectations?

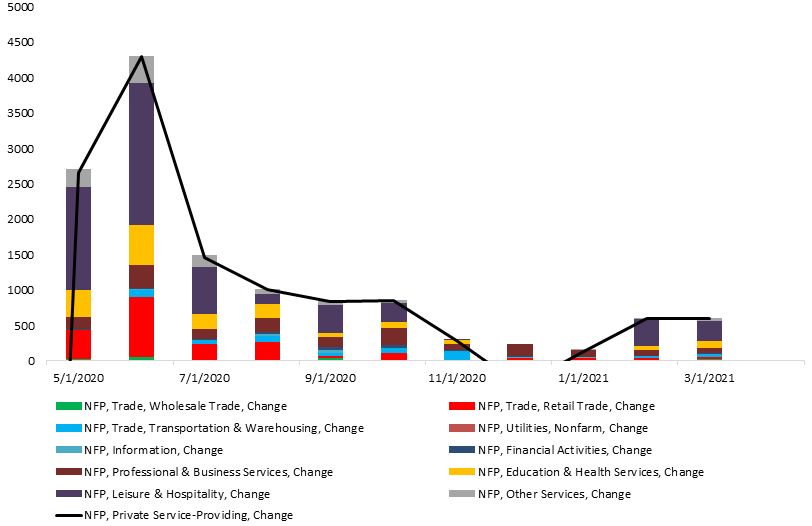

Market consensus compiled by Bloomberg points to a 998k employment gain in April. The lowest estimate hints at 700k increase while the highest suggests that 2100k jobs were created in the previous month. After a few months of stagnation, employment in Leisure & Hospitality as well as Education & Health Services has rebound over the past two months. Retail sector also experienced stagnation but in this case we may see a recovery in April due to a new round of stimulus checks.

Employment in Education & Health Services as well as Leisure & Hospitality segments experienced boom-like conditions in the past two months. However, those employment gains are not enough to satisfy the Fed. Source: Macrobond, XTB

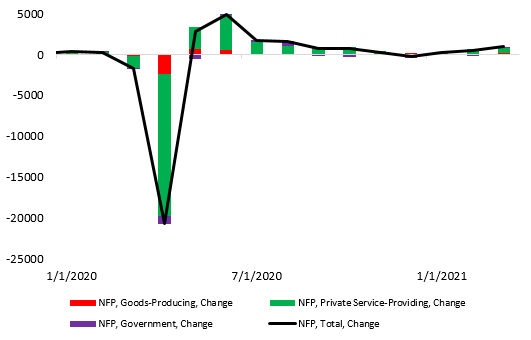

US economy is still short of around 8.4 million jobs lost during the pandemic. Will Fed change its view when employment starts to rise by 1 million jobs on a monthly basis? Source: Macrobond, XTB

What can we read from early signals?

Reopening of the economy is one thing but traders should also look at signals sent by companies. Situation looks to be improving on this front but that latest ADP report raises some concerns. It has shown a 742k employment gain, amid expected 810k increase. However, it should be noted that ADP pointed to a 565k increase in March while NFP report showed a gain of over 900k jobs.

Services ISM employment subindex increased in April from 57.2 to 58.8 - the highest readings since mid-2019. Meanwhile, manufacturing ISM employment subindex dropped in April from 59.6 to 55.1.

Average initial jobless claims dropped from around 720k to 610k since the last NFP release. The latest data showed claims significantly below 600k.

US monetary policy

Fed sent a clear signal that it is not concerned about inflation now. Latest remarks from Yellen calling for higher interest rates should not change the Fed's view. Having said that, even a stellar jobs report for April should not have a major impact on the direction of Fed's policy. However, should inflationary pressures mount, US central bankers may signal that there is a need to begin discussion about QE tapering. Given that the Fed has ignored recent signals, it looks unlikely that FOMC will decide to change policy prior to June.

EURUSD

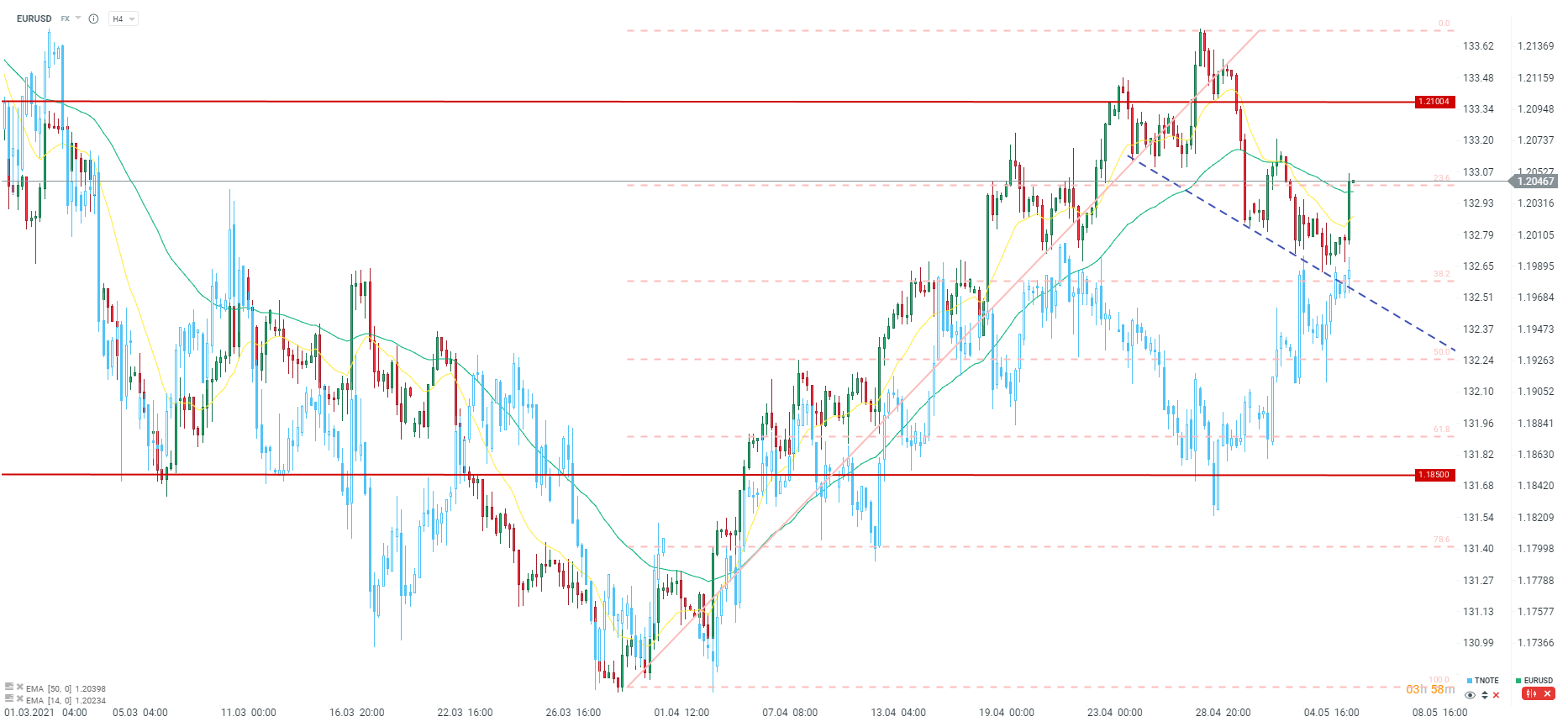

EURUSD managed to defend the key support area at 1.20 and relatively low yields may be the reason. As one can see, TNOTE trades near key short-term resistance at 132.8 points. Source: xStation5

EURUSD managed to defend the key support area at 1.20 and relatively low yields may be the reason. As one can see, TNOTE trades near key short-term resistance at 132.8 points. Source: xStation5

US100

US100 dropped hard following Yellen remarks on the need for higher interest rates. US100 reached the target of a double top pattern. 13,333 pts area is a key support for now. Source: xStation5

US100 dropped hard following Yellen remarks on the need for higher interest rates. US100 reached the target of a double top pattern. 13,333 pts area is a key support for now. Source: xStation5

Morning Wrap - Oil price is still elevated (07.03.2026)

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

BREAKING: US500 gains amid military officials remarks on Strait of Hormuz

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.