The cryptocurrency market, after a disastrous 2022 for the industry, is experiencing a real 'revival'. However, even Bitcoin's 140% growth has not satisfied the appetite of investors, who are looking to the future with increasing optimism. Where is this whiff of hope coming from, and is Bitcoin's truly bright future, in 2024, already a foregone conclusion?

Speculative rollercoaster

The first half of 2024 promises to be extremely exciting, due to the final decisions of the U.S. SEC regulator, in the case of the eagerly awaited ETF applications and the fourth ever halving of Bitcoin. The market expects the synergistic effect of both these events to start a new cryptocurrency bull market. Falling bond yields and a lower risk-free rate are throwing investors, once again, into the arms of risky assets. But is Bitcoin's future certain before the new year has even begun? The fact is that the creation of spot ETFs on Bitcoin, raises associations similar to the first such funds on the gold market or the S&P 500 index, which favored the price appreciation of said assets in the medium and long term. When analyzing the possible impact of such a scenario on the price of Bitcoin, it is necessary to understand how the new instrument would differ, from all those available so far?

Historically, events such as the launch of the first Bitcoin futures on the CBOE exchange in Chicago in December 2017 or the first ETF based on futures in 2021 led to profit taking. They failed to determine the medium-term trend and did not have the widely expected positive effects. Will this time be different? Source: XTB Research

Historically, events such as the launch of the first Bitcoin futures on the CBOE exchange in Chicago in December 2017 or the first ETF based on futures in 2021 led to profit taking. They failed to determine the medium-term trend and did not have the widely expected positive effects. Will this time be different? Source: XTB Research

ETF funds, would track the market price of Bitcoin, buying Bitcoins directly from the market, on behalf of investors, which would act as a hedge for such a fund. With a limited supply of Bitcoin, this makes it so that in the event of large institutional purchases, the natural result could be sharp price increases. All of this would take place in a manner technically identical to equities, without the need to engage in transactions on cryptocurrency exchanges or own so-called hardware wallets.

According to a number of analyzes, this would facilitate access to investing in Bitcoin, for those reluctant to innovate, and for institutions such as pension funds, which, thanks to ETFs, would be able to enter the hitherto inaccessible cryptocurrency market in accordance with regulatory requirements. It is worth noting that, for the moment, such an opportunity would be limited to US institutions. In Europe, the possibility of investing in Bitcoin outside of crypto exchanges has long existed, such as through the Swedish Bitcoin Tracker ETN, denominated in EUR, which, however, has not attracted serious interest.

Looking at the effort put in by a total of 13 institutions applying to create the first-ever, spot Bitcoin ETF, and the involvement of the agency itself, we conclude that approval of the applications is feasible. Reuters points out that the SEC has stepped up efforts and the frequency of stakeholder contacts, and the world's largest investment fund, BlackRock has once again modified its application. At the same time, in the short term, the impact of ETFs on Bitcoin may be less than the industry expects, leading an overheated market to realize profits and a 'buy the rumors, sell the facts' scenario. Without a doubt, however, an ETF fund on the spot price is something that could significantly increase demand and raise interest in Bitcoin.

Bitcoin's halving cycles

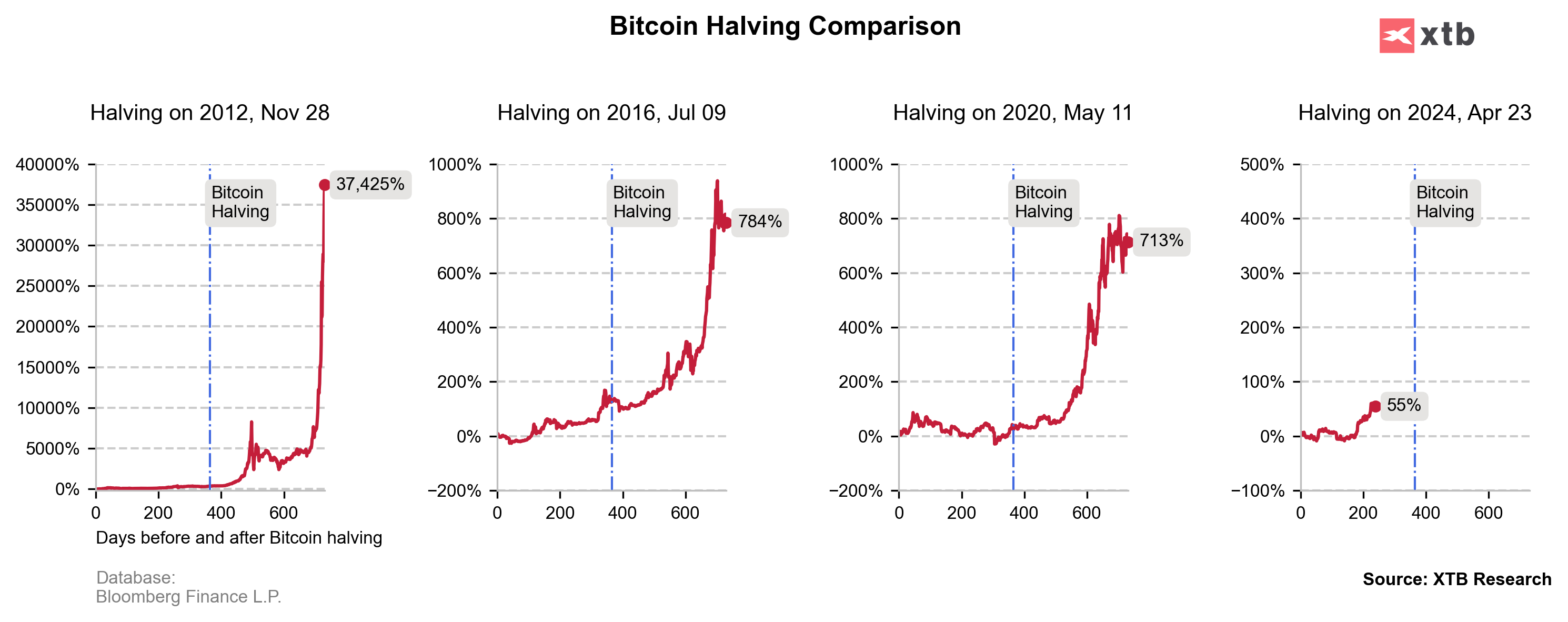

Bitcoin's history is only 15 years old, but investors in the industry closely follow the seasonality and dynamics of the cycles associated with so-called halving. Although the relatively very young market provides data that may not have significant statistical value, the dynamics of Bitcoin's three previous halving cycles suggest that they all affected the price similarly. Reducing Bitcoin's new supply and reward to 'miners' by half, affects investor sentiment. At the same time, it is important to remember that the past does not necessarily have to repeat itself in the future, although the mere reduction in the supply of an available asset should be positive for it - as it is, for example, in the commodities market.

After previous halvings, which occur on average every four years or so, Bitcoin's growth rate accelerated. This has led the market to link halving to cryptocurrency market increases, although three attempts are far too few to gain sufficient confidence in the durability of such a relationship. 90% of Bitcoin's total supply is already in the market, which clearly limits the real impact of further halving cycles. Source: XTB Research

Events that could disrupt Bitcoin's further growth could be not only unpredictable, random events, but also a sharp economic downturn or a second wave of inflation. None of the above seems likely at present. Falling inflation justifies the first central bank rate cuts, which, with consumers still strong, creates a favorable growth environment for cryptocurrencies, in 2024. There is also no basis for a collapse in sentiments on Wall Street (but of course, it always can happen). With lower yields and positive sentiment in the stock market, there are solid grounds that a cheaper US dollar should provide a favorable macro environment for further Bitcoin rise. Returning here to the "halving cycle" and the possible effect of ETFs debut, the fundamentals for continued growth are strong. Of course, there is room for disappointment or the aforementioned profit realization. However, it should be noted that the so-called Bitcoin reserves of long-term addresses (statistically reluctant to sell in a bull market) are at historic highs (about 75% of available supply), with record low Bitcoin balances, on cryptocurrency exchanges. This could mean that many investors are bracing for a continuation of the trend, limiting a supply.

Key dates:

- January 10, 2024 - SEC may make final decisions on ETF applications.

- April 23, 2024 - Bitcoin's fourth halving

Bitcoin (D1 chart)

BITCOIN, D1 interval. The cryptocurrency reacted by falling after reaching, at $44,000, the 38.2 Fibonacci retracement of the March 2020 upward wave. If the SEC rejects the ETF's applications, the first demand zone to test may turn out to be the $28,000 and $22,000 levels where we see the 61.8 and 71.6 Fibo retracements. In turn, a positive signal from the regulators could push Bitcoin above the 23.6 Fibo retracement at $53,600 in the medium term, from where the market would begin to seriously speculate about a new bull market. According to Glassnode, even despite the last third-largest one-day decline in all of 2023, Bitcoin is trading at a significant premium to many fundamental indicators of on-chain valuation, which suggest levels between $30,000 and $36,000 as relatively neutral. The rally has lost momentum, but this doesn't mean that Bitcoin will 'sleep through' the next few months, in a sideways trend. Source: xStation5

BITCOIN, D1 interval. The cryptocurrency reacted by falling after reaching, at $44,000, the 38.2 Fibonacci retracement of the March 2020 upward wave. If the SEC rejects the ETF's applications, the first demand zone to test may turn out to be the $28,000 and $22,000 levels where we see the 61.8 and 71.6 Fibo retracements. In turn, a positive signal from the regulators could push Bitcoin above the 23.6 Fibo retracement at $53,600 in the medium term, from where the market would begin to seriously speculate about a new bull market. According to Glassnode, even despite the last third-largest one-day decline in all of 2023, Bitcoin is trading at a significant premium to many fundamental indicators of on-chain valuation, which suggest levels between $30,000 and $36,000 as relatively neutral. The rally has lost momentum, but this doesn't mean that Bitcoin will 'sleep through' the next few months, in a sideways trend. Source: xStation5

Eryk Szmyd Financial Markets Analyst at XTB

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Bitcoin jumps above $70k USD despite stronger dollar📈

Daily summary: Markets capitulate under the influence of the Persian Gulf

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.