Summary:

-

Clear risk-off moves after Iran retaliates

-

Initial moves pared however

-

Boeing to drop after Tehran crash

There were some wild swings in the markets overnight after Iran carried out its retaliation for the US attacks last week. More than a dozen ballistic missiles were aimed at US forces in Iraq in the first military move against Washington since the killing of Qassem Soleimani. Oil prices jumped with brent crude moving above its recent peak to trade close to the $71 handle while Gold prices surged above the $1600/oz mark to hit levels not seen since Q1 2013. US stock futures tumbled by more than 1.5% as a clear risk-off mood gripped the markets.

However, these moves were subsequently pared and this has become a recurring theme in recent sessions as the initial knee jerk reaction faded back. The rationale for this seems to be that despite the clear escalation in US-Iranian tensions over the past week traders are still of the belief that things won’t get as bad as many have feared. Defence minister, Amir Hatami, has said that the response will be proportional and it is perhaps telling that the attacks seem to have been directed as to not cause maximum damage. We still await a detailed response from Trump, but his initial reaction on Twitter with a post that began with “All is well” suggests that the retaliation may not have further angered the US president.

While the markets remain on tenterhooks, fearful of any further escalation, there is a growing feeling that the latest events could have signalled a high-water mark in tensions between Tehran and Washington and hopefully the situation will not flare up any further.

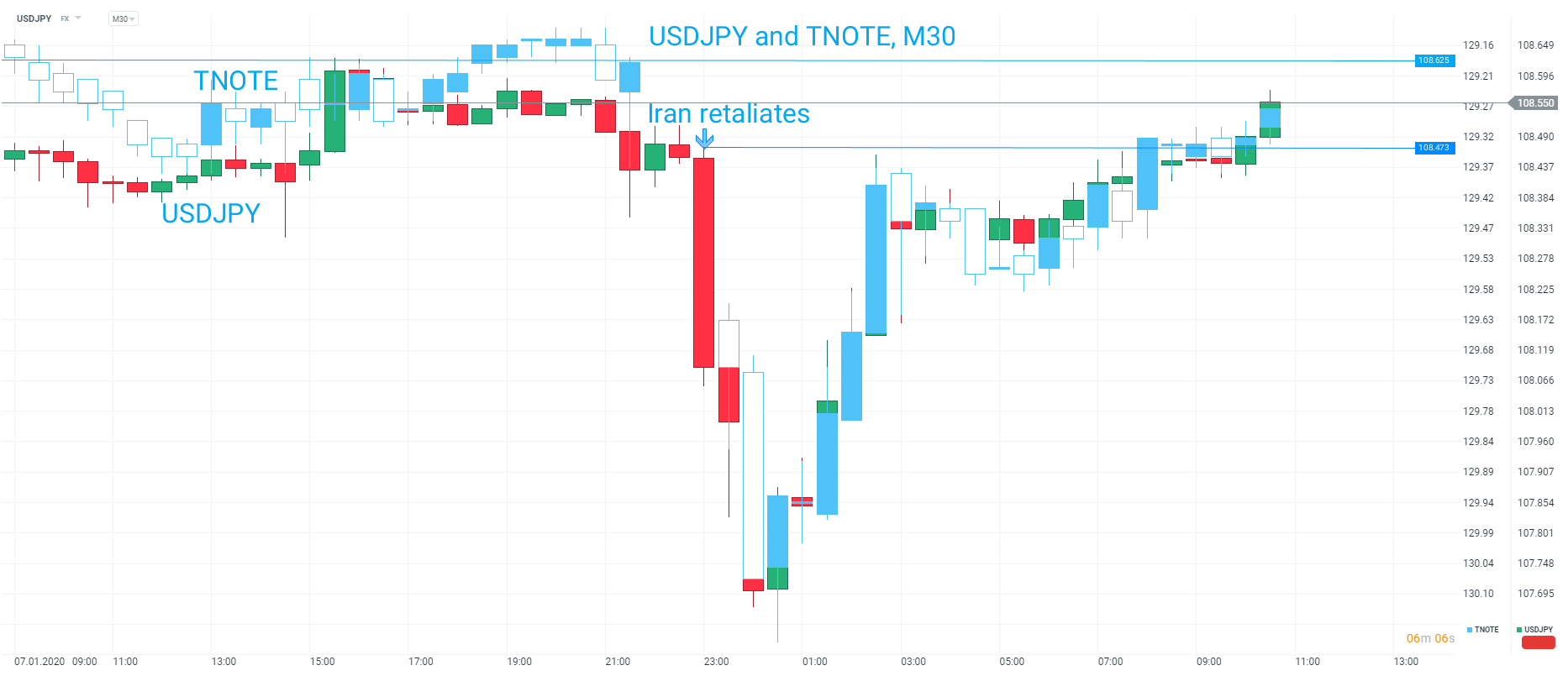

Risk off moves were seen in USDJPY (Green/Red candles) and the TNOTE (Blue/Transparent candles) as Iran launched the retaliatory attacks. However, both these markets have since pared the moves to trade back near where the were before the news broke. Source: xStation

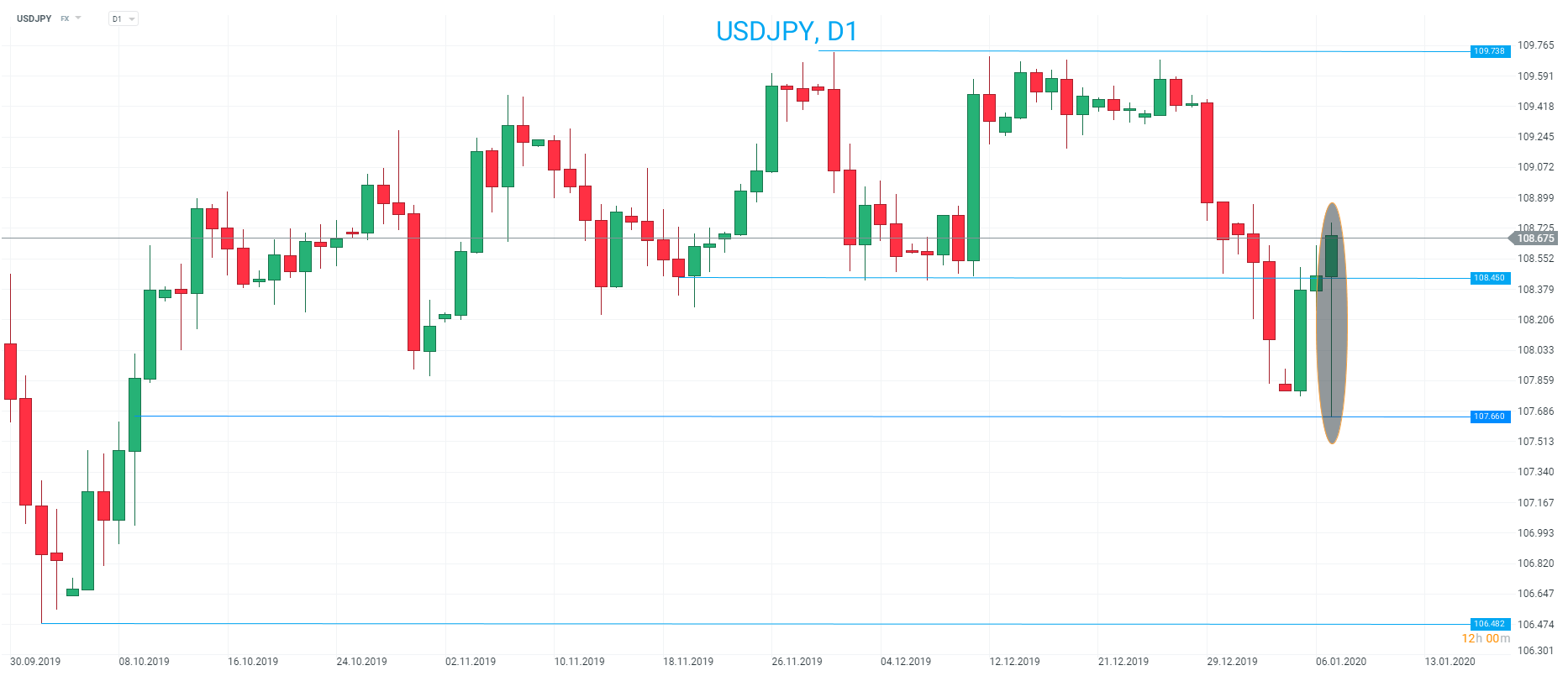

USDJPY is forming a large bullish hammer on D1 as the market looks to recover after being rocked by the latest tensions in the Middle East. Source: xStation

Market Wrap: Capital Flees Europe 🇪🇺 📉

Morning Wrap - Oil price is still elevated (07.03.2026)

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Morning wrap (05.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.