Key takeaways:

- Analysts expect Meta to report revenue of $33.52 billion (+21% YoY) and EPS of $3.60 for Q3 2023, up from $2.98 in Q2 and $1.64 a year ago.

- Investors will be tracking the benefits of Meta's heavy investment in AI, as well as a rebound in digital advertising driven by Reels adoption.

- CEO Mark Zuckerberg's commentary on new AI products and services, Threads, and regulatory pressure will be closely watched.

- Investors may also want a spending update, as Meta has continued to spend heavily on VR despite cost-cutting in other areas.

- Meta decided to launch significant cost-cutting measures and is expected that SG&A expenses to have dropped more than 30% in the past year (according to Reuters)

Expected financial data (from Bloomberg):

- Revenue Q3 23 estimate $33.52 billion

- Advertising rev. estimate $32.94 billion

- Family of Apps revenue estimate $33.08 billion

- Reality Labs revenue estimate $313.4 million

- Other revenue estimate $211.7 million

- Revenue estimate Q4 23 $38.76

- EPS estimate $3.60 (EPS beat estimates in 8 of past 12 quarters)

- Operating margin estimate 33.9%

Other statistics:

- Facebook daily active users estimated at 2.07 billion

- Facebook monthly active users estimated at 3.05 billion

- Ad impressions estimate +29.6%

- Average price per ad estimate -8.94%

- Family of Apps operating income estimated at $15.23 billion

- Reality Labs operating loss estimated at $3.94 billion

- The average Family service users per day estimated at 3.09 billion

- The average Family service users per month estimated at 3.88 billion

Key metrics to watch:

- Revenue from Meta's Family of Apps, which includes Facebook, Instagram, and WhatsApp. Moreover any comments over Threads, a new platform that is the new rival for X (ex Twitter)

- Ad impressions and average price per ad.

- Operating income from the Family of Apps and Reality Labs.

- Daily and monthly active users for Facebook and the Family of Apps as Meta faces strong competition from platforms such as TikTok and BeReal

- Average Family service users per day and month.

- Operating margin.

The market is generally bullish on Meta's long-term prospects, but analysts acknowledge that the company faces some near-term challenges, such as competition from TikTok, BeReal, or even Snapchat. Moreover, investors will closely watch the introduction of new ways to monetize businesses on its platforms and its deep integration of AI across its services.

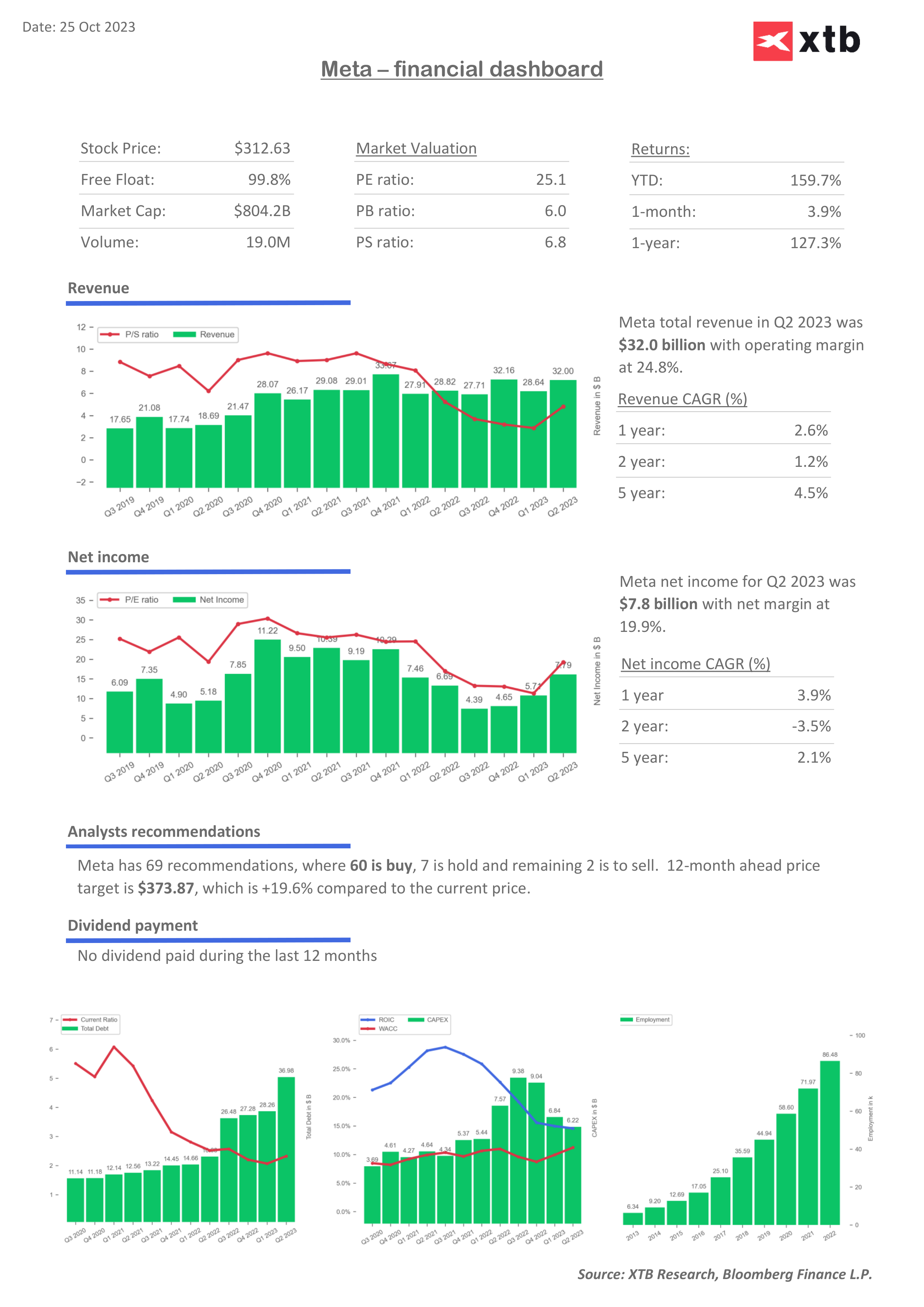

Dashboard for Meta. Source: Bloomberg Financial LP, XTB

Meta Platforms has recently been doing better than Nasdaq100 or the last driving force of the index, Nvidia. However, it is worth noting that the Meta is approximately 23% below the historical highs of 2021. The nearest resistance is at $330 per share, about 5% of the current price. On the other hand, the nearest support is close to $305 which is at the lower bound of the upward trend channel.

Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.