Social media giant Meta Plaforms (META.US, formerly Facebook) will report Q2 results after today's Wall Street session. Considering that the company's all apps amass nearly 3.78 billion users, its report could be crucial for many companies that mainly derive their revenues from digital advertising. Yesterday's results from Alphabet (GOOGL.US) indicate that Meta may surprise on the upside in the face of a rebound in the advertising sector. The market will pay attention to the company's costs and investments, primarily those related to AI and the 'Metaverse' concept pushed by Mark Zuckerberg.

- Revenues: $31.06 billion vs. $28.65 billion in Q1.

- Earnings per share (EPS): $2.92 vs. $2.20 in Q1.

- Number of active Facebook users (daily): 2.03 billion vs. $2.04 billion in Q1.

- Number of active Facebook users (monthly): 3 billion vs. $2.99 billion in Q1.

- Operating margin: 30.4% vs. 18.27% in Q1.

- Advertising revenue: $30.43 billion

- Reality Labs revenue: $391.9 million

- Estimated loss for Reality Labs: SD3.68 billion

Meta Platforms shares, after a dismal 2022 for the company, have already risen nearly 140% since January. The attention of the markets will focus not only on app traffic, costs and advertising revenues. Leading topics will be Twitter's rival project Threads and Metaverse, which remains particularly controversial because the development of 'virtual worlds' costs a fortune and is still far from paying off. The company's recent promises to develop AI have somewhat distracted investors from the 'cash burn' by Reality Labs, and if the results are positive investors will probably 'turn a blind eye' to the technology division's several billion loss.

Google revived ads - what about Meta?

- The company may benefit from the improved performance of its ad segment, with daily traffic of 3 billion people on leading apps like Facebook, What'sApp and Instagram. Address registrations on Threads rose to more than 100 million in just five days after integrating with Instagram (but user engagement soon dropped by 70%).

- If the rebranding, restructuring and transformation of Twitter into an X-to-everything platform' by Elon Musk ultimately fails, Meta could be a big beneficiary of all the turmoil. Investors will pay attention to whether Meta will be able to maintain lower costs despite outlays to develop the Threads brand.

- The company's Reality Labs division lost more than $13 billion in 2022, which hasn't deterred Zuckerberg from further investment. The company's latest VR kit, Meta Quest 3, will be released in the fall and may bring more answers to the question of whether the massive outlay will ultimately pay off. Apple is also entering the space with its Vision Pro headset.

Will AI bring Meta Platforms to life?

- As the topic of AI fires people's imaginations, Wall Street will also want to hear more specifics on how artificial intelligence can help the company and entice advertisers using Meta's services. More than 3 billion users give powerful access to data that can be used to develop AI. Meta Platforms and Microsoft recently announced a partnership to support LLM models on Microsoft Azure and Windows platforms.

- Meta plans to use AI to strengthen its presence in the metaverse, integrate users across platforms, improve business messaging and customer service, among other things. The key, however, seems to be not so much automation but how AI will help analyze customer behavior across platforms and how much advertisers will be willing to pay for the data. Zuckerberg recently indicated 'that advertisers should simply give the company a budget and a target, and the company will do the rest' - the company intends to heavily simplify the operating model with generative AI;

- JMP Securities analysts believe the company may be in the early stages of reaping the benefits of AI both in terms of automation supporting lower costs and catalysts for a number of products, including Reels or Threads.

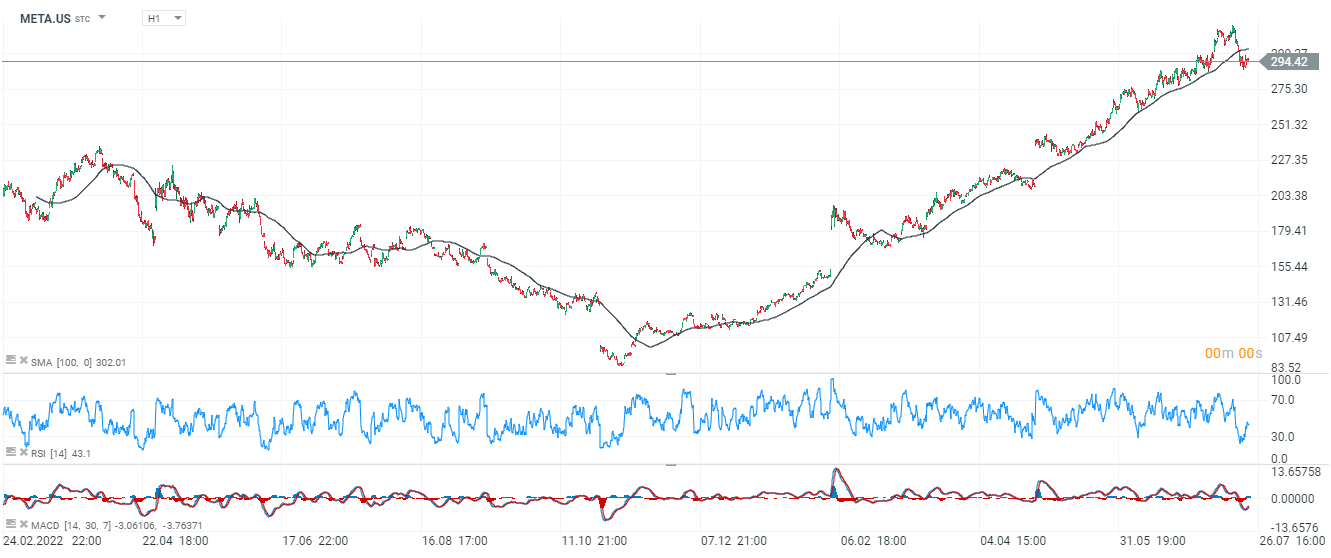

Meta Platforms (META.US) shares, H1 interval. The company's shares on the lower hourly interval have been discounted quite dramatically, which is well reflected in the sudden RSI, which was below 30 points for a while (over 40 points today). Since the autumn of 2022, any drop in stocks below the SMA100 was quickly dialed up by the bulls, and if the results do not surprise negatively we can expect a continuation of such a scenario. Source: xStation5

Meta Platforms (META.US) shares, H1 interval. The company's shares on the lower hourly interval have been discounted quite dramatically, which is well reflected in the sudden RSI, which was below 30 points for a while (over 40 points today). Since the autumn of 2022, any drop in stocks below the SMA100 was quickly dialed up by the bulls, and if the results do not surprise negatively we can expect a continuation of such a scenario. Source: xStation5

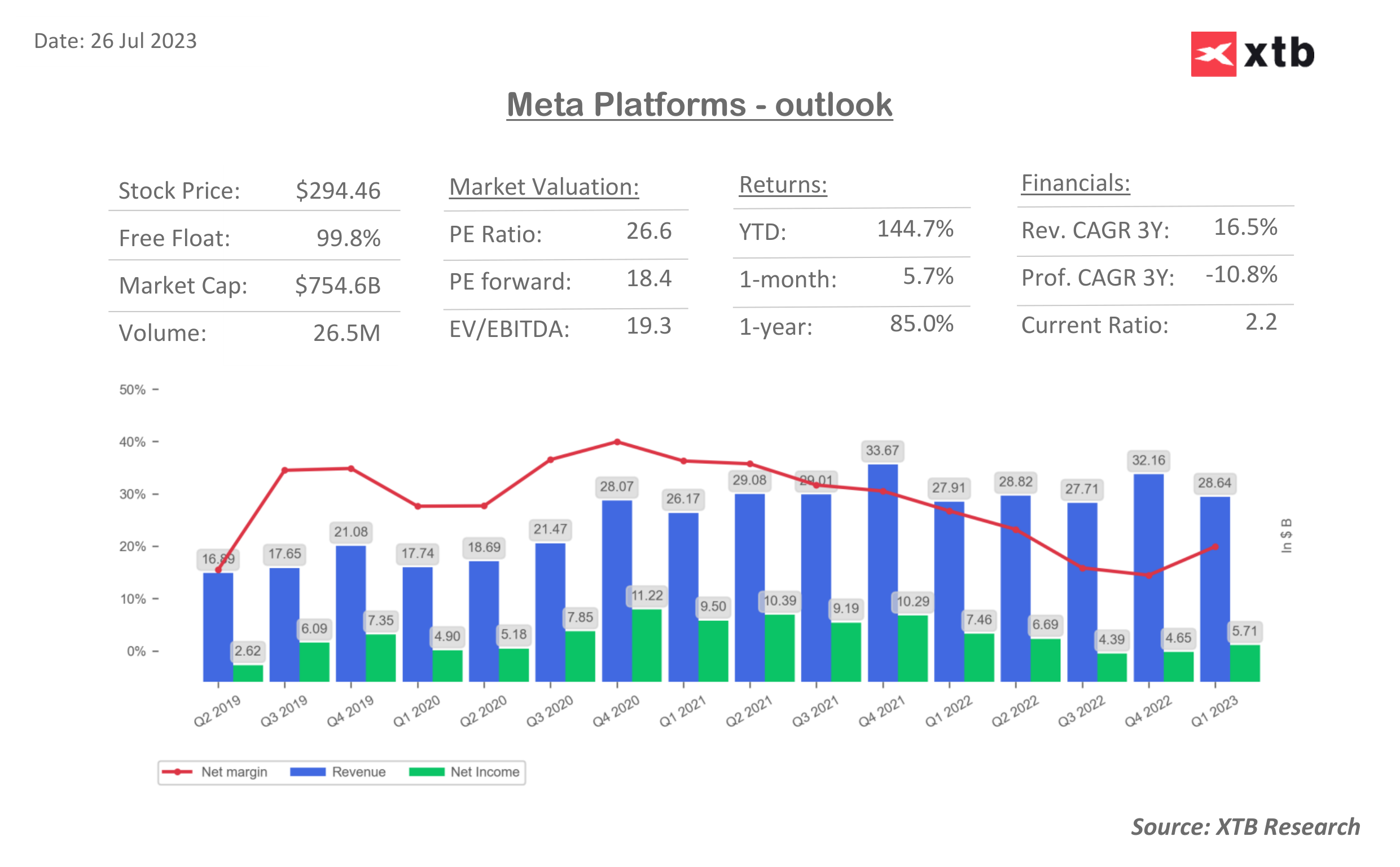

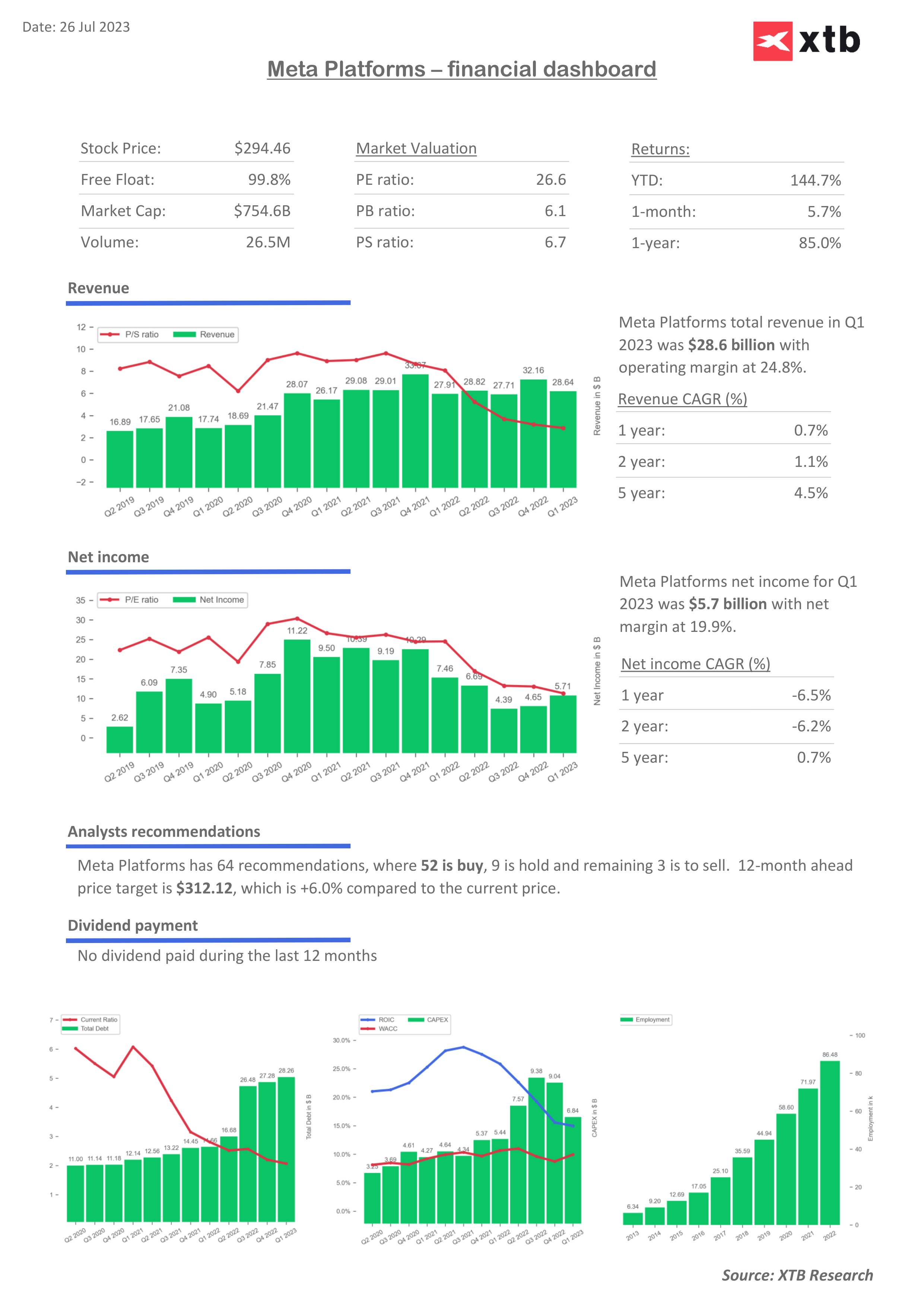

Source: XTB Research, Bloomberg

Source: XTB Research, Bloomberg

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.