Meta Platforms (META.US) shares settled below $90 today. The company is being dragged down by rising development and research spending on virtual reality technologies and negative investor sentiment toward risk. In Q3 2021, META's free cash flow was $12.8 billion; it now stands at $317 million. This represents a massive decline in less than a year and also the lowest level in a decade. In addition, shareholders are clearly uncomfortable with the lack of a dividend policy and Zuckerberg's near-total control over setting the company's direction, based on the shareholder structure. The company's valuation has melted by nearly 70% since the beginning of the year, with a capitalization loss of more than $660 billion, which is roughly equivalent to Warren Buffett's entire fund, Berkshire Hathaway.

Bad times for new technology?

A hawkish Jerome Powell and an interest rate hike-focused central bank in the U.S. is a highly unfavorable environment for investment in new technologies. Rising rates mean rising financing costs. In addition, slowing economic activity is causing advertisers to cut back on ad spending, which is hurting Meta, whose main source of revenue is still Facebook and Instagram. The market seems to doubt the success of Mark Zuckberg's futuristic, dangerous visions and fears the possible effects of the company's failure.

Is the Metaverse a bottomless pit?

Zuckerberg signaled as early as 2021 that the company would undergo a transformation from a social hub of popular apps and platforms, to a technology company focused on moving user activity into virtual reality, dubbed Metaverse. Since the inception of its Reality Labs division, Meta has spent nearly $36 billion on development in this area, and returns are not even on the horizon yet.

Zuckerberg's vision - far from generating profits

Mark Zuckerberg is focused on increasing spending on the virtual reality segment at a time when Europe's biggest war in 80 years is underway, inflation has become a massive problem for the global economy, energy prices are raging and consumer sentiment is nowhere near as euphoric as it was a year ago. The economic slowdown is knocking on the door of the new technology and equipment market. It's hard to expect investors to like the idea of entrusting their own funds to Zuckerberg's 'vision of virtual reality' in such an extremely uncertain macro environment. Just nearly a year ago, the market reacted euphorically to news of the creation of the Metaverse. Share prices of companies like Unity and Matterport literally exploded, as did cryptocurrencies offering platforms in the metaverse space like Decentraland and Sandbox. Today, we see that market sentiment has changed, and the pendulum is starting to swing out in the opposite direction. Meta Platforms' valuation fundamentally now seems potentially the most attractive of all US major tech stocks.

It has a C/Z ratio of about 8.8 points, a C/WK ratio of about 2 points, and a debt-to-equity ratio of about 0.08. Metaverse's spending of about $36 billion since Reality Labs' inception may indeed 'scare' investors to whom the concept of virtual worlds does not appeal, but its scale does not seem as massive as it looks when one considers the value of the company's revenues. In the last two quarters, Meta's revenues totaled about $55 billion. Has Wall Street caved and overreacted with panic? As the percentage of quarterly spending on the Metaverse increases, the company's share price is falling. Currently, Metaverse spending is already close to 33% of quarterly revenue and continues to rise. The average for the past two years is roughly 23.3%. Share price as of October 30. Source: Ycharts

As the percentage of quarterly spending on the Metaverse increases, the company's share price is falling. Currently, Metaverse spending is already close to 33% of quarterly revenue and continues to rise. The average for the past two years is roughly 23.3%. Share price as of October 30. Source: Ycharts

Meta is still powerful

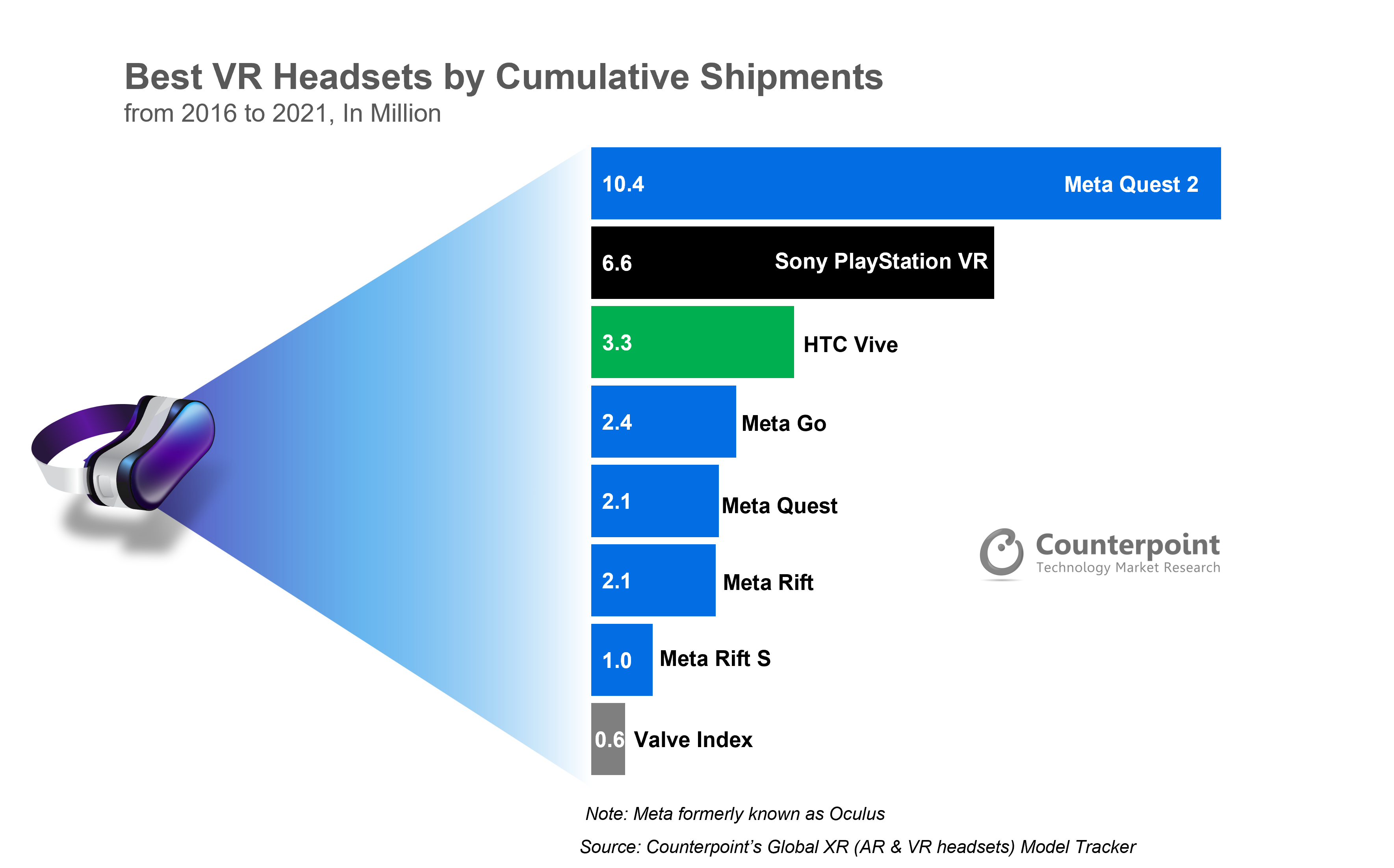

Zucerkberg's company still has nearly 4 billion people using its apps and platforms like Facebook and Instagram. It seems very likely that ad revenues will jump once advertisers significantly increase ad spending, and the macro landscape will improve as inflation falls. With both social media platforms giving Meta its largest global 'market', the company may still be the 'first choice' for many advertisers. However, it faces Apple's policy of limiting its ability to track its own users' activities and personalize ads. In addition, the market for so-called VR headsets has been dominated by devices produced by Zuckerberg's company, Oculus. The company was absorbed by Meta back in 2014. Competition in price and quality for VR kits provided by Meta is still not seen on the horizon (which does not mean that one will not appear). Oculus headsets continue to beat the biggest competing brands in popularity, 'divide and rule' in the market of new virtual reality technologies and enjoy very positive feedback from users. Source: Counterpoint

Oculus headsets continue to beat the biggest competing brands in popularity, 'divide and rule' in the market of new virtual reality technologies and enjoy very positive feedback from users. Source: Counterpoint Meta Platforms (META.US) share price. Source: xStation5

Meta Platforms (META.US) share price. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.