Big-tech companies are extending the wave of publishing surprisingly good quarterly results. Yesterday, Meta Platforms (META.US) boasted its results, managing to post a surprising increase in revenue, raising its full-year guidance and announcing that it will further strengthen its commitment to developing new AI solutions. All of this saw the company's shares rise more than 12% in the market after the close of the trading session on Wall Street. Let's look at the key details of the report presented:

Key result positions:

-

Earnings per share (EPS): 2.20 USD vs. 2.03 USD expected

-

Revenue: 28.65 billion USD vs.27.65 billion USD expected

-

Daily active users (DAU): 2.04 billion vs 2.01 billion expected

-

Monthly active users (MAU): 2.99 billion vs. 2.99 billion expected

-

Average revenue per user (ARPU): 9.62 USD vs 9.30 USD expected

-

Reels video monetization (Facebook and Instagram): +30% Facebook; +40% Instagram

-

Advertising impressions up 26%; previously assumed up 14%

-

Operating cost forecast lowered by a further 3 billion USD for 2023 due to 25% headcount reduction

-

Revenue forecast for Q2 2023 raised to a range between 29.5 billion USD and 32 billion USD; previously it was 29.5 billion USD

The surprisingly strong performance of advertising revenue will enable the company to allocate free capital to more innovative ventures, Zuckerberg comments. A lot is expected to happen, especially in the realm of AI, Zuckerberg added during the conference call, with artificial intelligence expected to have a significant impact on every Meta Platforms-branded app and device. Source: Bloomberg

The surprisingly strong performance of advertising revenue will enable the company to allocate free capital to more innovative ventures, Zuckerberg comments. A lot is expected to happen, especially in the realm of AI, Zuckerberg added during the conference call, with artificial intelligence expected to have a significant impact on every Meta Platforms-branded app and device. Source: Bloomberg

Regarding the employee situation, Meta plans to resume hiring after the layoffs end next month. The company expects to add employees particularly in the Reality Labs, advertising infrastructure and artificial intelligence sectors.

The company has been successful in its overall cost-cutting program, further encouraging investment in new ideas. The rest of the year will bring a continuation of this trend (expenditure forecasts have been reduced by 2 billion USD to 90 billion USD). Source: Meta

The company has been successful in its overall cost-cutting program, further encouraging investment in new ideas. The rest of the year will bring a continuation of this trend (expenditure forecasts have been reduced by 2 billion USD to 90 billion USD). Source: Meta

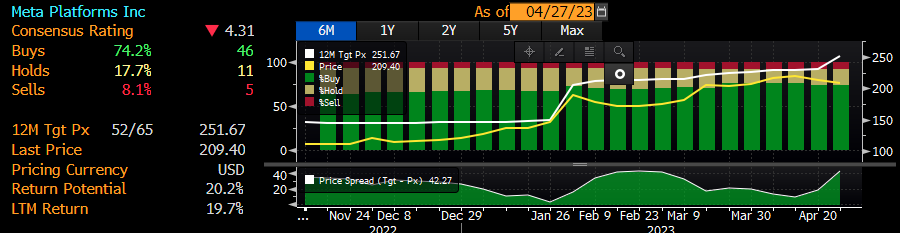

The good results did not escape investment bank analysts, either, who significantly raised their target prices for Meta's shares. Morgan Stanley raised its recommendation to 300 USD per share and JP Morgan analysts valued the company's shares at 305 USD per share. Source Bloomberg

Meta Platforms (META.US) share chart, W1 interval. Yesterday's trading after the close of the Wall Street session saw the share price rise to the April 2022 resistance area, which will now be the main control level defining further sentiment on the shares of this company. Source: xStation 5

Meta Platforms (META.US) share chart, W1 interval. Yesterday's trading after the close of the Wall Street session saw the share price rise to the April 2022 resistance area, which will now be the main control level defining further sentiment on the shares of this company. Source: xStation 5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.