- Market expects revenues of around $75.5 billion, with year-over-year growth of approximately 14% and an EPS of $3.66.

- Copilot and Cloud services performance will be crucial

- Investors will play close attention to any mentions of competitors and potential agreements related to AI

- Forward guidance might "make or break" the market's sentiment

- Market expects revenues of around $75.5 billion, with year-over-year growth of approximately 14% and an EPS of $3.66.

- Copilot and Cloud services performance will be crucial

- Investors will play close attention to any mentions of competitors and potential agreements related to AI

- Forward guidance might "make or break" the market's sentiment

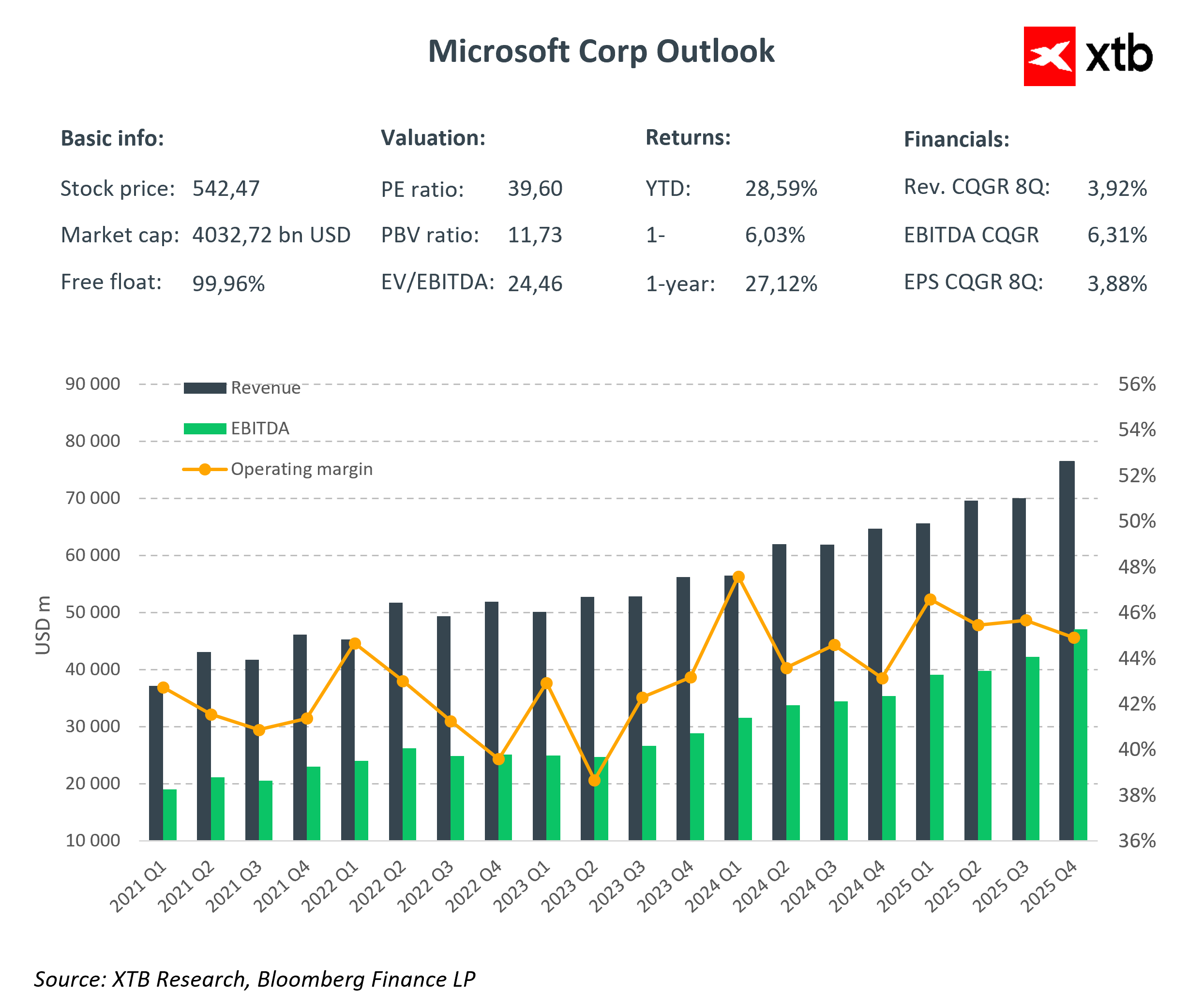

Microsoft is one of the pillars of the global digital economy and a brand that permeates almost every aspect of software. The company's financial results often become a barometer of demand for technology and investments in data infrastructure and artificial intelligence. Today, after the stock market closes in the United States, the company will present its report for the last quarter. Not only the results table itself will matter, but also the interpretation of trends in individual business lines and guidance for the coming months.

- The market expects revenues of around $75.5 billion, which would mean a year-over-year growth of approximately 14% and an EPS of $3.66.

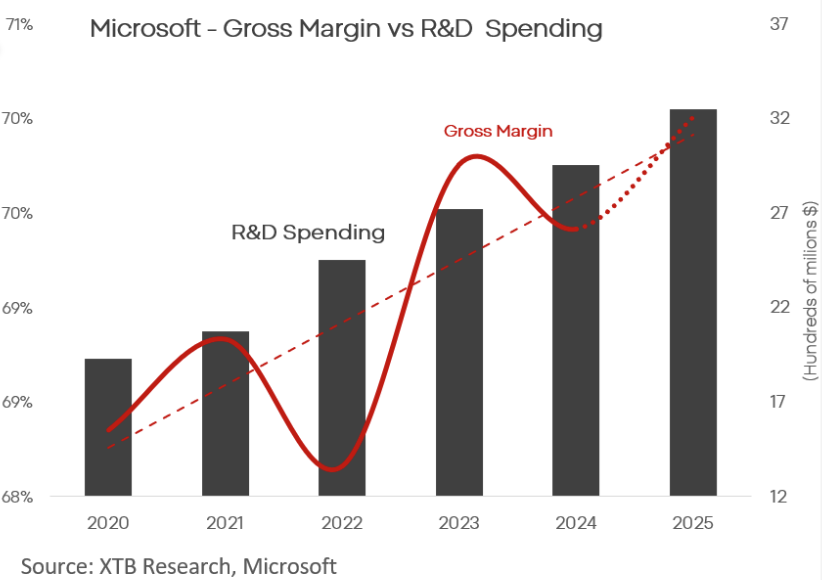

Beyond hitting these values, it will be important how the company describes the condition of its main segments and whether it confirms the sustainability of demand for cloud services and AI-based solutions. Investors will compare the dynamics of revenues and margins over the last quarters to assess whether the current growth rate is sustainable.

Cloud

Cloud operations will be at the center of attention. The Intelligent Cloud segment currently accounts for about 40% of the company's revenues. Market expectations assume that Microsoft's cloud revenues will grow by over 20% year-over-year to around $46 billion. The dynamics of the Azure platform, which reflects the migration to the cloud, will be particularly closely monitored. Important indicators may also include server service usage rates, customer base, and the relationship between growth and the costs of expanding data centers.

Copilot

The second star of the evening will be Copilot, a set of AI-assisted features in office products. Investors are counting on maintaining a high growth rate of users and, more importantly, a clear increase in monetization.

Key data will include conversion rates from trials to paid plans, revenue per user, and the expansion of Copilot's availability in subsequent layers of the ecosystem, from office suites to software development tools and customer contact solutions.

Expectations

Beyond the numbers themselves, the tone of communication and forecasts matter. Microsoft is among the leaders in investment spending on computing and storage infrastructure, and the market expects clear evidence that these expenditures will translate into sustainable cash flow growth.

Valuations remain high, so the margin for error is small. Market participants may expect an increase in profit guidance for the coming quarters. Too conservative signals or cautious commentary from management could cool sentiments.

An important thread will be references to competition, with particular emphasis on cloud services. A positive surprise, however, could be the announcement of new cooperation with a company deeply involved in AI development, which would strengthen the message about the advantages of the Microsoft "ecosystem," reinforcing expectations for further expansion in cloud and AI-assisted services.

MSFT.US (D1)

Source: xStation5

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Block Inc. lays off 40% of its workforce and rises 16% - Is this a new paradigm?

US OPEN: Wall Street holds its breath ahead of Nvidia earnings

Michael Burry and Palantir: A well-known analyst levels serious accusations

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.