Microsoft (MSFT.US) will report its fiscal-Q4 2024 earnings report today after close of the Wall Street session. This will the first of Big Tech earnings report scheduled for this week, and may help shape market sentiment ahead of report from other tech heavyweights. Let's take a quick look at what analysts expect from the release and what to focus on!

What analysts' expect?

Analysts' are expecting Microsoft to report a slowdown in total revenue growth, with growth being expected to decelerate in each of three key segments. Growth in Intelligent Cloud segment is expected to slow below 20.0% YoY, following 4 consecutive quarters of acceleration. Also, the company is expected to report a slowdown in commercial cloud revenue, to the lowest pace since fiscal-Q4 2023.

Profitability is also expected to deteriorate compared to a year ago period with gross, operating and net margins projected to be lower than in fiscal-Q4 2023. Nevertheless, the company is still expected to report positive growth in gross, operating and net income amid still-strong, although slower than previously, revenue growth.

Microsoft is expected to report an over-5% drop in free cash flow. However, it should not be seen as a big negative as the reason behind this is actually a positive - a massive, almost-50% jump in capital expenditures, which reflects increased investments in AI.

Microsoft fiscal-Q4 2024 expectations

- Revenue: $64.52 billion (+14.8% YoY)

- Productivity & Business Processes: $20.21 billion (+10.5% YoY)

- Intelligent Cloud: $28.72 billion (+19.7% YoY)

- New Personal Computing: $15.54 billion (+11.7% YoY)

- Commercial Cloud Revenue: $36.84 billion (+21.6% YoY)

- Cost of Revenue: $19.73 billion (+17.5% YoY)

- Gross Profit: $45.01 billion (+14.2% YoY)

- Gross Margin: 69.8% (vs 70.1% a year ago)

- Operating Expenses: $17.23 billion (+13.8% YoY)

- Operating Profit: $27.35 billion (+12.8% YoY)

- Operating Margin: 43.5% (vs 43.2% a year ago)

- Net Income: $22.05 billion (+9.8% YoY)

- Net Margin: 33.6% (vs 35.7% a year ago)

- EPS: $2.97 (vs $2.70 a year ago)

- Adjusted EPS: $2.94 (vs $2.69 a year ago)

- Capital Expenditures: $13.27 billion (+48.4% YoY)

- Free Cash Flow: $20.05 billion (-5.2% YoY)

- Billings: $78.66 billion (+27.7% YoY)

- Remaining Performance Obligation: $276.33 billion (+20.7% YoY)

Microsoft is expected to report revenue growth slowdown in each of three key segments. Dotted lines on the chart mark fiscal-Q4 2024 forecast. Source: Bloomberg Finance LP, XTB Research

What to focus on?

While headline results are the first things to catch investors' attention during earnings releases. A key to market reaction is usually in the details. There are a few themes that investors will focus on in the upcoming Microsoft's earnings release.

AI spending will be a big theme. Markets are projecting a big increase in Microsoft's CapEx compared to a year ago quarter. Failure to meet those expectations may trigger a pullback on the stock and a broader sector, as it will signal that AI prospects may not be as good as earlier thought.

Cloud performance and Office revenue will also be on watch, with the company expected to report a slowdown in cloud revenue growth. However, it is expected that the two will remain a stable source of revenue for the company.

A recent CrowdStrike incident is likely to also get a mention, but it is unlikely to have any major impact on the company's business. After all, it wasn't Microsoft's fault, but an issue with CrowdStrike software updated that cause blue screen errors on computers with Windows OS.

Last but not least, Microsoft's outlook for fiscal-2025 (calendar July 2024 - June 2025) will be watched closely as well. However, there is a feeling among analysts that Microsoft may offer a conservative guidance amid normalization of growth rates and compression of margins.

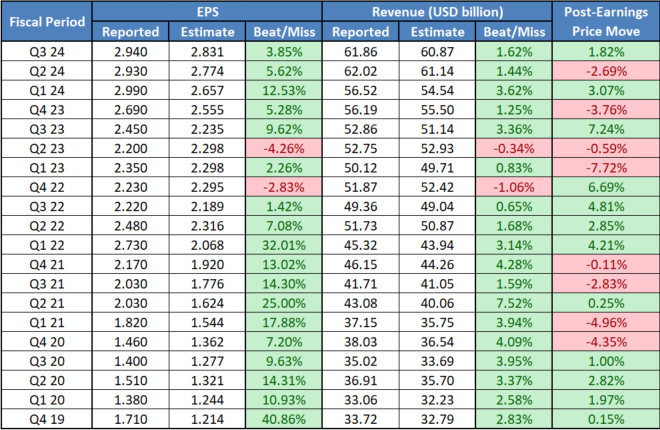

Microsoft's earnings history with beats, misses and price reactions for the past 20 quarters. Source: Bloomberg Finance LP, XTB Research

A look at the chart

Taking a look at Microsoft (MSFT.US) chart at D1 interval, we can see that the stock has pulled back from all-time highs recently during a broader tech sector sell-off. However, the pullback looks to have been halted in the $419 area, marked with previous price reactions and the 61.8% retracement of the upward move launched in late-May 2024. Stock opened above the 50% retracement in the $428.50 area yesterday, but bulls failed to maintain those gains. Should today's earnings report disappoint and stock drops, key levels to watch can be found in the aforementioned $419 area (61.8% retracement) and $411 area, where early-June local lows and the lower limit of the market geometry can be found. On the other hand, a strong earnings report combined with solid fiscal-2025 guidance may push the stock higher. In such a scenario, $438 area, marked with 50-session moving average (green line) and 38.2% retracement may offer some resistance.

A point to note is that the average absolute post-earnings move for the past 20 Microsoft quarterly earnings releases is 3.2%, while options markets pricing implies an around-3.8% post-earnings price move. The lower limit of the market geometry in the $411 area is 3.7% below yesterday's closing price, while the 38.2% retracement in the $438 area, which we suggested as potential resistance level to watch, can be found 3.2% above yesterday's close.

Source: xStation5

Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.