MicroStrategy’s preferred shares have lost nearly 7.0% and 13.5% this month as sentiment in the cryptocurrency market deteriorated. As a result, the decline in preferred shares raises questions about the company’s ability to continue financing Bitcoin purchases and covering cash-paid dividend obligations.

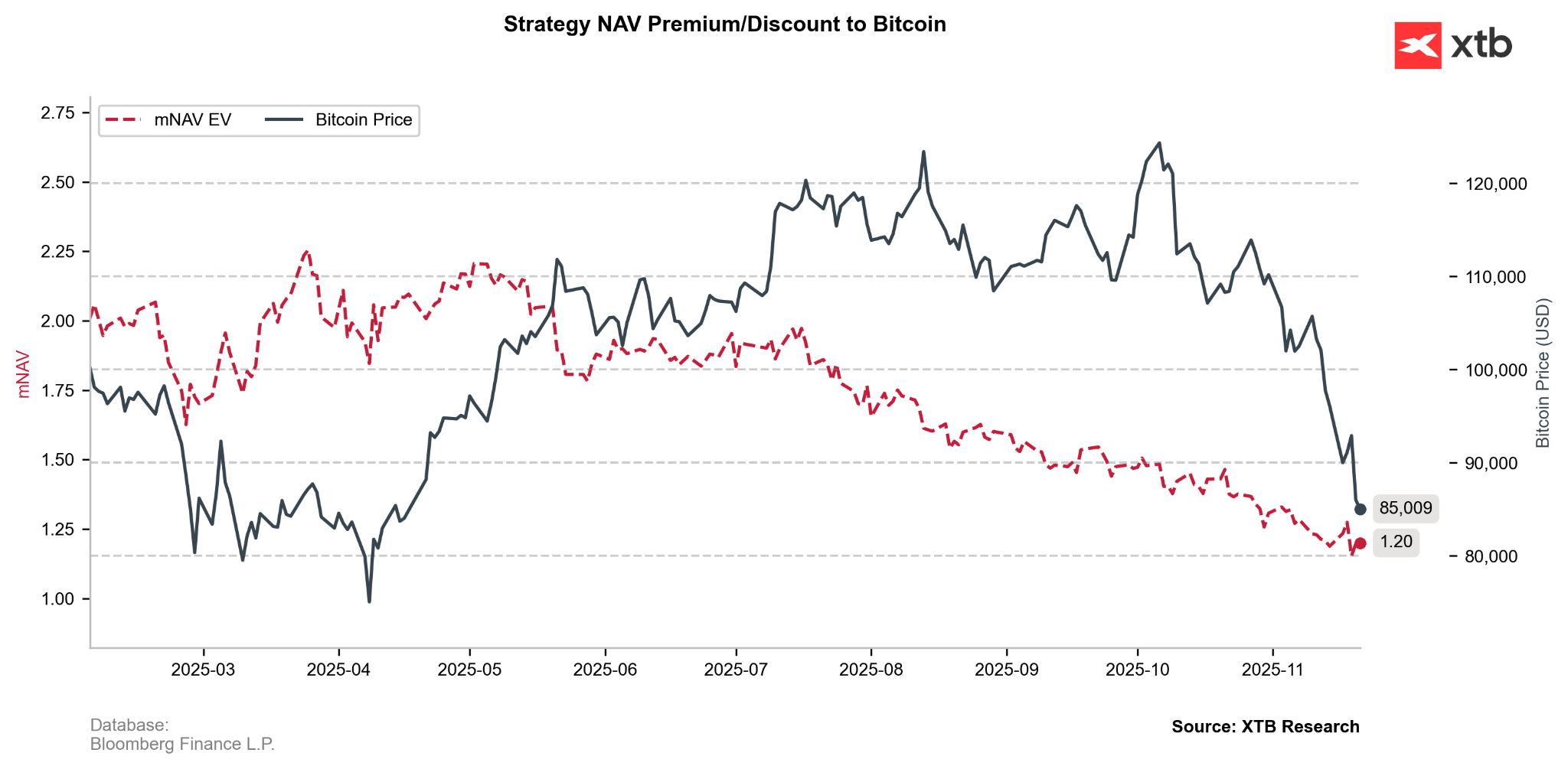

The company’s premium, which historically allowed Strategy (MSTR.US) to raise capital more cheaply than buying Bitcoin directly, has been declining steadily since mid-2025 (mNAV = EV/BTC holding).

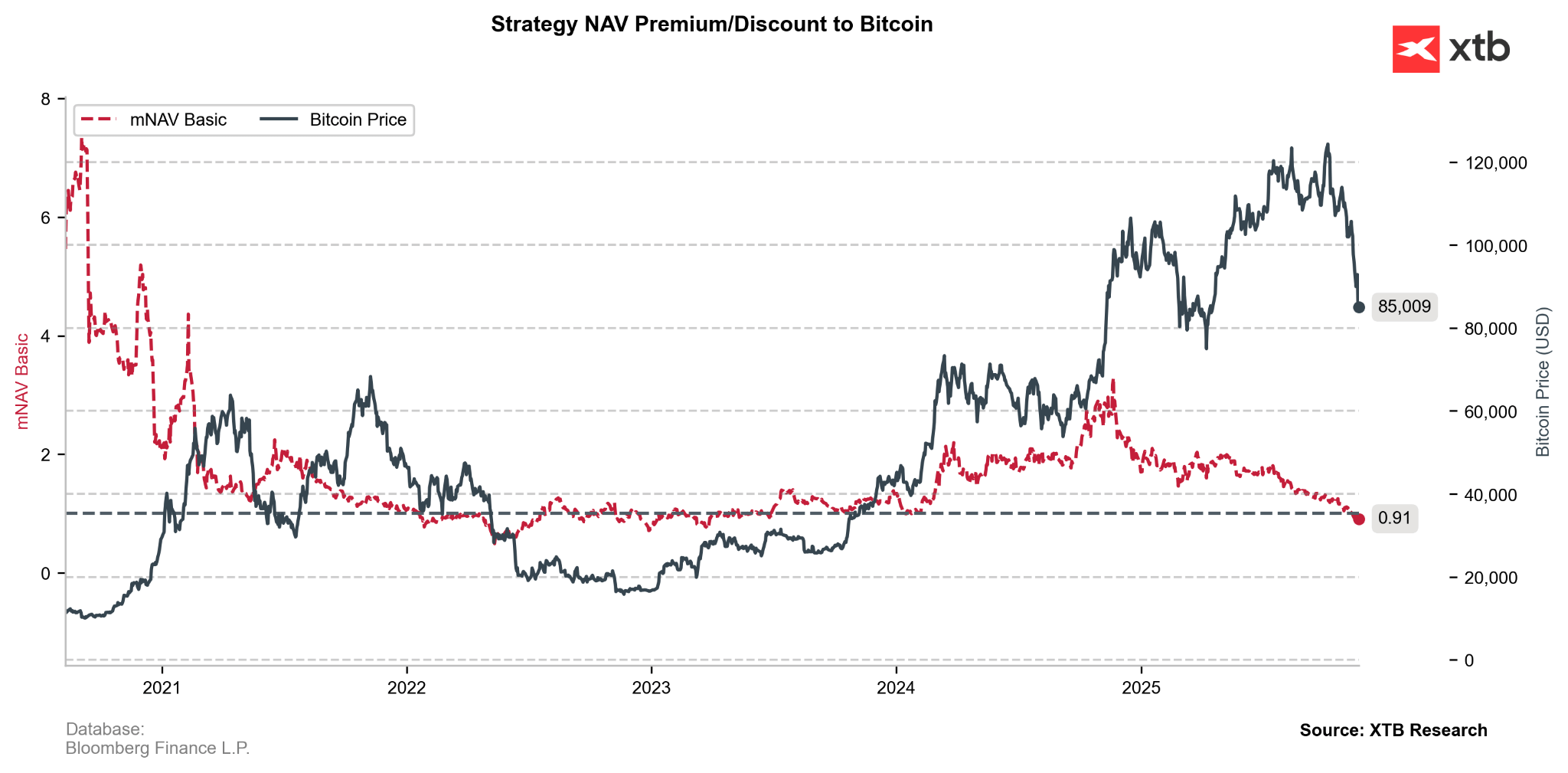

The mNAV Basic ratio (mcap / BTC holding) has fallen below 1, meaning the company’s total market capitalization is now lower than the value of the Bitcoin it holds at current prices. JPMorgan also warned that MicroStrategy could be removed from major MSCI indices, which could trigger outflows of 2.8–8.8 billion USD.

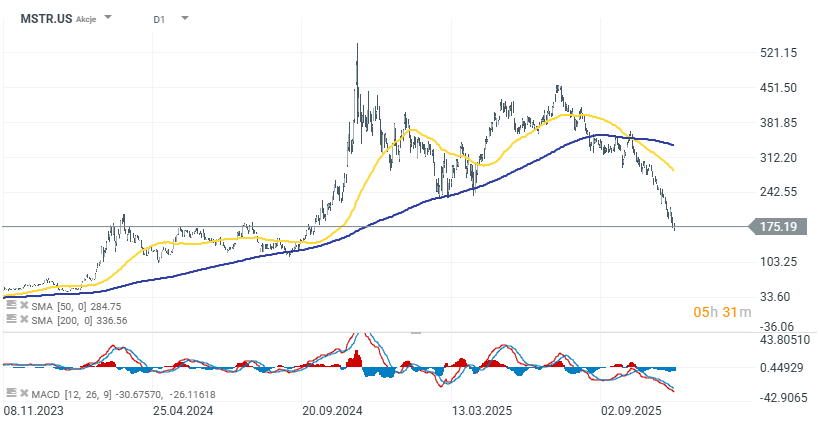

MSTR shares have fallen 10% this week, 55% over the past six months, and 60% year-over-year — much more sharply than Bitcoin itself, which is down 32% from the peak. The stock is trading near 52-week lows amid very high volatility. The company continues to raise capital through new preferred-share issuances, but rising funding costs and the risk of index removal remain key risk factors for investors. In the short term, the most important element appears to be stopping the decline in Bitcoin. Strategy is not facing a liquidity threat, as the nearest debt obligations mature only in 2027 (a small portion) and in the years that follow.

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.