-

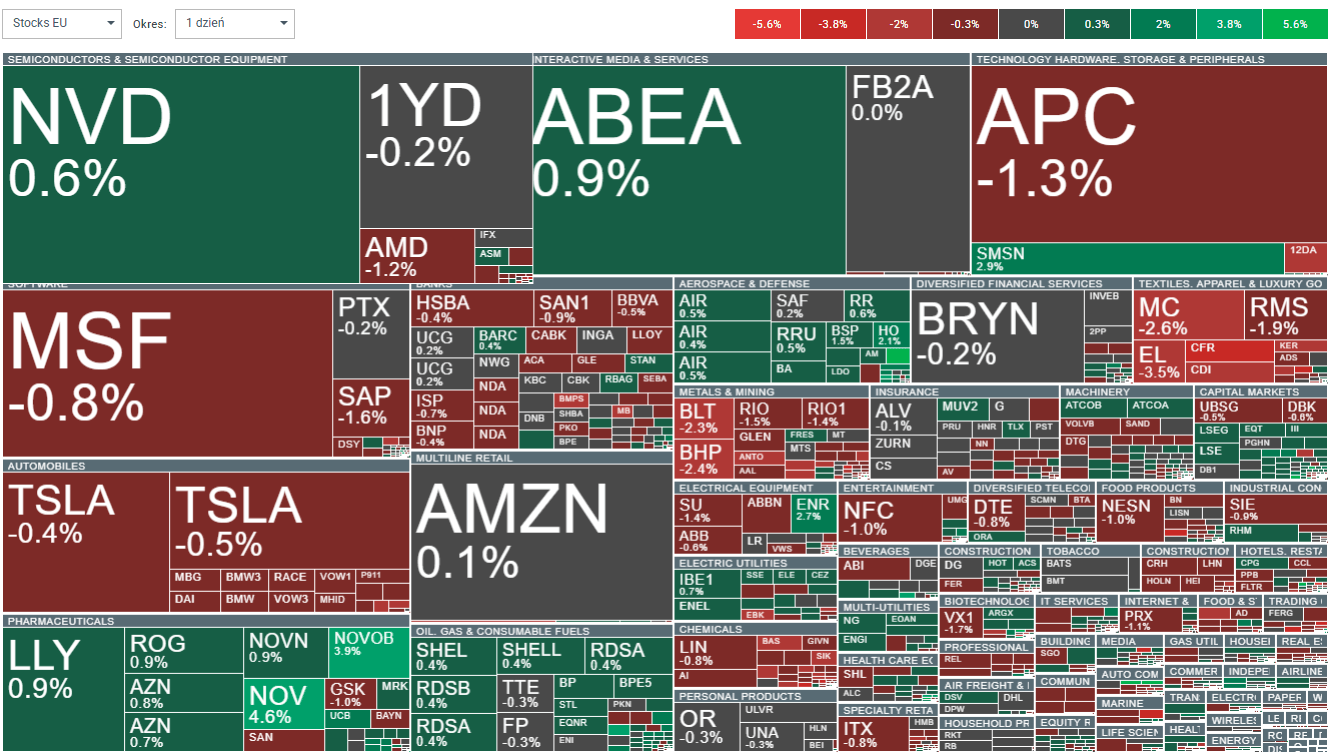

Sentiment in European equity markets remains mixed toward the end of the week. The Euro Stoxx 50 is down 0.40%, Germany’s DAX is up 0.10%, and overall moves are contained within a ±0.40% range.

-

Market mood in Europe is increasingly shaped by the technology sector, which is up 11.8% YTD. This makes it the second-best performing sector after basic resources and clearly stronger than US technology stocks, which are currently consolidating.

-

Companies such as ASML, ASM International, and BE Semiconductor account for nearly 40% of the Stoxx 600 Technology Index and have generated almost 90% of the sector’s gains this year.

-

Optimism was further reinforced by TSMC, which delivered very strong capital expenditure guidance, supporting expectations of a sustained upswing among its supply-chain partners. The world’s largest contract chipmaker forecasts capex growth of around 30% in 2026, along with a significant increase in spending over the following three years.

-

Confirmation of strong demand in TSMC’s results is clearly positive for European suppliers of data-center and semiconductor manufacturing equipment. Demand for production tools is expected to remain strong beyond 2026, especially as new fabs come online and physical capacity constraints gradually ease.

-

Morgan Stanley raised its price target for ASML to EUR 1,400 (from around EUR 1,165 currently, implying roughly 20% upside). This is among the highest valuations on the market. The bank expects strong order inflows over the next two to three quarters, with improved growth prospects likely to persist at least through 2027.

-

The current rally marks a reversal of earlier weakness among European semiconductor equipment makers, which had lagged US peers at the start of the AI boom.

-

Valuations of European tech companies are gradually catching up with their US counterparts. ASML trades at around 43x forward earnings, compared with its 10-year average of roughly 29–31x. The Stoxx 600 Technology Index is valued at about 27x forward earnings, broadly in line with US levels.

-

Global markets show mixed sentiment: US100 and US500 futures are slightly higher, while Asian equities have reached record levels following TSMC’s results.

-

In commodities, oil has edged higher to around USD 59.80 per barrel, while precious metals such as gold and silver are seeing modest declines.

-

Investor attention may also turn to European clean-energy stocks after a US court allowed Equinor to resume construction of a large offshore wind farm near New York.

Daily summary: Markets capitulate under the influence of the Persian Gulf

Paramount Skydance shares under pressure after S&P warning

Broadcom as the Last of the Big Tech. What Can Markets Expect from the Earnings?

Nvidia Faces New H200 Limits in China

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.