Summary:

-

US500 remains near recent highs

-

Several major firms report earnings ahead of the open

-

Focus on 5 financial stocks; JPM, Citi, GS, Wells Fargo and Blackrock

Despite some more negative trade headlines this morning coming out of China, US stock futures are actually trading a little higher ahead of the opening bell. Trade has dominated the headlines as far as Wall Street is concerned in recent weeks and while it is unlikely to disappear anytime soon, there is a new driving force to keep an eye on as the Q3 earnings season kicks off in earnest today.

Several of the largest financial firms have reported their latest trading results ahead of this afternoon’s opening bell with the overall feeling somewhat mixed with JP Morgan putting up some solid numbers while Goldman Sachs announced a disappointing miss.

JP Morgan - Q3 EPS: $2.68 vs $2.45 exp. Revenue: $30.1B vs $28.5B exp.

A pleasing performance for JP Morgan saw the bank beat the street on both the top and bottom line in Q3 with strong consumer banking operations helping to mitigate the impact of lower interest rates.

Shares are expected to start brightly this afternoon with the stock looking to probe the top of the range around 120 that has provided a ceiling in the past couple of years. Source: xStation

Citigroup - Q3 EPS: $1.97 vs $1.95 exp. Revenue: $18.6B vs $18.55B exp

These earnings exclude a tax benefit of $0.10/share which if taken into account paint a more positive picture for the firm. However, a lower than expected net interest margin is a possible concern and the pre-market trade is pointing towards a red open later.

The stock has been towards the higher end of its past range in recent trade but is expected to start lower this afternoon. Source: xStation

Goldman Sachs - Q3 EPS: $4.79 vs $4.86 exp. Revenue: $8.32B vs $8.31 exp

A miss on earnings is the main takeaway here and when you consider that the firm made $6.28 for the same period last year it looks even worse. Goldman said it had taken losses of $267m in the third quarter for “investments in public equities, primarily from investments in Uber, Avantor and Tradeweb”. The losses were taken though its investment and banking division and combined account for approximately $0.71/share.

Another chart lacking a clear longer-term trend of late is Goldman Sachs with shares called to start lower by around 2%. Source: xStation

Wells Fargo - Q3 EPS; $0.92 vs $1.24 exp. Revenue: $22B vs $21.09B

Another miss on earnings here with lower interest rates adversely impacting profits. The lender also took a financial hit related to the fake-account scandal that has dogged Wells Fargo since 2016. The company booked a $1.6 billion charge for legal costs related to its long-running sales-practices problems, but also had a $1.1 billion gain related to the sale of a business.

Shares are expected to start lower this afternoon but a longer term base could be forming with the 43 region potential support. Source: xStation

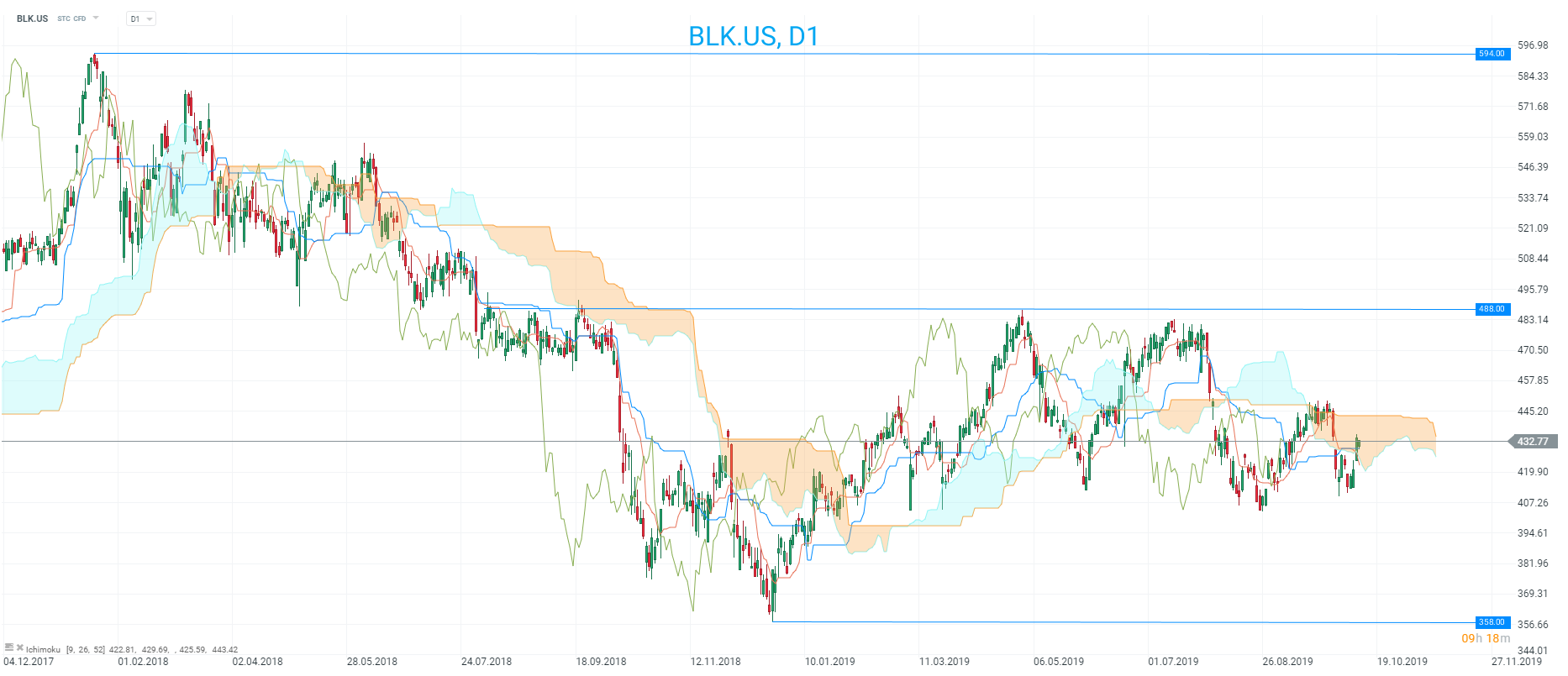

Blackrock - Q3 EPS: $7.15 vs $6.96 exp. Revenue: $3.69B vs $3.58B prior

The world’s largest asset manager posted a solid set of results, beating on earnings and seeing a small increase in revenue. Assets under management rose 8% in the third quarter to now stand at just under $7T. Chairman and CEO Larry Fink also offered a fairly positive take on the markets at present. “We’re paying so much attention to political and geopolitical issues that we’re losing sight that the world still is moving forward,” Fink said on “Squawk Box.” “It’s not great but not as bad as we feel every morning we wake up.”

Blackrock shares are currently in the D1 cloud but if they can get back above 445 then the outlook becomes more favourable: xStation

US OPEN: The market looks for direction after inflation data

Market Wrap: Dollar accelerates before CPI. Mixed earnings from French giants (13.02.2026)

Arista Networks closes 2025 with record results!

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.