Another key takeaways from the speeches of the FED members regarding the current tightening cycle after today's hawkish comment from Bullard:

- Raphael Bostic from the Federal Reserve Bank of Atlanta expressed his preference to hold interest rates steady next month. He believes that the policy actions taken so far are still in the early stages of their impact and wants to observe how things unfold before making further decisions.

- Thomas Barkin, Bostic's colleague from the Richmond Federal Reserve, is keeping his options open and not pre-judging the outcome of the June meeting. He believes that previous rate hikes and tighter credit standards may cool demand and prices, but he still needs to be convinced of this narrative.

- Mary Daly emphasized the importance of not making premature decisions regarding the rest of the year's tightening cycle. She suggests that a pullback in bank lending could have a significant impact, potentially equivalent to a couple of rate hikes.

- Neel Kashkari, another member of the FOMC, sees the decision for June as a close call. He believes that the banking sector strains may contribute to cooling prices, but he wants more evidence before making a decision. He emphasizes the need to keep the possibility of further rate increases open.

Overall, the Fed members have varying views on the appropriate actions for the upcoming meeting. Some advocate for holding rates steady and observing the effects of previous actions, while others remain open to potential rate hikes but want more evidence before committing to a decision.

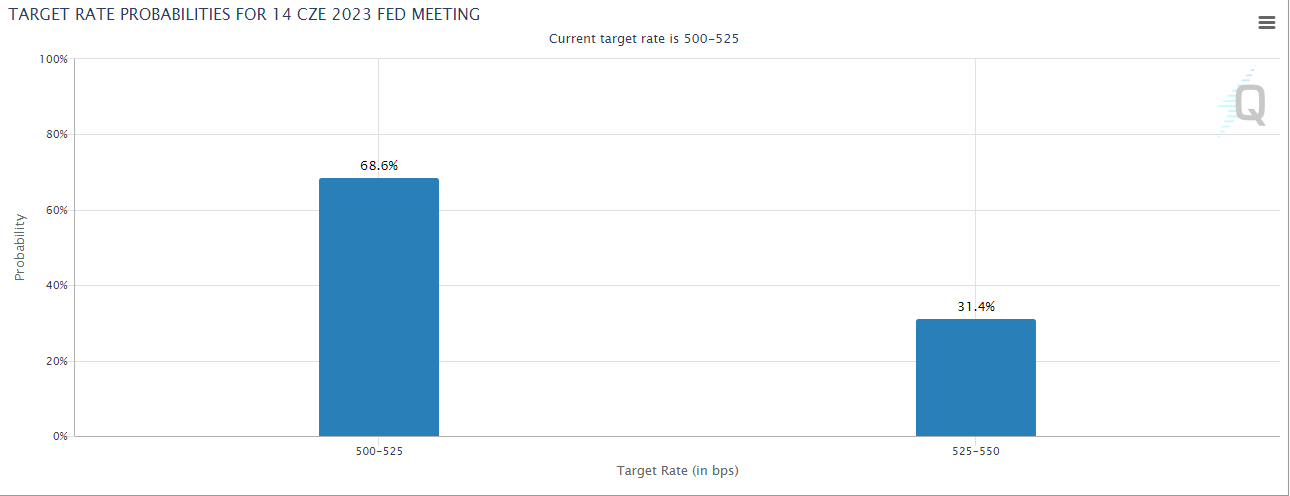

Currently, the markets are assessing a 31% probability of a 25 basis points rate hike at the next FOMC meeting in June. This probability has increased significantly over the past two weeks, driven by strong macroeconomic data and hawkish comments from certain FED members. While it is not yet above the 50% threshold, the likelihood of a rate hike has notably risen.

The EURUSD currency pair is currently trading at 1.08099, and recently rebounced from the lows of 1.07591. Over the past two weeks, we have observed a trend of USD appreciation. This suggests that the US dollar has been strengthening against the euro during this period.

The EURUSD currency pair is currently trading at 1.08099, and recently rebounced from the lows of 1.07591. Over the past two weeks, we have observed a trend of USD appreciation. This suggests that the US dollar has been strengthening against the euro during this period.

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

Chart of the Day: EURUSD after data from Europe and weaker US labor market

Economic calendar: Canadian labor market and Michigan Index (06.02.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.