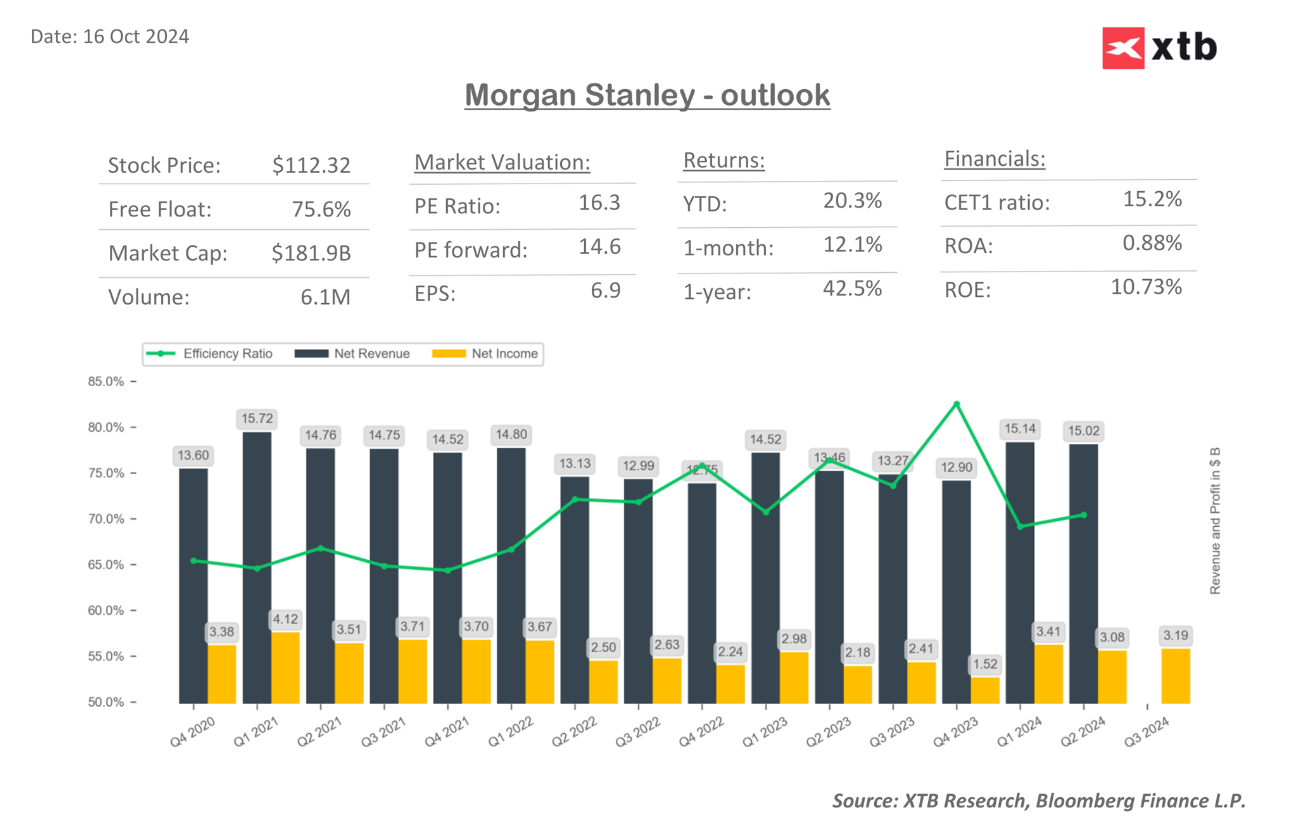

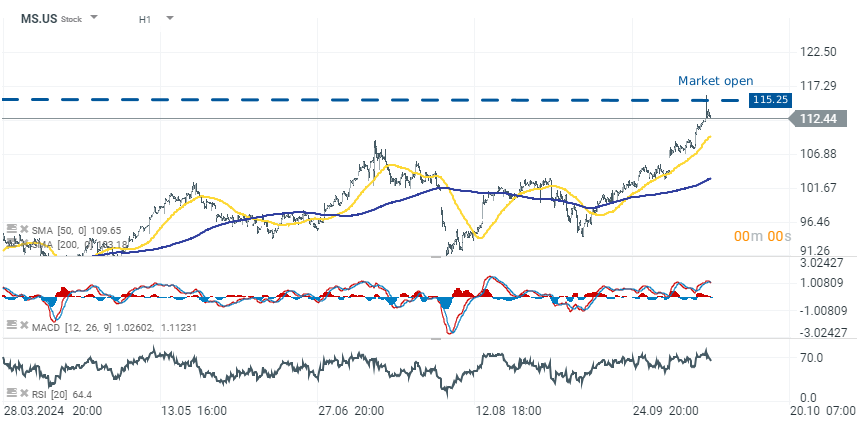

Morgan Stanley gains 2.70% to $115.25 after releasing a better-than-expected Q3 report.

- Earnings per Share (EPS): $1.88, up 32% from $1.42 in Q3 2023.

- Revenue: $15.38 billion, a 16% increase from $13.3 billion in Q3 2023.

- Wealth Management Revenue: $7.27 billion, up 14% year-over-year.

- Investment Banking Revenue: $1.46 billion, a 56% increase from last year.

- Equity Trading Revenue: $3.05 billion, up 21% from $2.52 billion in Q3 2023.

- Fixed Income Revenue: $2 billion, up 3% year-over-year.

- Return on Tangible Common Equity (ROTCE): 17.5%.

Morgan Stanley exceeded analyst expectations for Q3 2024, reporting a 32% rise in profit to $3.2 billion, or $1.88 per share, compared to a $1.58 estimate. Revenue increased by 16% to $15.38 billion, surpassing the $14.41 billion forecast. All key divisions performed well, with Wealth Management revenue up 14% and Investment Banking revenue soaring 56%. Strong trading activity and improved market conditions contributed to robust earnings, and shares rose by 3.8% following the release.

Wealth Management achieved record revenues of $7.3 billion, driven by increased client asset inflows and robust transactional revenues. The firm added $64 billion in net new assets, pushing total client assets to $6 trillion. Institutional Securities reported a 20% year-over-year revenue increase, largely due to strong trading in equities and fixed income.

Investment Management also saw growth, with a 9% increase in revenues to $1.46 billion, driven by higher assets under management (AUM) and positive net flows. CEO Ted Pick highlighted the firm’s capital generation and strong returns with a 17.5% return on tangible common equity (ROTCE) for the quarter.

Paramount Skydance shares under pressure after S&P warning

Broadcom as the Last of the Big Tech. What Can Markets Expect from the Earnings?

Nvidia Faces New H200 Limits in China

US Open: Wall Street in Blood

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.