-

US indices finished yesterday's trading higher. S&P 500 gained 0.21% while Dow Jones added 0.61%. Nasdaq dropped 0.17%. Russell 2000 finished trading 0.07% higher.

-

Pessimism dominated during the Asian trading hours. Nikkei dropped 0.4%, S&P/ASX200 moved 0.5% lower while Kospi declined 0.4%. Indices from China traded mixed

-

DAX futures point to a higher opening of the European session

-

Japanese authorities are considering a new stimulus package

-

Chinese manufacturing PMI (Caixin/Markit) dropped from 52.0 to 51.3 pts in June

-

Japanese Tankan index for the manufacturing sector jumped from 5 to 14 in Q2 2021 (exp. 16). Services index moved from -1 to 1 (exp. 3)

-

South Korean exports increased 39.7% YoY in June (exp. 33.6%) while imports were 40.7% YoY higher (exp. 33% YoY). Semiconductor exports increased 34.4% YoY

-

Australia trade balance reached A$9.68 billion in May (exp. A$10 billion)

-

Bitcoin trades near $34,000 mark

-

Gold and silver gain while platinum and palladium drop. Oil trades slightly higher with industrial metals decline

-

JPY and USD are the best performing major currencies while AUD and EUR lag the most

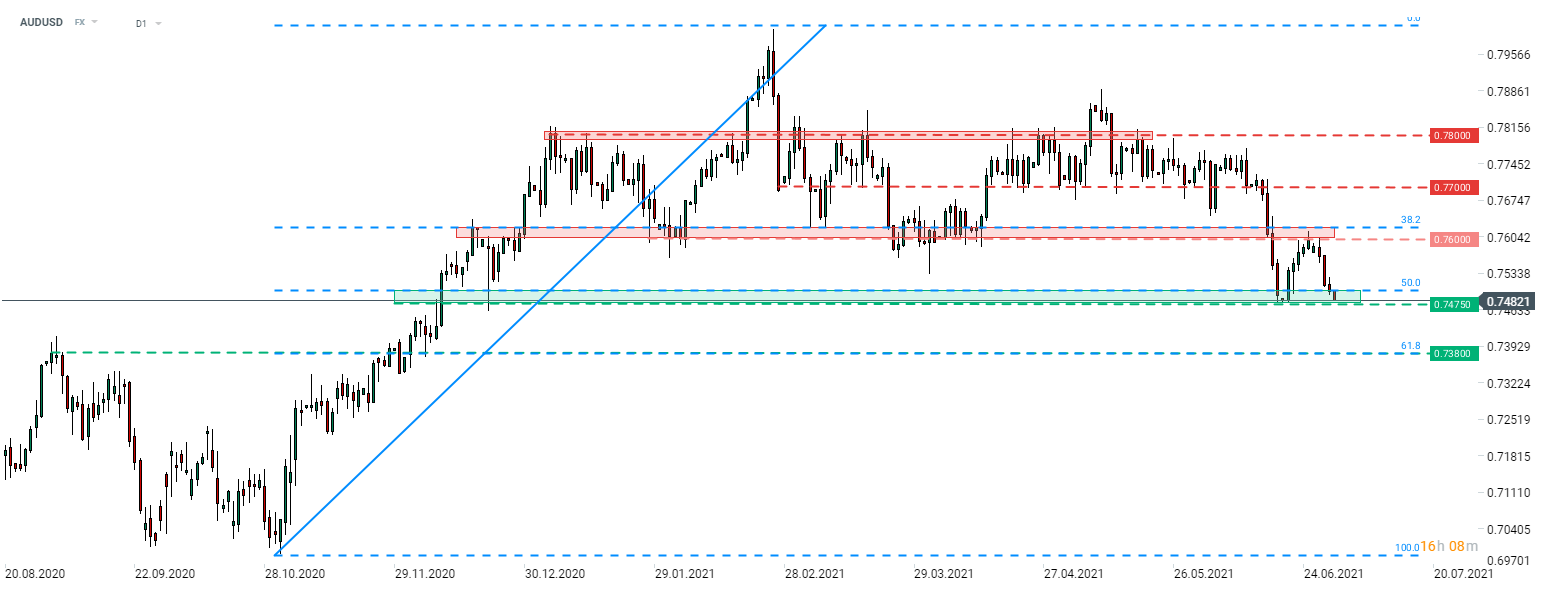

AUDUSD is one of the worst performing major FX pairs today. Price is retesting a support zone ranging between 0.7475 mark and 50% retracement of the upward move impulse launched in late-2020. Breaking below this hurdle could pave the way for a test of the next support - 0.7380 area at 61.8% retracement. Source: xStation5

AUDUSD is one of the worst performing major FX pairs today. Price is retesting a support zone ranging between 0.7475 mark and 50% retracement of the upward move impulse launched in late-2020. Breaking below this hurdle could pave the way for a test of the next support - 0.7380 area at 61.8% retracement. Source: xStation5

Daily summary: Markets capitulate under the influence of the Persian Gulf

🚨 EURUSD deepens decline, falls to key support zone

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

Three markets to watch next week (27.02.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.