-

The session in the Asia-Pacific region is proceeding with moderate sentiments. Indices are mostly noted with a slight decrease. The Korean KOSPI index loses the most, down 1.20%.

-

Chinese indices are down by 0.40-0.70%, and the Japanese Nikkei225 also drops by 0.20%. Meanwhile, the Indian Nifty 50 registers modest gains of 0.70%, and the Australian SP ASX 200 is up by 0.30%.

-

In the first part of the day, movements in the forex market are limited. However, at the time of publication, the dollar is pulling back after yesterday's gains and remains among the weakest of the G10 currencies. EURUSD gains 0.15% to 1.0908.

-

Today, there are many final PMI reports scheduled for November. We have already learned the PMI for these countries in the first part of the day:

- China, Caixin Manufacturing PMI: Actual 50.7 (Forecast 49.6, Previous 49.5)

- South Korea, Manufacturing PMI: Actual 50 (Previous 49.8)

- Japan, Jibun Manufacturing PMI: Actual 48.3 (Forecast 48.1, Previous 48.1)

- Australia, Manufacturing PMI: Actual 47.7 (Previous 47.7)

-

Report from the Japanese labor market:

- Unemployment Rate: Actual 2.5% (Forecast 2.6%, Previous 2.6%)

- Job-to-Applicant Ratio: Actual 1.3 (Forecast 1.29, Previous 1.29)

-

The Israeli military stated on Friday that it resumed fighting with Hamas in the Gaza Strip and accused the Palestinian group of violating the ceasefire terms and shelling Israeli territory. Despite a hard-won break in the fighting, Israel has now announced plans to resume shelling if the Palestinian militant group does not agree to release more hostages.

-

Goldman Sachs has revised its forecasts for the European Central Bank, expecting a cut in interest rates in the second quarter of next year. Previously, GS predicted a cut in ECB rates in the third quarter.

-

Precious metals continue to rise. Gold gains 0.30% and returns to the level of 2041 USD per ounce. Meanwhile, silver records a modest increase of 0.10% to the level of 25.26 USD.

-

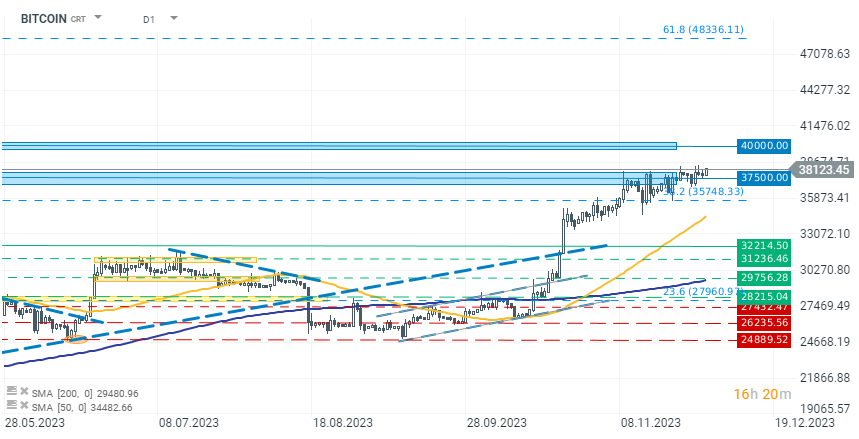

In cryptocurrencies, we observe a significant rebound in the first part of the day. Bitcoin gains 1.10% and returns to the level of 38100 USD. Interestingly, we see bigger increases in Ethereum, which gains 2.0% to 2095 USD.

-

The rises in the cryptocurrency market are likely driven by further progress in the work on a spot Bitcoin ETF and the submission of another application for a spot Ethereum ETF, this time by Fidelity.

-

Fidelity's new application signifies the official start of the verification period by the SEC, which can last up to a maximum of 240 days.

Bitcoin is rising again in an attempt to break through the upper limit of the current consolidation channel at $38,000. The increases are fueled by hopes of a potentially upcoming SEC approval of applications. The next window of opportunity for more applications to be accepted is expected in early January. Source: xStation 5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.