Asian markets began Wednesday's trading with declines that were initiated yesterday on Wall Street.

The American technology sector recorded sharp declines yesterday, pushing the Nasdaq 100 down by as much as 2% and ending the session 1.43% lower. The S&P 500 (US500) contract recorded a nearly 0.9% decline, falling to 6,900 points. Among BigTech companies, Nvidia and Microsoft suffered the heaviest losses (over 3%), but the IT services sector is performing disastrously. We are seeing increases in the shares of banks, defence companies and oil and gas producers.

Software companies fell on the wave of Antrhropic's new Cloude application layer. Investors fear that more similar solutions will appear in the near future and disrupt the business models of many companies in the software industry, leading to limited growth potential or customer churn. Shares in Intuit, Salesforce and ServiceNow, among others, fell sharply, in most cases exacerbating an already severe sell-off that has been going on for several months.

The weakness of the tech sector ultimately also affected the hardware sector. Shares in GPU supplier Broadcom, among others, fell by more than 6%, and memory suppliers such as Micron, which recorded a decline of more than 4%, also performed poorly. Interestingly, thanks to its strong results, Palantir resisted the sell-off on the stock market and recorded a 6% increase. WalMart's share price is up nearly 2.5% and has reached a market capitalisation of USD 1 trillion for the first time in its history. PepsiCo is also up more than 3% after its results.

According to media reports, sales of NVIDIA (NVDA) AI chips to China have reportedly been suspended by US security controls.

Advanced Micro Devices announced its fourth quarter financial results after the close of the US stock market. Although the chipmaker exceeded expectations in terms of both revenue and profits, its outlook for the future proved less optimistic than expected, triggering a sharp sell-off in extended trading.

The four-day partial shutdown of the US government came to an end after the House of Representatives finally approved the funding bill on Tuesday and President Trump signed it into law.

However, it should be noted that BLS announced on Monday that it would not publish its January employment report and JOLTS data this week as planned due to the partial shutdown of the federal administration.

In January, China's service sector accelerated, with the PMI rising to 52.3, signalling the fastest growth in activity in three months thanks to stronger domestic and export demand. In Japan, the services PMI jumped to 53.7, its highest level in 11 months, driven by growth in new orders and employment. In Australia, the index showed the strongest growth in nearly four years, supported by dynamic growth in new orders and improved exports, despite a slight weakening in business sentiment.

UBS Group announced better-than-expected fourth-quarter earnings and a £3 billion share buyback programme through 2026, with the possibility of increasing that amount.

Novartis: Fourth quarter revenue amounted to $13.34 billion, slightly below expectations of $13.68 billion. Adjusted earnings per share (Core EPS) reached $2.03, slightly exceeding the forecast of $2.01.

Crédit Agricole: The bank posted revenues of €6.97 billion, exceeding expectations of €6.78 billion, but net profit of €1.03 billion was lower than the forecasted €1.10 billion.

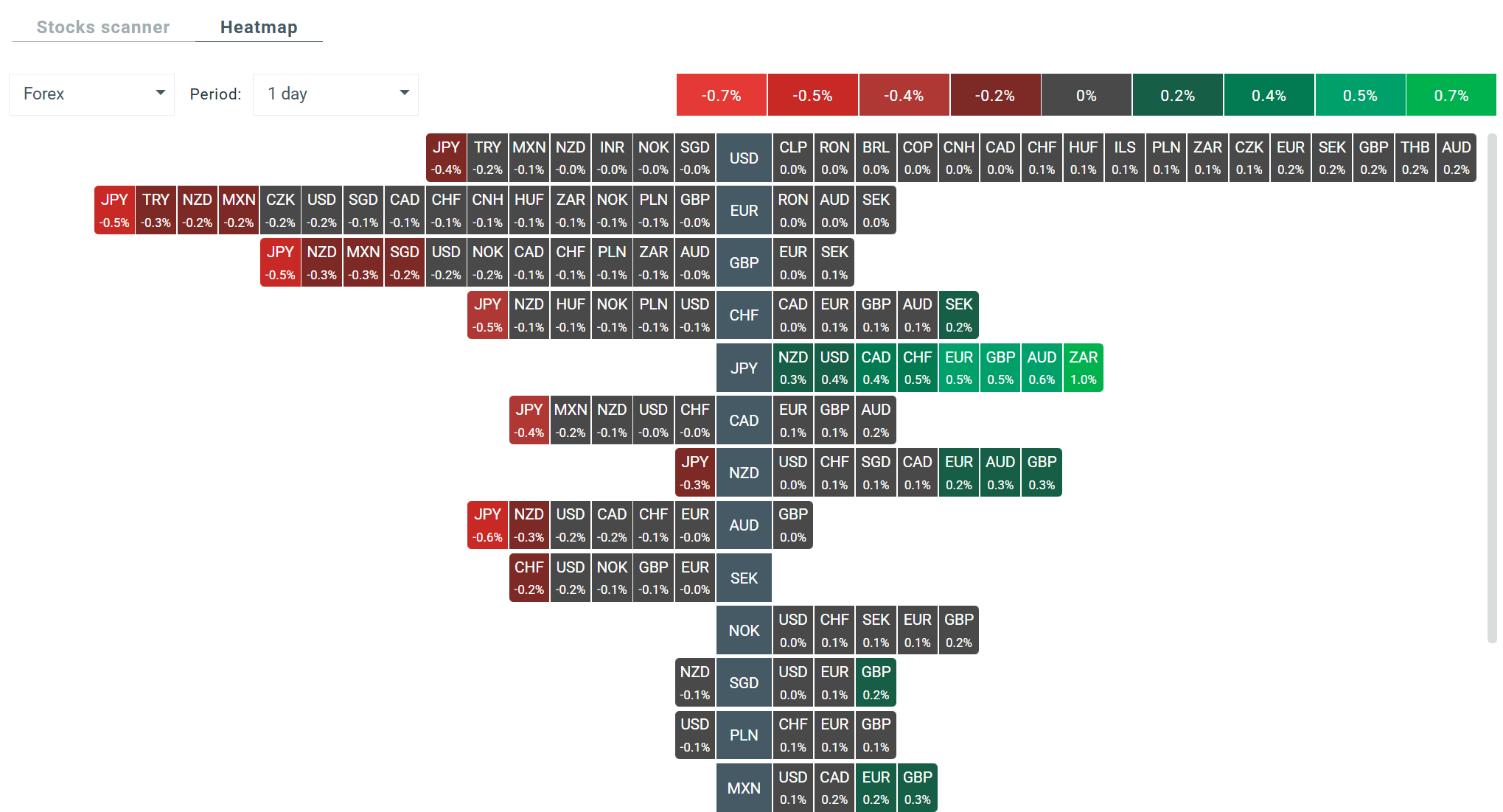

On the broad Forex market, the British pound and the euro are currently performing best. On the other hand, we are seeing increased downward pressure on the Japanese yen and the NZD.

The NZD/USD exchange rate fell slightly after the release of New Zealand's employment report for the fourth quarter of 2025, which showed an increase in the unemployment rate to 5.4%, the highest level in ten years. Despite the rise in the headline figure, the details of the report were assessed more constructively, which limited the downward pressure on the kiwi.

The reaction of oil prices to reports of the shooting down of an Iranian Shaded-139 drone by a US Navy F35 fighter jet has been limited, and today we are seeing a 0.35% drop in WTI prices. The US has commented that the current schedule for negotiations with Iran remains unchanged and that the decision to shoot down the drone was the right one.

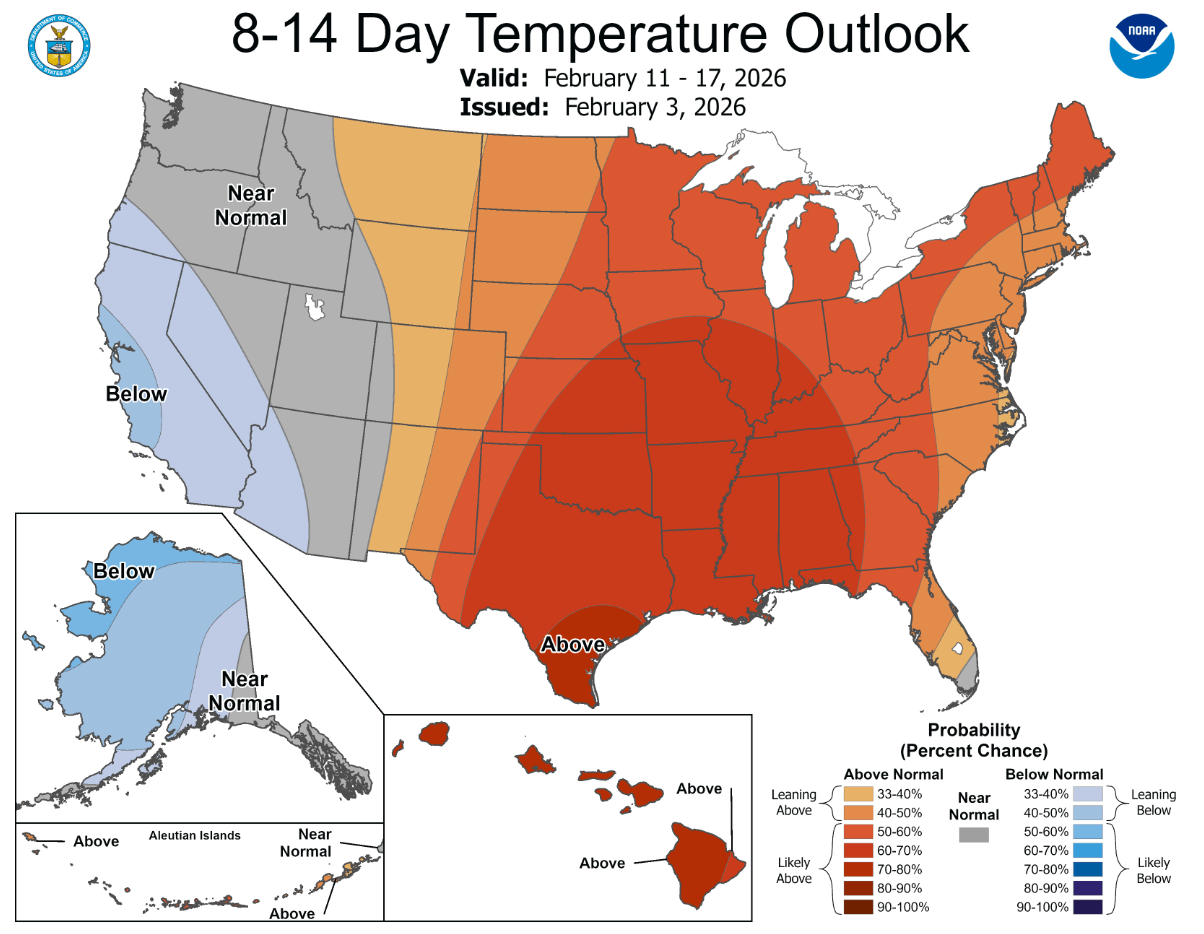

NATGAS loses 2% and extends recent declines. New weather forecasts indicate prolonged warming in the US.

Source: NOAA

The situation has also remained unchanged for precious metals. Both GOLD and SILVER continue to rise, reaching 2.4% and 3% respectively.

Heatmap of volatility currently visible on the Forex market. Source: xStation

Economic calendar: Nvidia earnings in focus on Wall Street

BREAKING: German GfK consumer sentiments worsen, GDP in line with expectations

Morning wrap (25.02.2026)

Daily summary: Technology Drives Wall Street as Tehran Seeks Truce

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.