-

US indices slumped yesterday, erasing all of post-FOMC gains. S&P 500 dropped 3.56%, Dow Jones moved 3.12% lower and Nasdaq slumped 4.99%. Russell 2000 dropped 4.04%

-

Indices from Asia-Pacific followed Wall Street's lead and also slumped. S&P/ASX 200 dropped 2.2%, Kospi dropped 1.1% and indices from China traded 2-4% lower

-

DAX futures point to a slightly lower opening of the European cash session

-

Josep Borrell said that agreement on next sanctions package on Russia has almost been reached by EU members

-

Hungary's Orban said that his country will need 5-year exemption from Russian oil embargo

-

According to RBA Statement on Monetary Policy, interest rates in Australia will need to increase further as inflation is seen staying above goal until at least 2024

-

ECB's Holzmann said that European Central Bank will discuss raising rates and may even decide to deliver a rate hike in June

-

Cryptocurrencies trade mostly higher. Ripple trades over 2% higher, Ethereum gains 0.5% and Bitcoin adds 0.1%

-

Precious metals pull back amid USD strengthening. Platinum is top laggard with a drop of 2.7%

-

Energy commodities do not experience major moves on Friday. Brent and WTI trades 0.2% higher

-

USD and CAD are the best performing major currencies while JPY and CHF lag the most

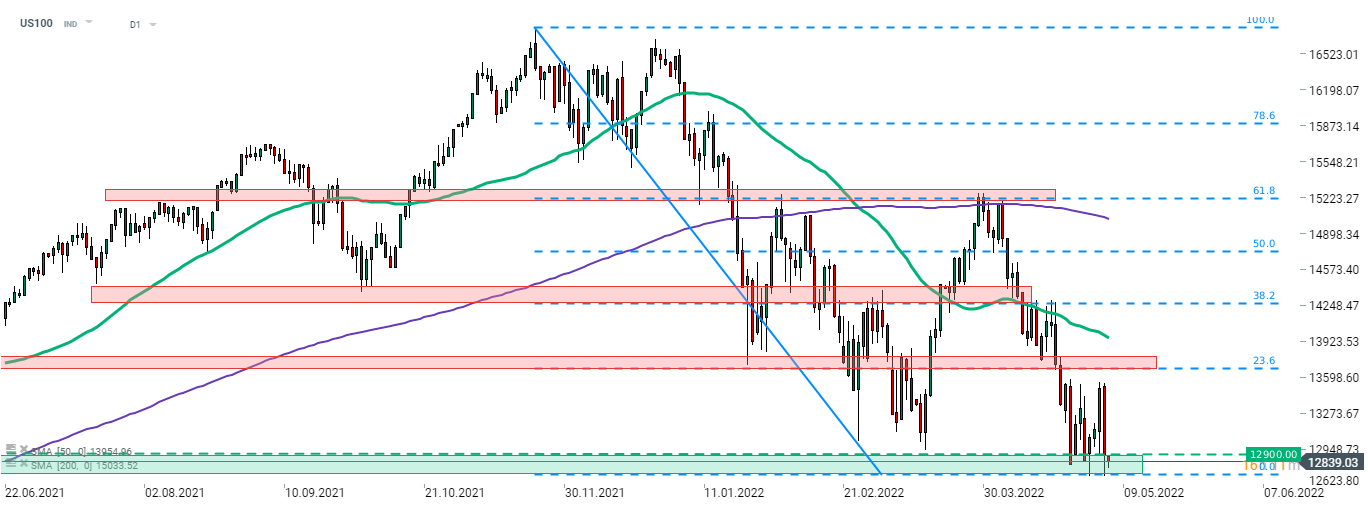

Nasdaq-100 (US100) and other US indices slumped yesterday, erasing all of the post-FOMC gains. US100 is once again testing a support zone ranging below 12,900 pts handle. While yesterday's plunge was very steep, it looks like the situation has calmed somewhat during overnight trading. Source: xStation5

Nasdaq-100 (US100) and other US indices slumped yesterday, erasing all of the post-FOMC gains. US100 is once again testing a support zone ranging below 12,900 pts handle. While yesterday's plunge was very steep, it looks like the situation has calmed somewhat during overnight trading. Source: xStation5

US OPEN: Cautious gains after GDP disappointment

Market Watch: Calm European Session, Weak Industry, Easing Inflation

Chart of the Day: US500 Moves on PCE Data and AI Momentum

Morning Wrap: Russian Oil with a 30-Day Purchase Permit

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.