-

Wall Street finished yesterday's trading higher as market odds for Fed rate hike in May dropped following another streak of disappointing data from US jobs market

-

Market now sees around 50% chance of 25 bp rate hike in May and around 50% chance of Fed leaving rate unchanged and pausing rate hike cycle

-

S&P 500 gained 0.36%, Dow Jones traded flat, Nasdaq rallied 0.76% and Russell 2000 moved 0.13% higher

-

Indices from Asia-Pacific traded higher today - Nikkei gained 0.1%, Kospi added 1.3% and indices from China traded up to 0.8% higher

-

Liquidity during today's European trading session is expected to be very thin as majority of stock exchanges from the Old Continent will be shut in observance of Good Friday

-

Japanese household spending increased 1.6% YoY in February (exp. 4.2% YoY)

-

Major cryptocurrencies trade mixed - Bitcoin drops 0.1%, Litecoin gains 0.1%, Ethereum trades 0.3% higher and Dogecoin slumps 2.8%

-

AUD and NZD are the best performing major currencies while JPY and CAD lag the most

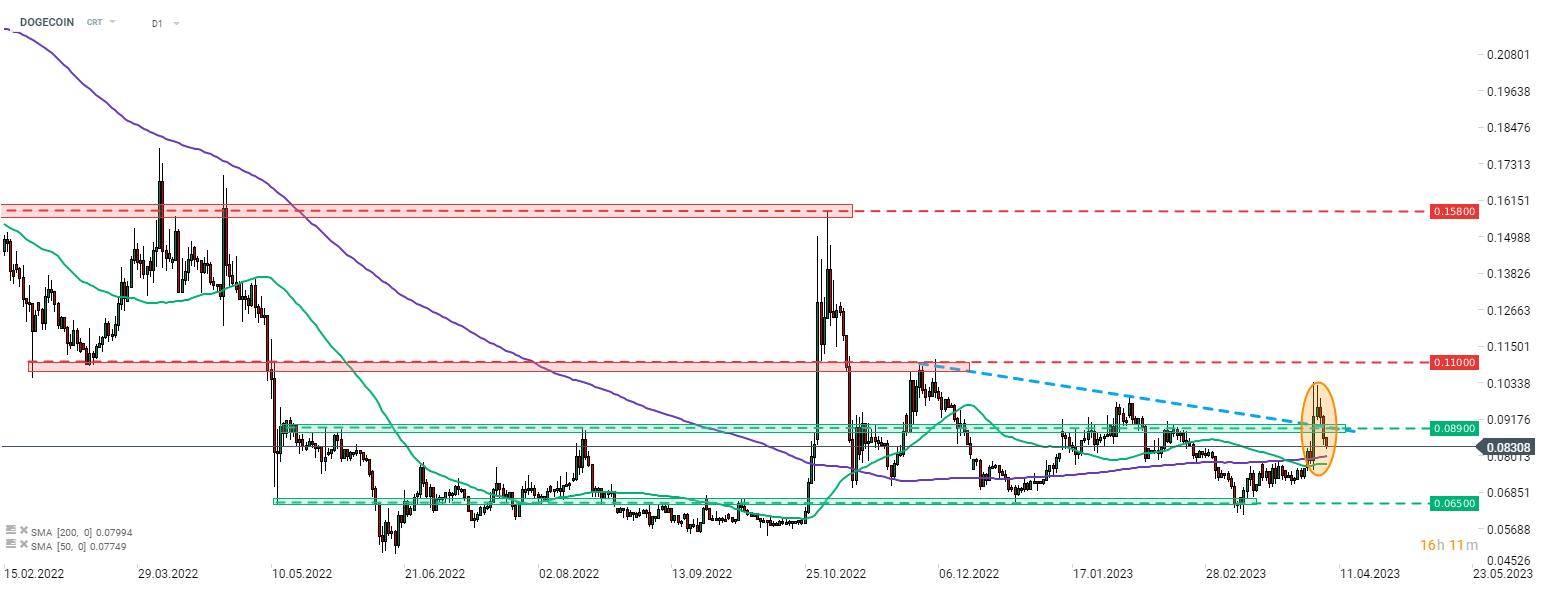

DOGECOIN is one of the worst performing cryptocurrencies today. The coin has almost fully erased the price jump triggered by Elon Musk changing Twitter logo to Shiba Inu. Source: xStation5

DOGECOIN is one of the worst performing cryptocurrencies today. The coin has almost fully erased the price jump triggered by Elon Musk changing Twitter logo to Shiba Inu. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.