-

US futures trade little changed compared to Friday's closing prices. US trades return to the markets today following a long weekend

-

Stocks in Asia are trading mixed. Nikkei and most Chinese indices trade higher while S&P/ASX 200 and Kospi drop

-

DAX futures point to a slightly lower opening of the European cash session

-

The Reserve Bank of Australia left rates unchanged at today's meeting. RBA extended bond purchases until at least February 2022 amid slowdown in economic recovery. However, Bank remains committed to begin tapering soon

-

Fumio Kishida, one of the key politicians in the Japanese Liberal-Democratic Party, said that he will support more fiscal stimulus if he becomes prime minister. Kishida also said that he wants Bank of Japan to maintain its inflation goal as well as monetary stimulus

-

Chinese exports increased 25.6% YoY in August (exp. 17% YoY) while imports were 33.1% YoY higher (exp. 27% YoY)

-

Japanese household spending increased 0.7% YoY in July (exp. 3% YoY)

-

Bitcoin trades near $52,500

-

Precious metals drop. However, palladium is an exception gaining around 0.2% at press time

-

Industrial metals trade lower while oil gains slightly

-

EUR and CHF are the best performing major currencies while NZD and AUD lag the most

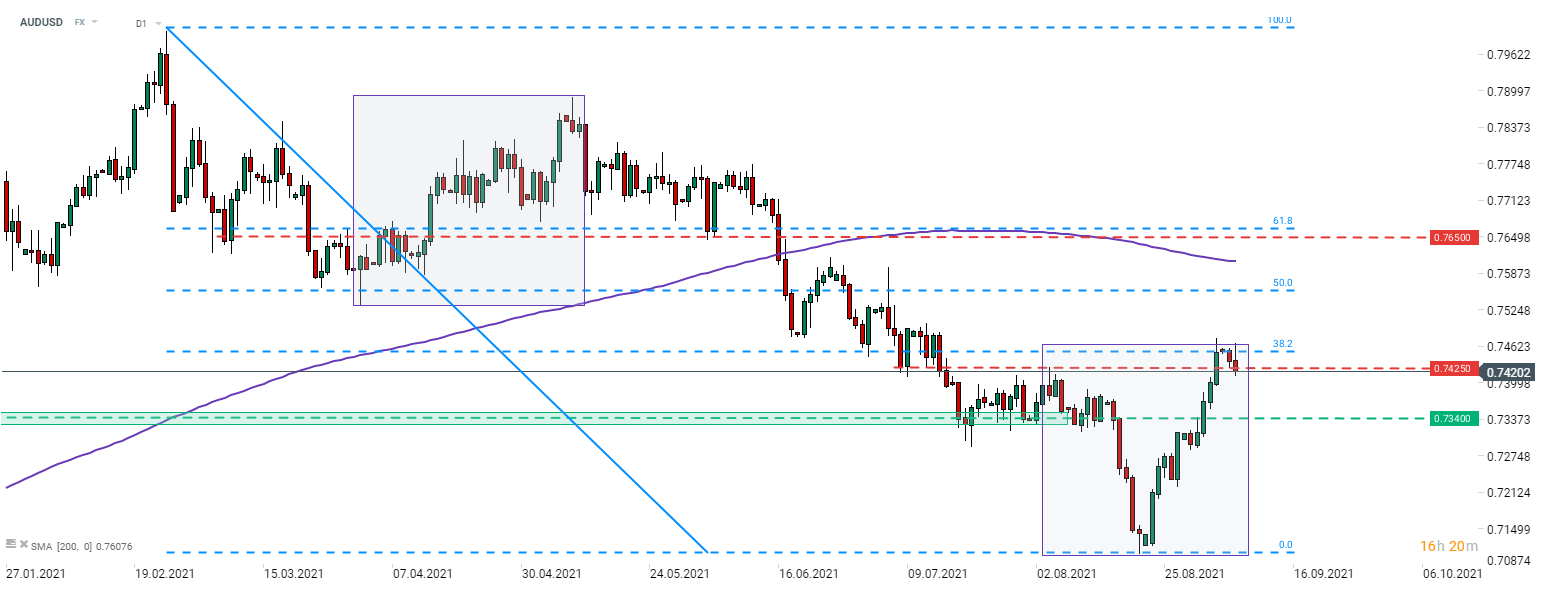

The Australian dollar weakened after the RBA noted slowing recovery and decided to extend bond purchases. AUDUSD failed to break above the upper limit of the Overbalance structure earlier this week and today's pullback fits into the technical landscape. Source: xStation5

The Australian dollar weakened after the RBA noted slowing recovery and decided to extend bond purchases. AUDUSD failed to break above the upper limit of the Overbalance structure earlier this week and today's pullback fits into the technical landscape. Source: xStation5

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Morning wrap (05.03.2026)

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.