-

US indices finished yesterday's trading mixed. S&P 500 dropped 0.03%, Nasdaq declined 0.25% and Dow Jones gained 0.20%. Russell 2000 dropped 0.72%

-

Trading in Asia was muted as China and Japan were off for holiday. S&P/ASX 200 declined 0.1%

-

DAX futures point to a flat opening of the European session

-

Joe Biden spoke with China's Xi on phone. Leaders agreed that cooperation is better than confrontation. Biden said that he will work with China when it benefits the United States

-

United States will review trade policy with China

-

Fed Chair Powell said that the outlook for the jobs market is still bleak with the real unemployment rate being close to 10%. He said that rates will remain low

-

United States are willing to work with the European Union to resolve Airbus-Boeing dispute once new US Trade Representative takes office

-

Janet Yellen said that she is supportive of digital assets but high misuse risks remain a problem

-

Precious metals and agricultural commodities pull back. Oil trades flat

-

Bitcoin trades near $44,500

-

CHF and USD are the weakest major currencies while AUD and NZD are top performers

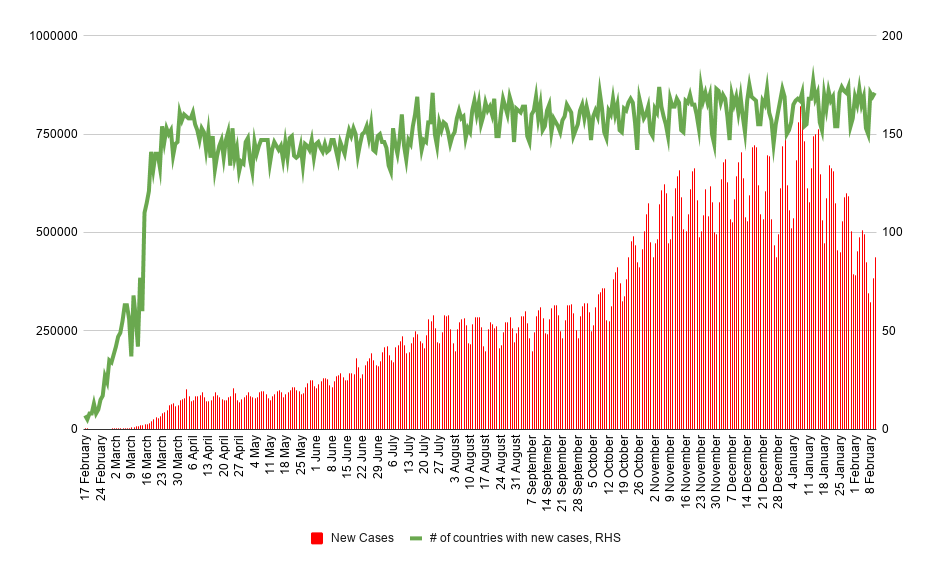

Almost 440 thousand new coronavirus cases were reported yesterday. Source: worldometers, XTB

Almost 440 thousand new coronavirus cases were reported yesterday. Source: worldometers, XTB

Market wrap: European stocks attempt to stabilize despite the surge in oil prices 🔍

Morning Wrap: Conflict Escalation Pushes Oil to $100 (12.03.2025)

Daily summary: Oil still pressures Wall Street despite favorable CPI data 🗽

Mixed sentiments on Wall Street amid Iran war🗽Oracle shares surge 10%

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.