We are starting a new week on the financial markets.

Today's session will be unique because, due to bank holidays in China, the US and Canada, there will be no session on the cash markets, which may significantly reduce the volatility observed in many markets.

Interestingly, the break in China will last until the end of the week, due to the Lunar New Year celebrations.

For this reason, volatility on Asian markets was very low today. At present, Japan's Nikkei is up 0.02%, while India's Nifty 50 is up 0.2%.

This week, the dollar will remain in the spotlight, and the market will play along with the narrative of "USD rebalancing", with Credit Agricole expecting consolidation rather than major movements, unless there is clearly weaker data or dovish signals from the Fed. Key publications will include: December core PCE, preliminary PMI for February, FOMC meeting minutes and the December TIC report, which will show whether foreign demand for US bonds and equities has begun to weaken. An additional, non-calendar source of volatility could be the potential US Supreme Court ruling on tariffs, scheduled for 20 February. All these factors mean that the end of the week could bring increased volatility for the USD and Treasury yields, especially if the data and decisions deviate from the consensus.

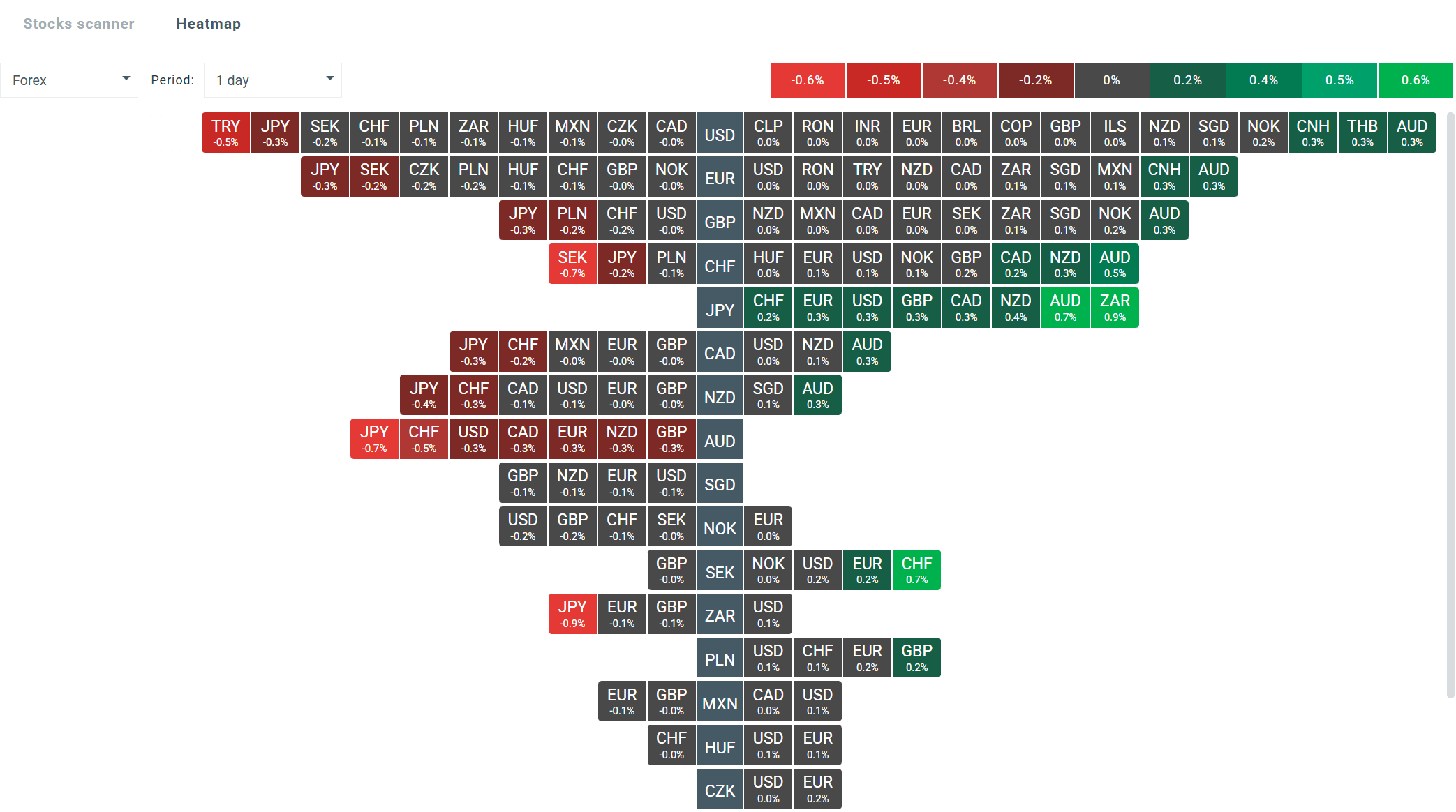

Today, however, the Australian dollar is performing best on the Forex market. Increased declines are being observed in the Japanese yen.

The yen weakened after the data was released, as GDP growth of only 0.2% annualised (0.1% month-on-month) clearly fell short of expectations, confirming the fragility of the recovery and the weakness of exports and investment. This combination – soft growth with still elevated inflation – on the one hand does not give the Bank of Japan the comfort to tighten aggressively, and on the other hand reinforces the narrative that policy will remain unchanged for longer, which the market interprets as negative for the yen. In addition, today's meeting between Prime Minister Takaichi and Governor Ueda raises concerns that the government will push for caution in normalisation, which also weighs on the currency.

The service sector in New Zealand continues to grow (PSI 50.9 – business sentiment index), but momentum is slowing, with employment and inventories contracting, indicating caution among companies and dampening optimism for the NZD. The 1.1% m/m decline in spending measured by payment card transactions in January, despite a slight y/y increase, confirms the seasonal weakness in consumption after the holidays, limiting expectations for interest rate cuts and supporting a slight stabilisation of the economy.

Both SILVER, which is down 1.2%, and GOLD, which is down 0.83%, are performing poorly on the metals market.

However, the biggest declines are seen in NATGAS, where investors are once again reacting to higher than average temperatures in the 8-14 day forecast. Prices for this commodity have already fallen by nearly 7%.

Bitcoin loses 1% and is trading close to £68,000.

Heatmap of volatility on the FX market at present. Source: xStation

Economic and corporate calendar: Bank holiday in China, the US, and Canada 💡(February 16, 2026)

Daily summary: The Market recovers losses and awaits rate cuts

Three markets to watch next week (13.02.2026)

IBM Goes Against the Tide: Three Times More Entry-Level Employees

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.