-

China futures surged by nearly 4% at the close of yesterday's Wall Street trading session. This significant rebound may be attributed to the Chinese government's continuous increase in long-term liquidity injections into the financial system for the sixth consecutive month. The Medium-Term Lending Facility remained at 2.75%, as anticipated, aiming to stimulate growth amidst signs of a waning economic recovery. Despite the strong performance at the end of the day, Asia-Pacific indices are mostly trading lower today. CHNComp and HKComp declined by over 1.0%, while Nikkei gained 0.14%. S&P/ASX 200 fell by 0.48%, and Nifty 50 is trading 0.35% lower.

-

In April, Chinese consumer spending and industrial activity exhibited faster growth compared to March but fell short of expectations. Chinese Industrial Production grew by 5.6% YoY, below the forecasted 10.9% and previous 3.9%. Retail sales data from China also came in lower than expected, with actual YoY growth at 18.4% versus the expected 21.0% and previous 10.6%.

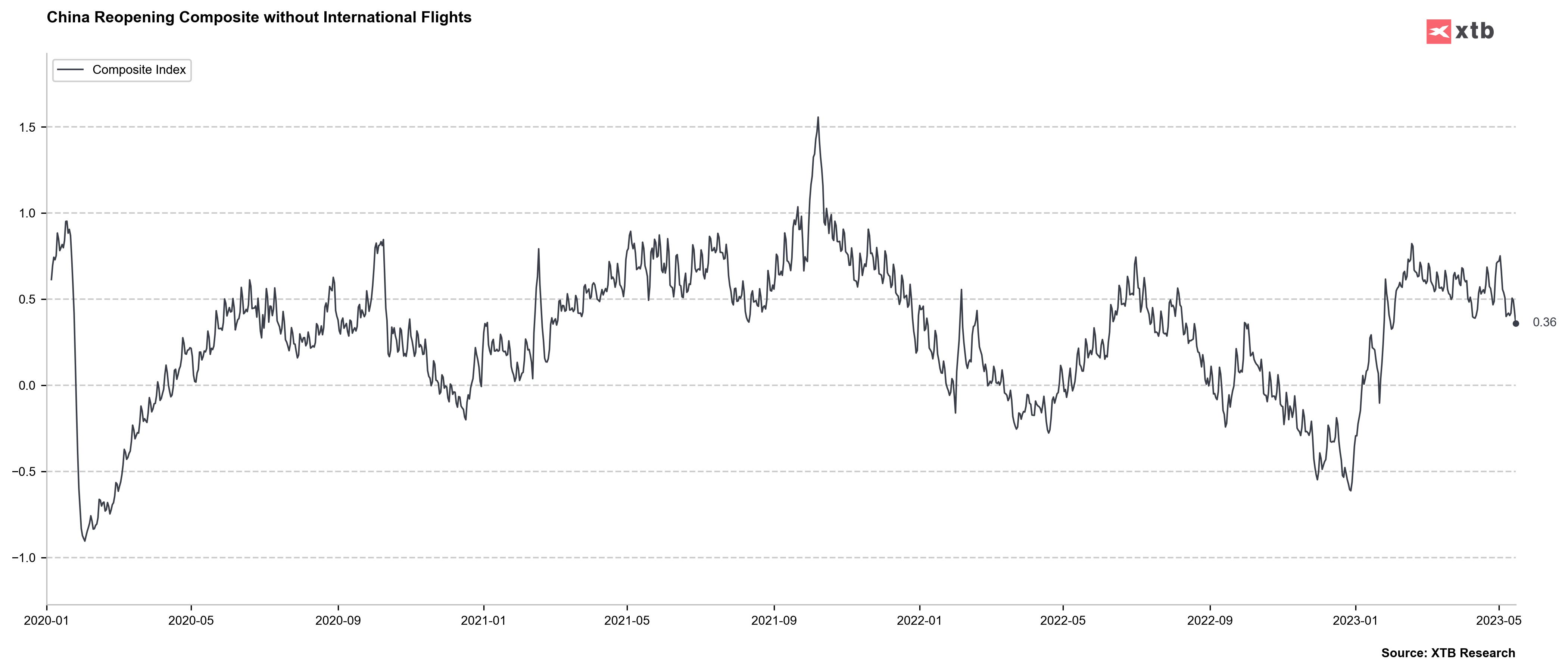

The composite index for China's economy reflects a decline in daily data, indicating consecutive decreases in the recent weeks. This index combines data on metro traffic, port congestion, box office revenue and various other daily indicators of China's economy.

The composite index for China's economy reflects a decline in daily data, indicating consecutive decreases in the recent weeks. This index combines data on metro traffic, port congestion, box office revenue and various other daily indicators of China's economy.

-

European and US index futures are trading slightly lower than Monday's cash closing prices, with US500 falling by 0.2% and DAX by 0.3%.

-

A poll suggests that 62 economists expect the European Central Bank (ECB) to raise deposit rates by 25 bps to 3.50% on June 15. ECB's Stournaras stated that rate hikes are nearing an end.

-

The US dollar is experiencing slight appreciation, while currencies like AUD, NZD, CAD, and EUR have weakened.

-

The Reserve Bank of Australia (RBA) released its meeting minutes at 02:30 AM BST, which did not provide much clarity. The bank expressed concerns about potential damage to labor markets as interest rates rise and emphasized the need for productivity gains. During the May policy decision, the board considered pausing or implementing a 25 basis point hike. The next meeting will be on the 6th June 2023. Further interest rate increases may still be necessary, depending on the evolution of the economy and inflation.

-

AUDUSD has experienced a small decline, but with no significant changes and volatility

-

Talks between President Biden and congressional leaders regarding the US debt ceiling are scheduled for 3 pm US Eastern time on May 16, 2023.

-

Bitcoin initially rallied at the beginning of Tuesday's session but unexpectedly dropped by $500 to $26.8K. This short-term dip indicates continued demand for Bitcoin when its price falls below $27.5K. Other cryptocurrencies are trading in correlation with the highest market cap token, with Ethereum down by 0.3% to $1,810.

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.