- The FOMC decided to increase interest rates by 75bps yesterday, above initial expectations. The main rate is in the range of 1.5-1.75%

- The Fed message was rather hawkish – president Powell stressed the importance of ensuring price stability. The Fed sees the economy as being strong (unlikely to refrain from tightening due to worries of possible slowdown at this point)

- Risk assets rallied in an immediate reaction to the meeting, similar to the 50bp hike in May. S&P500 gained 1.46%, Dow 1% and Nasdaq as much as 2.5% on Thursday

- However, just like in May, this reaction fizzled overnight with futures now pointing lower. DE30 seems to be set up for a lower opening after rallying overnight

- While markets have largely moved past the Ukrainian war, it still rages and the Ukrainian side reports Russian assaults from 9 directions. The focus in on resulting food crisis (major corn and wheat supplies are at risk).

- The ECB held an extraordinary meeting yesterday and started working on measures to address market fragmentation. Markets read this as possible watering down of expected tightening – this helped European stocks and incidentally helped defend 20000/1000 levels on Bitcoin and Ethereum

- In Asia Hong Kong raised rates by 75bp to 2% while Shanghai reopening seems to be taking longer than expected

- Very mixed data prints:

- Japanese May trade close to expectations (exports +15.8% y/y, imports +48.9% y/y)

- Awful GDP Q1 report on GDP -0.2% q/q vs +0.6% expected!

- +60.6k jobs in Australia (+25k expected) but unemployment rate stays at 3.9% (3.8% expected)

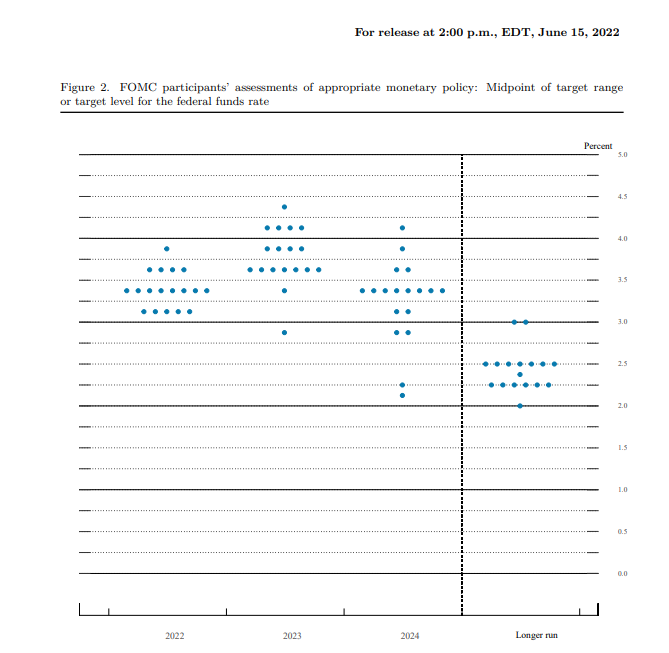

After hiking by 75 bp, the Fed communicates 175 bp moves over the next 4 meetings this year. Source: federalreserve.gov

After hiking by 75 bp, the Fed communicates 175 bp moves over the next 4 meetings this year. Source: federalreserve.gov

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.