-

Stocks in Asia traded lower at the beginning of a new week. Nikkei dropped over 2%, Kospi plunged 1.8%, S&P/ASX 200 finished 0.1% lower and indices from China declined

-

US and European equity futures launched new week lower

-

US Senator Manchin changed his position and said that he cannot support Biden's 'Build Back Better' infrastructure deal. This made situation more complex and will cause any talks to drag in 2022

-

Goldman Sachs lowered US real GDP forecasts for 2022 amid struggles with infrastructure deal. GS expects Q1 real GDP growth to reach 2% (3% earlier), Q2 growth to reach 3% (3.5% earlier) and Q3 growth to reach 2.75% (3% earlier)

-

Fed's Waller said late on Friday that goal of accelerating QE taper is to make conditions for a first rate hike as soon as March 2022

-

Netherlands imposed a 3-week lockdown over the Christmas period due to Omicron concerns

-

Australian authorities ruled out new Covid restrictions for now. The German health minister said that a lockdown during Christmas is not an option. Similar comments were made by the UK authorities

-

People's Bank of China lowered 1-year loan prime rate from 3.85 to 3.80% while 5-year rate was left unchanged at 4.65%

-

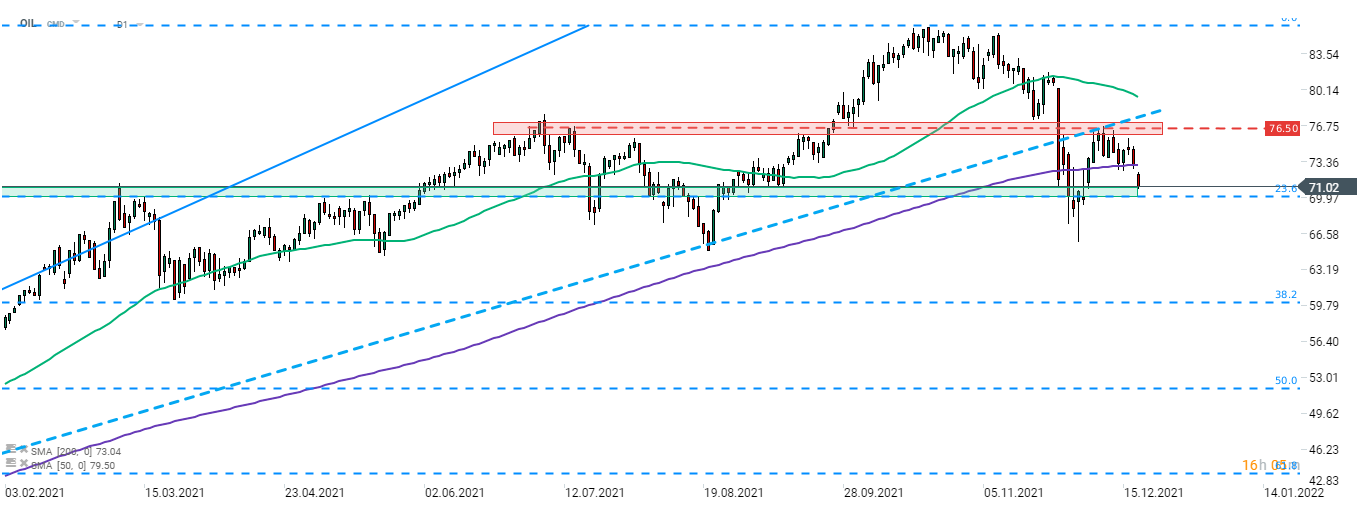

Oil is trading lower following news of Dutch Christmas lockdown. Industrial metals also drop

-

Gold is trading slightly higher while other precious metals drop

-

EUR and JPY are the best performing major currencies while AUD and NZD lag the most. Turkish lira continues to drop with USDTRY reaching daily high at around 17.60

OIL (Brent) launched a new week with a big bearish price gap and dropped to a 2-week low. The Netherlands decide to impose a 3-week lockdown over Christmas and crude price moves lower as traders fear other countries may do the same. Nevertheless, UK and Germany have ruled out similar measures for now. Source: xStation5

OIL (Brent) launched a new week with a big bearish price gap and dropped to a 2-week low. The Netherlands decide to impose a 3-week lockdown over Christmas and crude price moves lower as traders fear other countries may do the same. Nevertheless, UK and Germany have ruled out similar measures for now. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

NATGAS muted amid EIA inventories change report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.