-

US and European index futures launched new week lower as the West moved to impose harsher sanctions on Russia over the weekend

-

The United States and EU decided to impose harsh sanctions on Russia and its ability to finance war. Allies announced that part of Russian banks, that are not handling energy financing, will be cut off from SWIFT while assets of the Central Bank of Russia were frozen

-

Central Bank of Russia forbade domestic brokers from accepting sell orders for Russian securities from foreign investors. Launch of Russian stock trading session was postponed from 7 am to 12 pm GMT

-

Ruble crashed after the West moved to target the Russian financial sector. USDRUB launched a new week near 120.00, up from around 82.00 at the close of the previous week. However, it is hard to say at what levels ruble trade right now as liquidity on the market is very thin and most brokers have not resumed RUB trading yet

-

ECB assesses that European unit of Russian state-owned Sberbank is likely to fail following sanctions

-

Fighting in Ukraine continued over the weekend. According to media reports, Russian offensive is unsuccessful with Russian army being unable to capture any major locations over the weekend

-

Belarus voted in a referendum to change law and allow Russian nuclear warheads to be located on its territory. International community claims that results were forged

-

Russian jet fighters and rockets were launched against Ukraine from Belarus territory. According to media reports, Belarus will officially join Russian invasion today and send its troops to Ukraine

-

Russian and Ukrainian delegations arrived at locations of talks near Ukraine-Belarus border

-

According to UK Times, 400 Russian mercenaries were deployed to Kyiv with task of assassination Ukrainian President

-

Putin ordered nuclear deterrence forces to be in state of readiness

-

Norway's sovereign wealth fund will exit the $2.83 billion position it has in Russian equities and bonds. French BP said it will entirely divest its stake in Russian Rosneft, taking a $25 billion charge in the process

-

More European countries announced aid to Ukraine over the weekend, including military and humanitarian aid

-

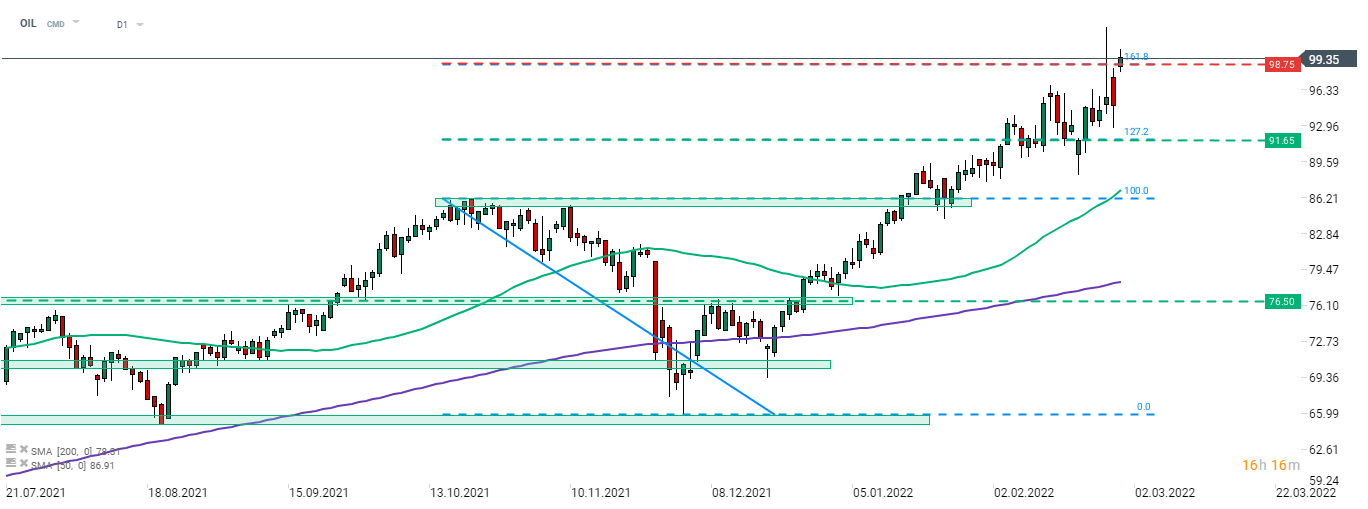

Oil trades higher as risk of disruption to energy flows from Russia increases. Brent gains over 4% and trades back above $99 per barrel

-

Precious metals trade higher. Gold and platinum gain around 1% while palladium rallies 5%

-

AUD and GBP are the best performing major currencies while CAD and USD lag the most

Western countries moved to target Russian reserves as well as cut off part of Russian banks from SWIFT. There is a risk that Russia may retaliate by cutting off energy exports to Europe. However, this would be a massive hit to Russian revenues. Brent (OIL) jumped at the start of a new week and once again trades above $99. Source: xStation5

Western countries moved to target Russian reserves as well as cut off part of Russian banks from SWIFT. There is a risk that Russia may retaliate by cutting off energy exports to Europe. However, this would be a massive hit to Russian revenues. Brent (OIL) jumped at the start of a new week and once again trades above $99. Source: xStation5

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.