*Natural gas (NATGAS) prices are undergoing a dynamic correction, moving away from last week's highs of $5.5/MMBTU and testing key support around $4.3. Importantly, bearish sentiment persisted even despite the publication of a bullish EIA report.

Key conclusions:

-

The market ignores historical data: The EIA report showed a massive decline in inventories of -177 bcf (compared to forecasts of -166 bcf and the previous reading of -12 bcf). Although this reflects the cold start to December (the coldest since 2017), the market is already discounting the future, not the past. The downward reaction to such a strong reading is a sign of weak speculative demand.

-

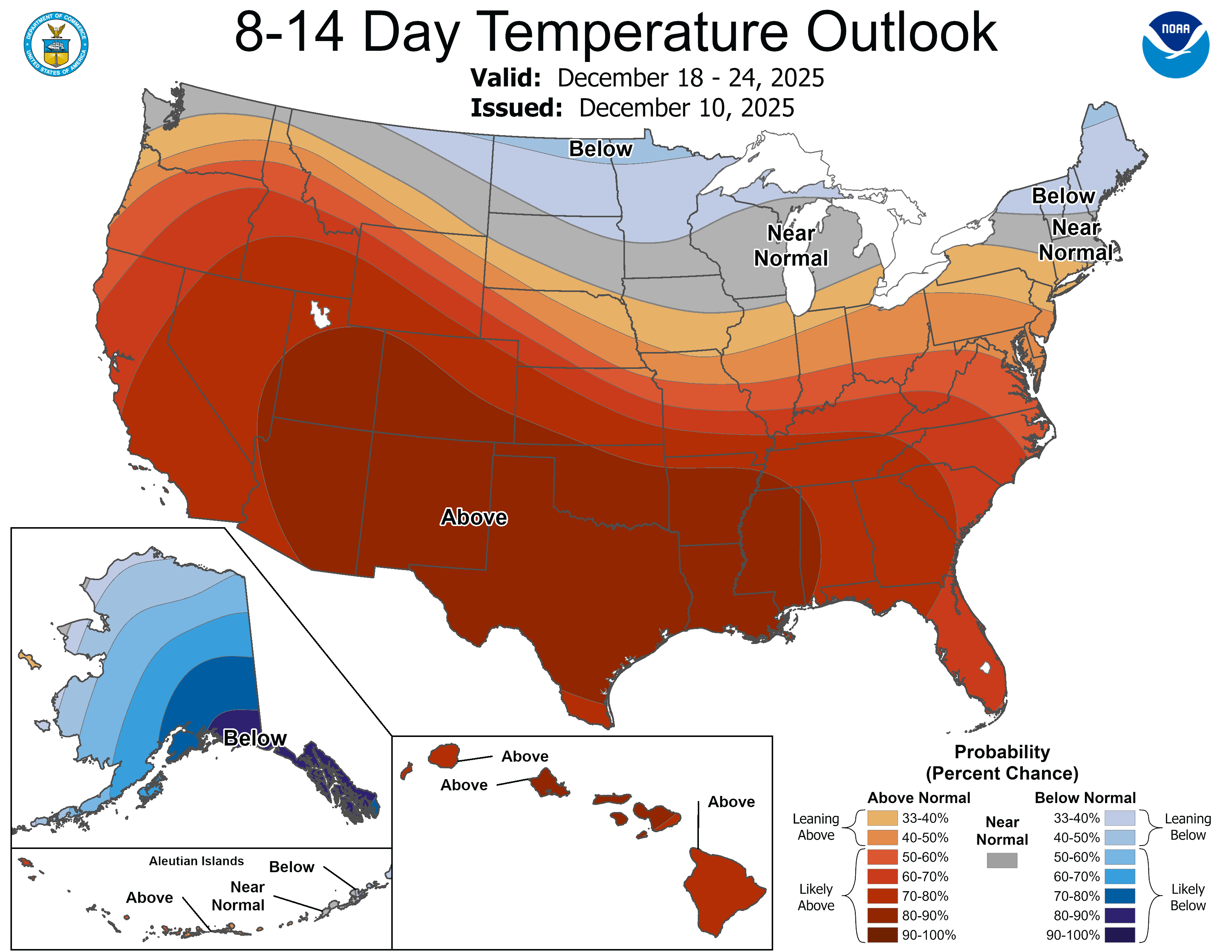

Weather front change: The main catalyst for the sell-off is the update of weather models (NOAA). Forecasts for the second half of December indicate the arrival of a heat wave moving from west to east across the US, which will drastically reduce the number of heating degree days (HDD) during the key period.

Sources: NOAA

-

Supply remains a burden: Record gas production in the US represents a ceiling for growth once weather pressures ease.

-

Technical situation: The price is testing support at $4.3/MMBTU, coinciding with the 50-day exponential moving average, which the market has not tested since 20 October. Interestingly, however, the RSI indicator for the last 14 days does not indicate that the instrument is oversold.

Source: xStation

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.