US natural gas price (NATGAS) are trading over 7% higher this morning after launching today's trade with an over-8% bullish price gap. Price tested $7.00/MMBTu resistance zone today, following an attack on the $6.30-6.40 zone on Friday. Price has now recovered a third of the latest major downward impulse and has broken above the downward channel in which it traded since early-August. The aforementioned $6.30-6.40 price zone, along with 23.6% retracement of the downward impulse, can now be seen as a key near-term support should bears attempt to fill the price gap.

Source: xStation5

Source: xStation5

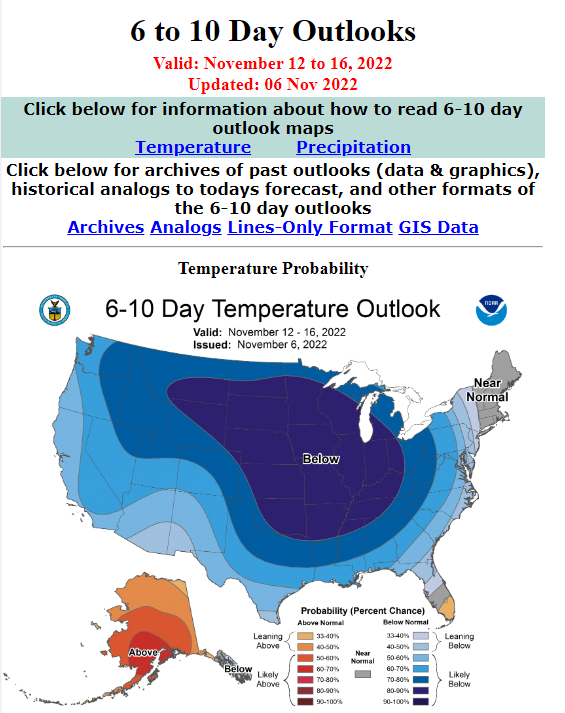

US weather forecasts for the coming days point that temperatures in key heating regions will be lower than usual. This means that the US heating season may already be underway. Source: NOAA

US weather forecasts for the coming days point that temperatures in key heating regions will be lower than usual. This means that the US heating season may already be underway. Source: NOAA

Interestingly, 5-year seasonal patterns suggest that significant natural gas price jumps are set to occur by the end of this week. Simultaneously, forecasts for Europe still point to higher-than-average temperatures, what is triggering a 3-4% drop in European natural gas price today.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.