Henry Hub natural gas (NATGAS) contracts are falling to their lowest levels since late autumn last year, testing a key technical support area near $2.95. While forecasts point to significant heat building over the next 10 days, demand remains muted due to currently mild conditions across most of the United States. More importantly, strong domestic supply and elevated storage levels continue to weigh on market sentiment, offsetting both rising LNG exports and weather-driven demand projections.

Prices are now hovering near the critical technical level of $2.972, and a decisive breakdown below it could pave the way for deeper declines — potentially toward $2.885, a price zone not visited in several months.

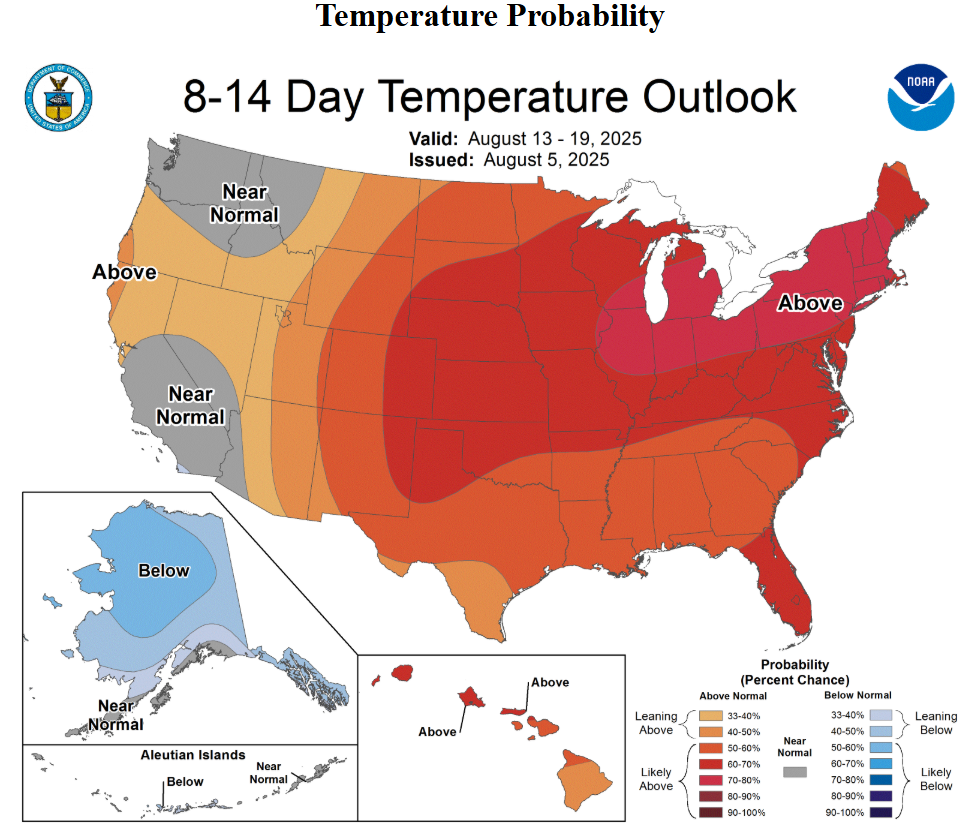

Despite meteorological models predicting a heatwave between August 9–17, with widespread temperatures in the 90s and 100s °F (30–40°C), current conditions remain too mild to spark significant cooling-related gas demand. Much of the U.S. is experiencing seasonally moderate temperatures, with limited air-conditioning loads outside the Southern states and California.

-

A stronger uptick in electricity demand is expected later in the week, driven by the South and West Coast.

-

For now, near-term weather remains a weak catalyst, and futures markets are showing clear skepticism, signaling a lack of conviction that the heat will be long-lasting or impactful enough to shift fundamentals.

Source: NOAA, CPC

Supply Continues to Dominate the Narrative

Fundamentally, production growth continues to outpace consumption in the U.S., even with the usual summer fluctuations. According to recent data (August 1), dry gas output in the Lower 48 reached 108.1 billion cubic feet per day (Bcf/d) — up 3.4% year-over-year.

Meanwhile, total U.S. gas demand has fallen to 76.1 Bcf/d, marking a steep 13% year-over-year decline. This widening imbalance continues to pressurize prices.

-

LNG exports have improved, climbing to 15.2 Bcf/d, and while that provides some relief, it’s insufficient to balance the market in light of strong domestic supply.

-

Baker Hughes reported an increase of two active gas rigs last week, bringing the total to 124 — the highest in two years, reflecting producer confidence and expectations of sustained upstream activity.

-

U.S. regulatory policy is also leaning toward encouraging continued production, adding to the oversupply picture.

Storage Builds Reinforce Bearish Momentum

Further downside pressure came from last Thursday’s EIA storage report, which indicated a +48 Bcf injection for the week ending July 25 — well above the market consensus of +41 Bcf and nearly double the five-year seasonal average of +24 Bcf.

-

Current inventories now stand 6.7% above the five-year average, though still 3.9% below last year’s levels.

-

While total U.S. power generation was up 8.1% year-over-year, the bullish impact of that data was muted by the overwhelming supply and inventory narrative.

NATGAS (D1 Chart)

From a technical perspective, weather may hint at a bullish setup, especially across the Central and Eastern U.S., but the market is pricing fundamentals not forecasts. The prevailing sentiment remains that oversupply is the dominant force, and price action reflects that reality.

-

The RSI on the daily chart approaches oversold territory, hinting at possible short-term exhaustion among sellers.

-

Resistance levels remain clearly defined at $3.14 (recent price reaction zone) and $3.38 (Fibonacci retracement).

-

A sustained drop below $2.90 could open the door to a deeper correction, extending bearish momentum into late summer (before the seasonality catalysts).

The natural gas market remains pinned down by structural oversupply, even as short-term weather forecasts promise stronger demand. With production running at near-record levels, LNG export growth unable to absorb the excess, and storage building faster than expected, whether alone may not be enough to turn the tide. Until a structural rebalancing emerges through production cuts, stronger exports, or prolonged heat prices may continue to test the patience of the buyers.

Source: xStation5

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.