National Bank of Sweden (Riksbank) rises interest rates by 25 bp to 4.25%.

The Riksbank has raised its policy rate by 0.25 bp to 4% in an effort to curb persistently high inflationary pressures in the Swedish economy. This move, combined with decreasing energy prices, aims to stabilize inflation around the 2% target. The bank's forecast suggests that there could be further rate hikes in the future.

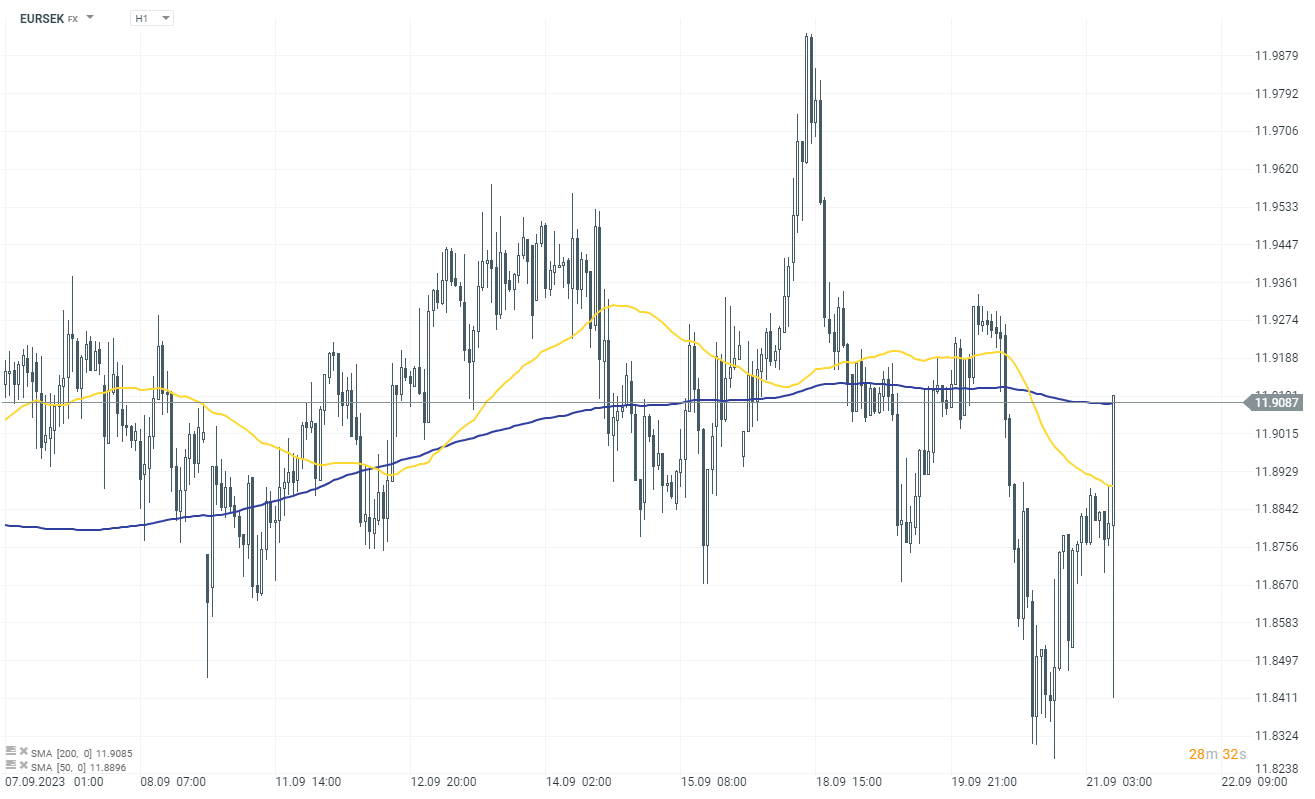

The market reaction is somewhat contrary to the decisions of Riksbank. Since rates are higher now, the SEK should appreciate. The Swedish krona's initial depreciation could be a result of the Riksbank's decision to hedge a portion of its foreign exchange (FX) reserves by selling 8 billion USD and 2 billion EUR in exchange for Swedish kronor. This process will start on September 25, 2023, and is expected to take four to six months to complete. The move is intended to curb potential losses for Riksbank in the event of the krona appreciating, and is not motivated by monetary policy objectives.

Source: xStation 5

3 markets to watch next week (05.12.2025)

BREAKING: Lower Unemployment in Canada🍁USDCAD sharply declines📉

BREAKING: Euro-zone GDP slightly above expectations!📈 EURUSD remains stable

BREAKING: Germany industrial orders for October higher than expected; EURUSD gains 📌

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.