Yesterday after the close of the box office session, streaming giant Netflix reported its second quarter results. The markets were awaiting them with bated breath because previous quarterly reports had caused dramatic sell-offs in the company's shares and turned out to be a harbinger of supply on the major indexes. This time Netflix beat analysts' expectations and the stock price is up almost 8% before the market opens, but are the results really that good?

Revenues: $7.97 billion vs. $8.05 billion forecast ($7.87 billion in Q1 2022)

EPS: $3.20 vs. $2.99 forecast ($3.53 in Q1 2022 )

Subscriptions: Loss of 970 k vs. 2 million forecast (200,000 loss in Q1 2022)

The company shared preliminary forecasts for Q3 2022:

Revenue: $7.87 billion vs. $8.18 billion expectations

EPS: $2.14 vs. $2.74 expected

Subscriptions: Increase of 1 million vs. 1.8 million expectations

- Netflix's results are mixed, but demand released as the company lost more than half as many subscribers as expected. Additionally, Netflix beat earnings per share forecasts. At the same time, however, revenue came in below expectations, and the company expects a further slowdown;

- It's worth taking note of the fact that the company's Q1 forecast of a loss of 2 million subscriptions was not so much cautious as catastrophic. The bar was lowered in such a way that it would be hard for the de facto company not to beat it, especially given the premiere of the new season of Stranger Things. The company admitted to lowering its revenue projections for paid subscriptions in the current quarter due to, among other things, exchange rate risks impacting sales;

- Bloomberg Intelligence analysts share concerns around the company's weakened forecasts for Q3 this year, and highlight the lack of catalysts (Stragner Things was one this quarter) and currency pressures, which may support a bearish scenario for Netflix of increasing competition and changing household spending. All of this raises concerns around prolonged sustained demand for Netflix stock;

- A strong dollar could weigh on Netflix going forward. Nearly 60% of the company's revenue comes from outside the U.S., plus Netflix incurs most of its expenses in dollars so it does not benefit from a strong currency. Specially due to the currency emergency, Netflix posted an F/X Neutral Operating Margin Disclosure section to show how the impact of F/X has affected margins. The company highlighted the negative impact of dollar appreciation on current results. Revenues grew nearly 9% year-on-year, however, they would have grown nearly 13% if the negative impact had not been due to the currency market. Operating profit and margin slightly exceeded the company's estimates;

- Netflix, despite the high-profile release of Stranger Things, lost nearly 1 million customers in the quarter, still nearly 500% more than in the previous quarter. Additionally, the strategy of building lower forecasts every quarter to build an atmosphere around a 'positive surprise' seems to be a road to nowhere. The market expects Netflix to leapfrog revenue growth and new subscriptions in order for the company to reaffirm its status as the market leader in streaming platforms, which has been challenged in the face of weakening and growing competition;

- The company is still able to gather millions in front of screens, and in June Netflix's share of TV viewing in the US nearly beat the combined performance of giants NBC and CBS and hit historic peaks reaching nearly 7.7% of total viewing. Indirectly, however, this is due to the successful new season of Stranger Things, which generated 1.3 billion viewing hours in the first four weeks after its premiere and drove up viewership of older seasons.

Ads and account sharing

- The letter to shareholders did not specify the exact date when advertisers will appear on the streaming platform, however, Netflix estimated the date to be 'around the beginning of 2023'. Previously, the company said it would introduce new business models later this year.

- The company conveyed that it is in the early stages of working to monetize the nearly 100 million households that use its services without paying. In 2023, Netflix intends to create a simplified model for paid password sharing among households in all countries (current account sharing rates in select Latin American countries are $2.99).

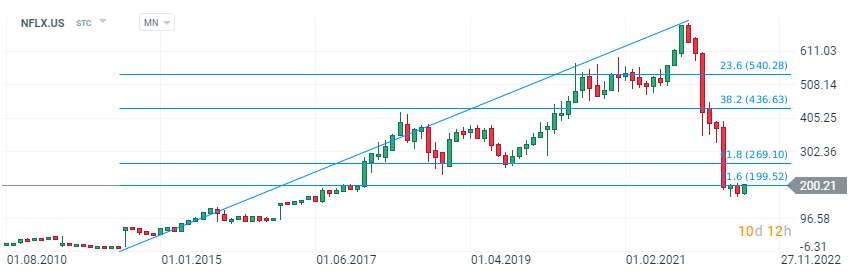

Netflix (NFLX.US) ackji chart, MN interval. The company was in a long-term strong uptrend of several years, which was challenged in 2022. After massive declines, in which Netflix has lost nearly 67% of its valuation since the beginning of 2022, the stock is trying to rebound, with today's opening suggesting levels near $220. Yesterday's session saw Netflix close above $200 and at the same time above the 21.6 Fibonacci retracement of the downward wave, which raises hopes around a rebound even towards $270, where we observe the retracement of 31.8. Source: xStation5

Netflix (NFLX.US) ackji chart, MN interval. The company was in a long-term strong uptrend of several years, which was challenged in 2022. After massive declines, in which Netflix has lost nearly 67% of its valuation since the beginning of 2022, the stock is trying to rebound, with today's opening suggesting levels near $220. Yesterday's session saw Netflix close above $200 and at the same time above the 21.6 Fibonacci retracement of the downward wave, which raises hopes around a rebound even towards $270, where we observe the retracement of 31.8. Source: xStation5

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.