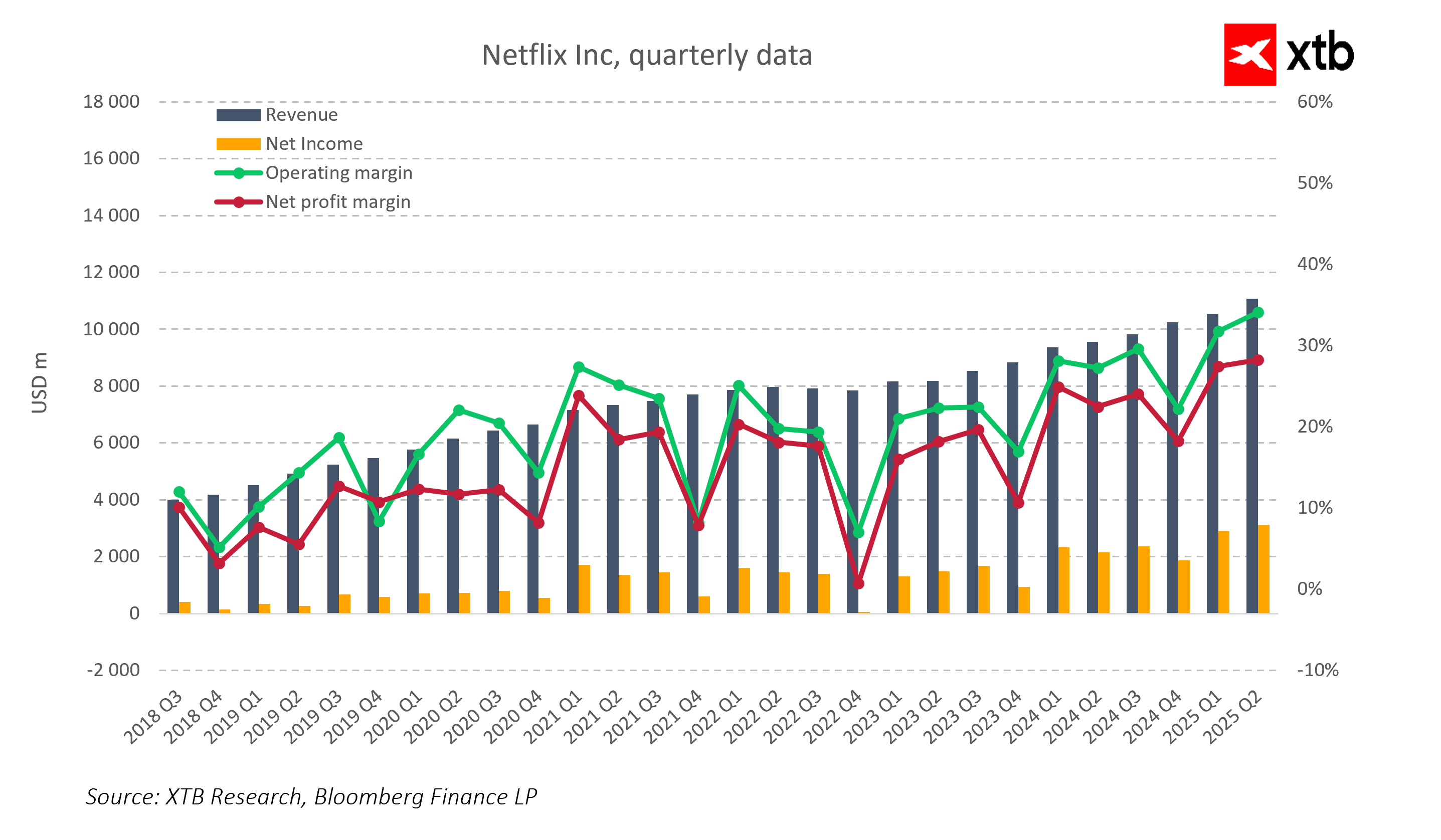

- Forecasts for Q3 2025 indicate a significant increase in revenue around USD 11.5 billion and net profit USD 3.01 billion,

- The company is consistently improving its margins, with plans to achieve an operating margin above 30% by 2025, reflecting effective cost control and growing efficiency.

- Forecasts for Q3 2025 indicate a significant increase in revenue around USD 11.5 billion and net profit USD 3.01 billion,

- The company is consistently improving its margins, with plans to achieve an operating margin above 30% by 2025, reflecting effective cost control and growing efficiency.

Netflix at a Crossroads: Will the Streaming Giant Surprise Investors and Return to Growth?

Netflix is the undisputed pioneer of the digital entertainment era, having sparked the binge-watching revolution. However, by 2025 the market is becoming increasingly crowded, and user expectations are rising. The key question is whether Netflix can maintain its pace and innovation.

Today, the company will announce its Q3 results, which could be decisive for its future trajectory. After facing growing competition, challenges in acquiring new subscribers, and cost pressures, investors will be closely watching every signal.

Will the latest productions and pricing strategy adjustments help Netflix regain momentum? Can the company hold a strong position in a world filled with aggressive competitors? We’ll find out today after the market closes.

Market Expectations: Q3 2025 – Netflix’s Record Quarter?

- Revenue: Around $11.5 billion, a 17.1% year-over-year increase

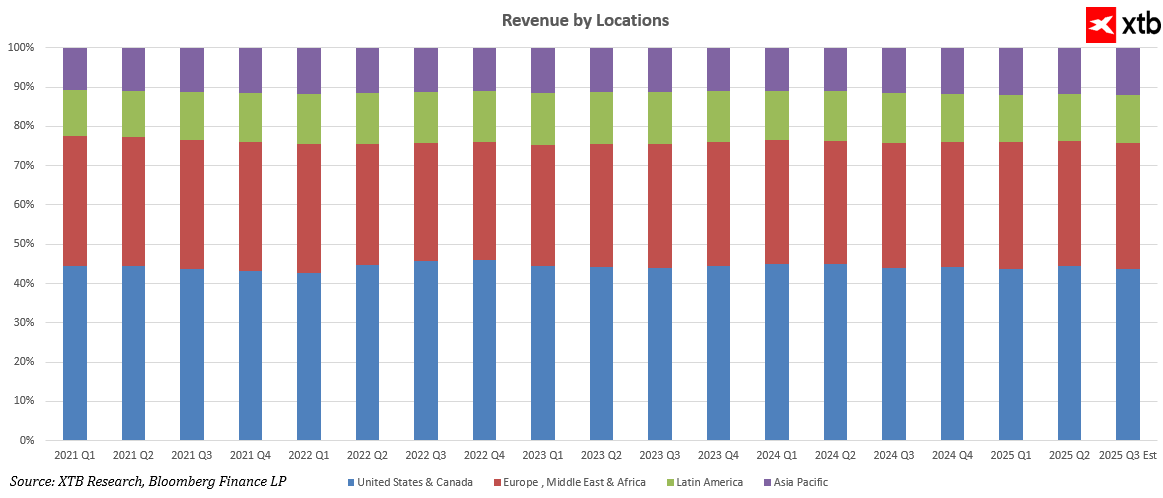

- Forecast Revenue by Region:

- US and Canada: $5.03 billion

- EMEA (Europe, Middle East, and Africa): $3.67 billion

- Latin America: $1.4 billion

- APAC (Asia-Pacific): $1.38 billion

- US and Canada: $5.03 billion

- Net Profit: Approximately $3.01 billion – a significant increase compared to Q3 2024

- Gross Margin: About 49.7% – improved profitability driven by cost optimization in production and distribution

- EBITDA: Around $3.79 billion – reflecting higher operational efficiency and stronger core earnings

- EPS (Earnings Per Share): Projected at $7.01

- Free Cash Flow: Expected near $2.38 billion

- CAPEX: Stabilized capital expenditures, maintaining around $150-160 million quarterly

Q4 2025 Analyst Forecasts:

- Revenue: $11.9 billion

- Gross Margin: 45.2%

- Net Profit: $2.39 billion

Netflix is set to report approximately $11.5 billion in revenue for Q3 2025. Forecasts suggest not only sustained growth but potentially accelerated momentum in upcoming quarters. Analysts highlight that Netflix’s dynamic expansion in 2026 and beyond will be fueled by strong subscriber additions, international market growth, and increasing revenue from the ad-supported model. Additionally, investments in original productions and innovative content formats are expected to further strengthen Netflix’s market position and boost revenues.

Analysis of Key Drivers Behind Netflix’s Performance and Regional Revenue Breakdown

Netflix continues to lead the streaming market, steadily growing its global subscriber base, which has surpassed 300 million. The introduction of a lower-priced ad-supported tier and efforts to curb password sharing have helped attract new users and improve revenue quality. The ad-supported model opens doors to price-sensitive customer segments while growing ad revenue, becoming a significant and profitable income source.

The company consistently optimizes spending on original content production, controlling growth and improving operating margins. Narrowing the gap between amortization and actual cash expenditures positively impacts cash flow, granting Netflix greater investment flexibility while maintaining financial stability.

Price hikes, especially in the U.S., have been well received by users, underscoring Netflix’s strong brand and high customer satisfaction. The current trend of rising streaming prices, dubbed “streamflation,” is leveraged by Netflix to increase revenue while minimizing subscriber churn.

The ad-supported model is emerging as a new revenue growth engine, allowing Netflix to monetize users who previously used cheaper or shared accounts. Ad revenues on connected TVs are growing rapidly, creating an attractive and profitable business line.

Geography of Netflix’s Success: Where Is the Company Growing Fastest and Why?

Netflix generates revenue globally, focusing on four main regions with varying scale and growth rates.

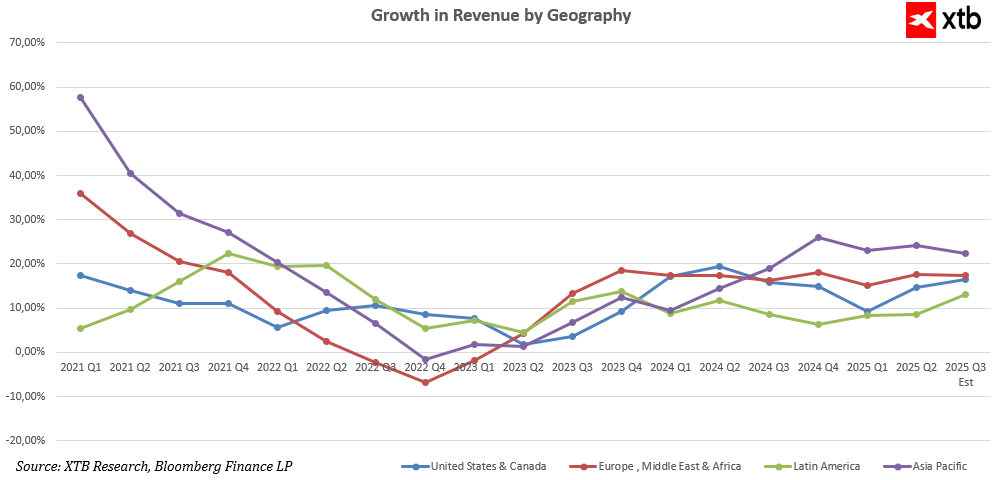

- United States and Canada: The largest market, accounting for over one-third of total revenue. This region experiences steady, moderate quarterly growth, typically several to double-digit percentages. For Q3 2025, Netflix forecasts approximately $5.04 billion in revenue here.

- EMEA (Europe, Middle East, Africa): The second-largest market, growing despite local challenges. Projected revenue for Q3 2025 is about $3.68 billion, driven by expansion and localization efforts.

- Latin America: Shows moderate but steady growth, benefiting from rising internet penetration and subscriber numbers. Expected Q3 2025 revenue is around $1.4 billion.

- Asia-Pacific: Although revenue here is the lowest ($1.38 billion projected for Q3 2025), growth rates often exceed 20% quarterly. Expansion in countries like India, Japan, and Australia offers significant opportunities for further development

Q3 2025 forecasts confirm Netflix’s dominant position in the U.S. market, alongside dynamic growth in EMEA, Latin America, and APAC. In coming quarters, the company plans to focus on expanding reach particularly in South America and Asia, where markets remain underpenetrated and offer substantial growth potential.

Netflix’s Strong Margins as a Foundation for Expansion and Innovation

Netflix steadily improves its margins, with market forecasts indicating continued growth, though Q3 2025 results will be confirmed after market close. Operating margin rose from 12.9% in 2019 to over 20% in 2023. In 2024 it reached approximately 26.7%, with 2025 consensus estimating over 30%, while Netflix itself forecasts around 29.5%.

Operating profit has also grown rapidly, from $2.6 billion in 2019 to an expected $13+ billion in 2025. Improved profitability stems from effective cost control, optimized content production spend, and rising revenues, partly thanks to initiatives like cheaper ad-supported subscriptions.

Netflix in 2030

Netflix aims for dynamic growth in both user base and profitability in the coming years. The company plans to reach approximately 400 million active subscribers by 2030. This growth will be driven by expansion into fast-growing, underserved markets, especially in Latin America and Asia-Pacific, where increasing internet penetration and digital entertainment demand present major opportunities.

Financial results, combined with a growing subscriber base, strengthen Netflix’s position as a streaming market leader and enable further investments in local productions, new content formats such as interactive experiences and gaming.

Conclusion

Netflix maintains strong growth momentum, targeting 400 million subscribers by 2030 and steadily increasing operating margins to surpass 30% in the near future. This improves profitability and fortifies its financial foundation.

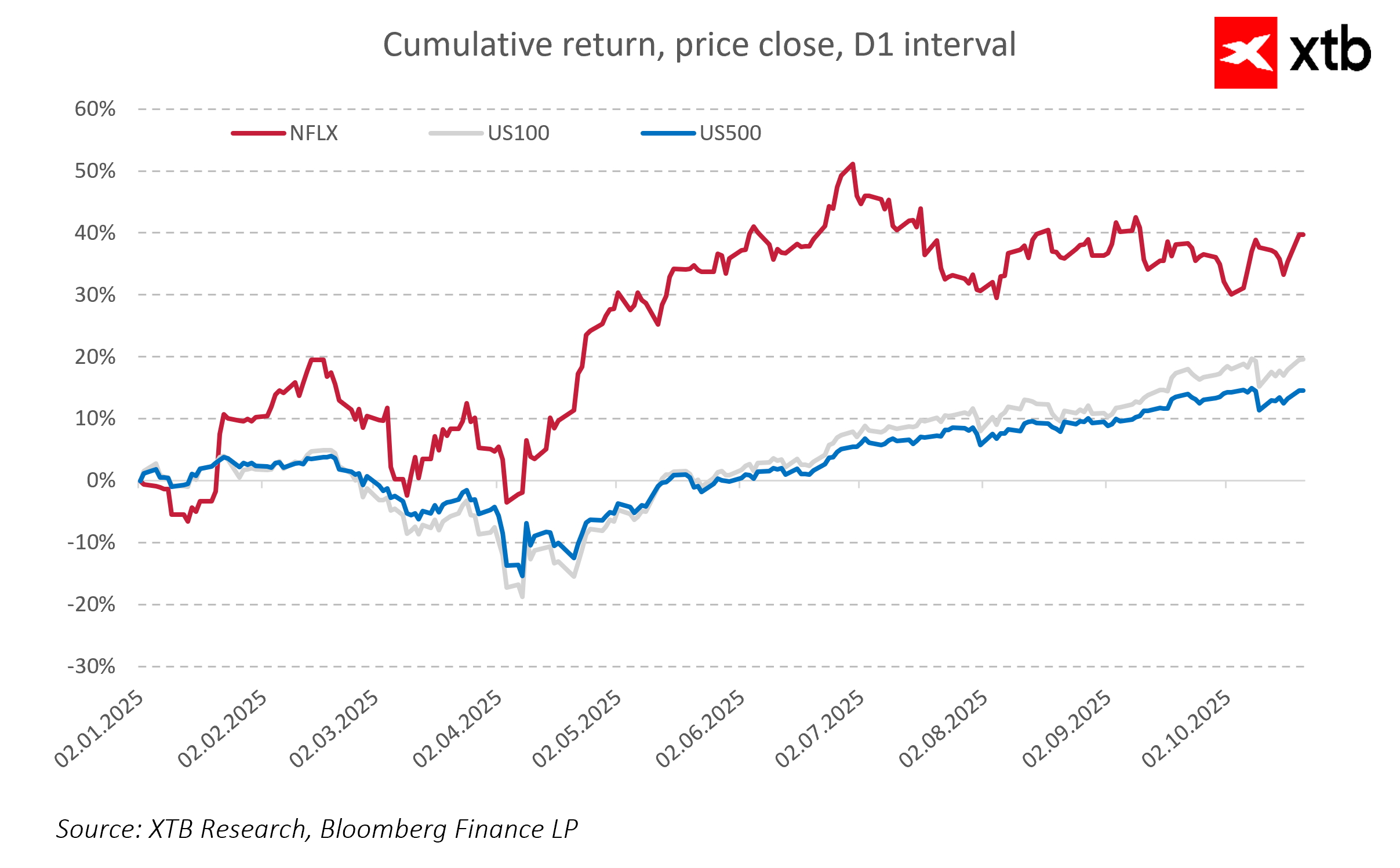

In 2025, Netflix stands out on the capital markets, delivering results that significantly outperform major indices like the S&P 500 and Nasdaq 100. This stock performance reflects investor confidence in the company’s strategy and ability to generate stable, solid financial outcomes. Netflix not only outperforms benchmarks but also earns recognition from analysts and investors for its innovation, expanding offerings, and effective cost management. This strong capital market position confirms Netflix as an attractive long-term investment, blending growth potential with financial stability.

Netflix continues to solidify its leadership in the streaming industry, efficiently growing its customer base and profitability—combined with positive capital market sentiment, this gives investors an optimistic outlook for the future.

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.