Why the Results Matter

Today, Netflix is set to release its fourth-quarter 2025 results, and the media and investor world is holding its breath. This is not just a standard financial report — it is a key moment for the company to demonstrate that its subscription and hybrid model (ads + subscriptions) is sustainable, even amid global competition and major strategic deals.

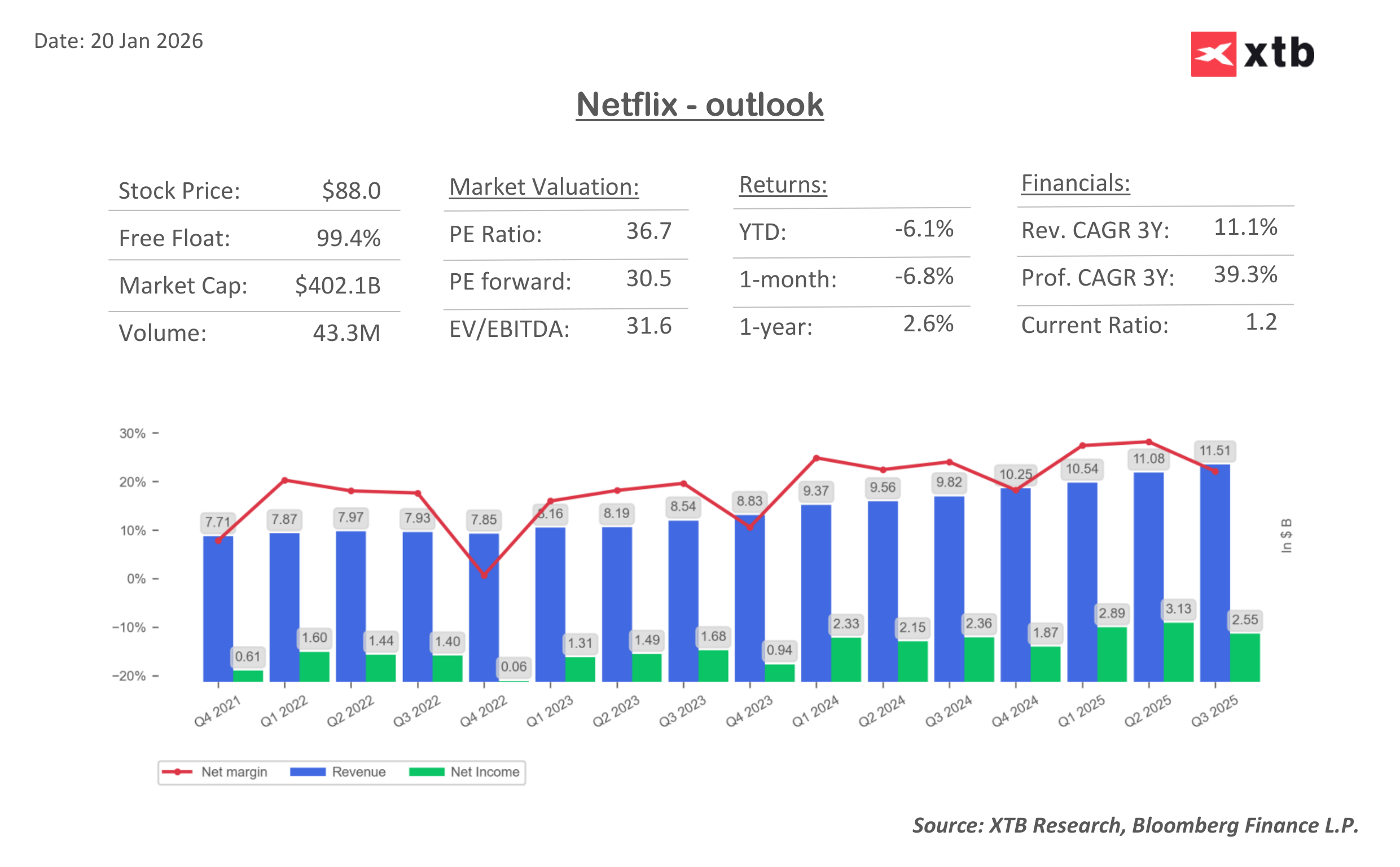

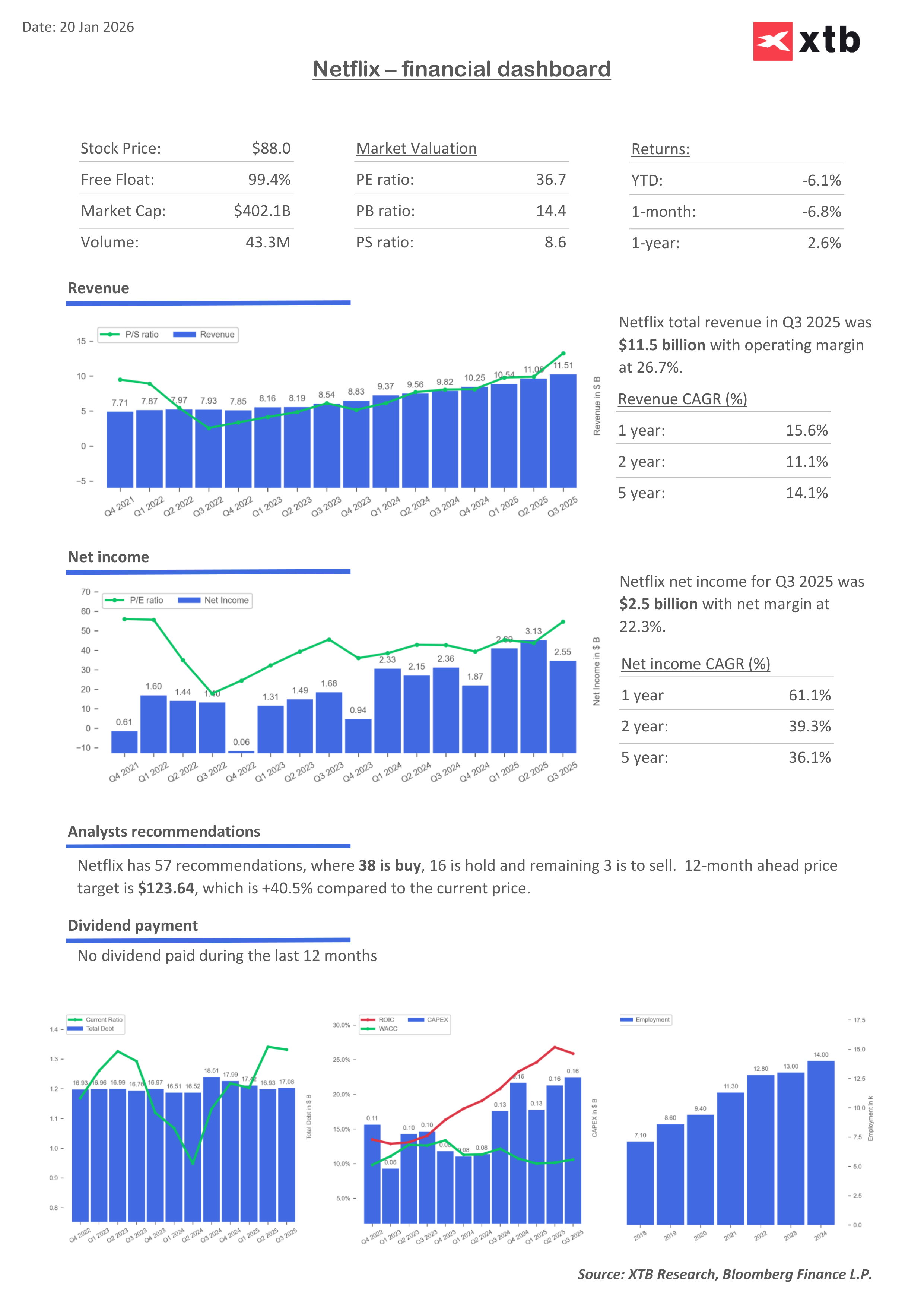

Forecasts point to revenue growth of around 16.7% year-on-year, driven by price increases, a growing advertising segment, and a blockbuster content lineup. Operating profit is expected to remain stable, and the streaming giant anticipates a 29% operating margin in 2025 and cash flows of $9 billion, compared to $6.9 billion in 2024.

Key Financial Estimates for Q4 2025:

-

Revenue: $11.96 billion, up 16.7% YoY

-

Earnings per share (EPS): $0.553, up 25.4% YoY

-

Operating margin: 29.6%

-

Net income: $2.36 billion, up 22.2% YoY

-

Operating income: $2.89 billion, stable versus the prior period

-

EBITDA: $3.03 billion, also stable

This shows that Netflix is not only growing but also generating strong cash flow, providing a foundation for investing in new content and potential acquisitions, including Warner Bros. Discovery.

What Investors Will Focus On

Investors will pay attention not only to revenue but also to the quality of growth and the potential for 2026. Key areas of focus are expected to include:

- Growth-driving content: Major Q4 hits such as the “Stranger Things” finale, the “Jake Paul vs. Anthony Joshua” fight, and NFL Christmas games increased engagement and attracted new users. Markets expect similar offerings in upcoming quarters.

- Advertising segment: Analyst estimates suggest ad revenue could reach $4–5 billion in 2026, after nearly doubling in 2025.

- Margins and profitability: Analysts project an operating margin of over 32% in 2026, continuing improvement from the 29% forecasted for 2025.

- Subscribers: Consensus anticipates 10.7 million new subscribers in Q4, although the company has stopped regularly disclosing subscriber numbers, focusing instead on revenue and ARPU.

All of this paints a picture of stable fundamentals, even as the market focuses on how Netflix plans to continue growing next year.

The Impact of Warner Bros.

Another important topic is the potential acquisition of Warner Bros. The $82.7 billion deal could dramatically change Netflix’s position in the market.

Even with relatively solid fundamentals in Q4, markets and investors will pay attention to:

- Regulatory risk: The deal is subject to antitrust review, which could lead to delays or additional restrictions.

- Concerns about core business growth: Some analysts question whether the company might be using this transaction as a “lifeline” amid slowing organic growth.

This shows that while quarterly results may be impressive, strategic decisions and M&A still dominate Netflix’s stock valuation.

Key Risks and Advantages for Netflix

Advantages:

-

Global subscriber base: Estimates suggest around 330 million users worldwide, with further potential to monetize content through ads.

-

Premium content: Original productions and live events, such as the “Stranger Things” finale or sports fights, increase engagement and help maintain user loyalty.

-

Improving profitability: Rising operating margins and ad revenue strengthen financial fundamentals.

Risks:

-

Competitive pressure: Disney+, Apple TV+, and Amazon Prime continue expanding content portfolios and investing in technology.

-

M&A risk: Debt and regulatory complications related to Warner Bros. could limit Netflix’s financial flexibility.

-

Macro and subscriber risk: Sensitivity to consumer sentiment and purchasing power across different regions worldwide.

Key Takeaways

Netflix is expected to show strong fundamentals in Q4 2025: revenue is growing, margins are improving, and cash flow is healthy. Despite concerns about slower core growth compared with previous quarters, the market expects Netflix to maintain revenue momentum and improve operational efficiency.

However, the strategic decision regarding the Warner Bros. acquisition remains a central issue, as it could reshape Netflix’s position in the global streaming market. Ongoing negotiations and the potential $82.7 billion deal continue to attract investor and analyst attention due to questions around financing, regulation, and the company’s long-term strategic direction.

Investors are therefore monitoring two parallel storylines: steady core growth in Q4 on one hand, and the risks and potential of a massive M&A transaction on the other. Success in one area without progress in the other may not be enough. 2026 is shaping up to be a year in which Netflix not only reports numbers but also actively shapes its future through strategic decisions and market expectations.

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.