-

Nagel: Highlighted gradual improvement in private consumption and exports, with strong wage growth and stubborn service inflation. Emphasized data-driven rate decisions and maintained that recent rate cuts were logical and not premature.

-

Kazaks: Emphasized that future decisions will be data-driven and gradual, indicating that victory over inflation is not yet achieved.

-

Muller: Urged caution and advised against rushing to cut interest rates.

-

Vasle: Stressed that the path of ECB interest rates cannot be predetermined.

-

Rehn: Expected declining inflation, supporting economic recovery, with a target of 2% inflation by 2025 assuming no surprises. Stressed the importance of evaluating policy restrictiveness.

-

Makhlouf: Acknowledged uncertainty in the disinflation pace but expressed confidence in its effectiveness, unsure about the speed of future actions.

-

Simkus: Noted clear disinflation with a challenging path ahead, suggesting more than one rate cut this year is possible if economic data remains in line with current forecasts.

-

de Guindos: Expressed concerns about economic uncertainty and projected inflation around 2% next year.

-

Holzmann: Indicated a cautious approach, with CPI risks outweighing growth risks from rate holds.

-

Schnabel: Warned about the lack of fiscal consolidation and its impact on monetary policy, emphasizing uncertainty in future inflation outlook.

-

Villeroy: Confident that inflation will return to 2% by 2025 assuming no unexpected shocks, with a balanced approach to rate cuts, ensuring appropriate pacing.

-

Centeno: Stated there is no fixed commitment on rate trajectory, noting the disinflation process is becoming clearer.

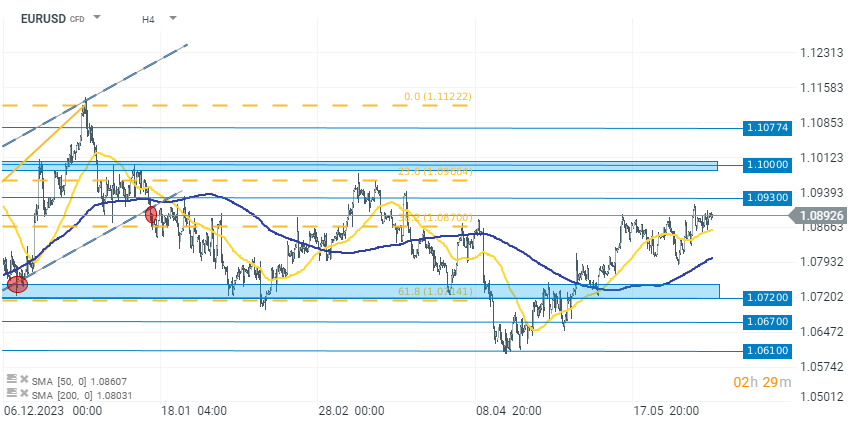

Statements from ECB representatives focused on justifying yesterday's decision to cut interest rates by 25 basis points. The overall message indicates a continuation of a cautious, data-dependent approach in the coming months. Many representatives confirmed the declining inflation dynamics in the Eurozone, while simultaneously expressing slight concerns about persistent inflation in the services sector. The ECB's stance remains unchanged. At the time of publication, a rate cut in July is unlikely, or even ruled out. Investor speculation is more likely to focus on a potential cut in September this year, along with a possible cut in the US.

Source: xStation 5

Source: xStation 5

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.