Sales: EUR 4.98 billion vs. EUR 5.67 billion forecasts

Earnings per share (EPS): €0.02 vs. €0.05 a year earlier

- Comparable sales fell 15% y/y. The company plans to lay off up to 14,000 employees from 86,000 currently to 72,000

- U.S. market demand weakens. The company cited consumer weakness in an environment of inflation and higher interest rates dampening demand

- Gross margin fell to 38.9% from 39.2% a year earlier. The company aims to save between €800 million and €1.2 billion by 2026

- Comparable operating margin fell year-on-year by 2% to 8.5%, which Nokia pointed to as evidence of profitability despite falling net sales

Nokia - weak but still optimistic?

- According to Nokia, working capital difficulties will subside from the current fourth quarter. The company also announced a strategy to give more autonomy to business groups to support the profitability of the business model. It sees long-term hope in the form of network services in the face of the AI and cloud computing trend, and sees current consumer weakness more as a temporary seasonal factor.

- Management's comments indicate that the company believes in the significant progress it has made over the past three years and the return on its investments over the long term. The company continues to expect full-year 2023 net sales in the range of €23.2 billion to €24.6 billion, with operating margins in the range of 11.5% to 13.0%.

- Network infrastructure revenues fell 14% y-o-y For mobile networks, net sales fell 19%, (slowing 5G deployment in India did not offset weaker results from the US). Cloud and network services proved stronger, falling 2% y/y with still strong corporate demand

Nokia (NOKIA.FI) stock chart D1 interval

The company's shares are trading more than 5% oversold today and are trading around the 71.6 Fibonacci retracement of the March 2020 upward wave at €3.13 per share.On the daily interval, the RSI indicator is around 24 points - an extreme oversold level, and from these levels historically the stock has often come out eventually on the defensive by starting a rebound. The key resistance is around EUR 3.9 - 4, where the average SMA200 (red line) is located.

Source: xStation5

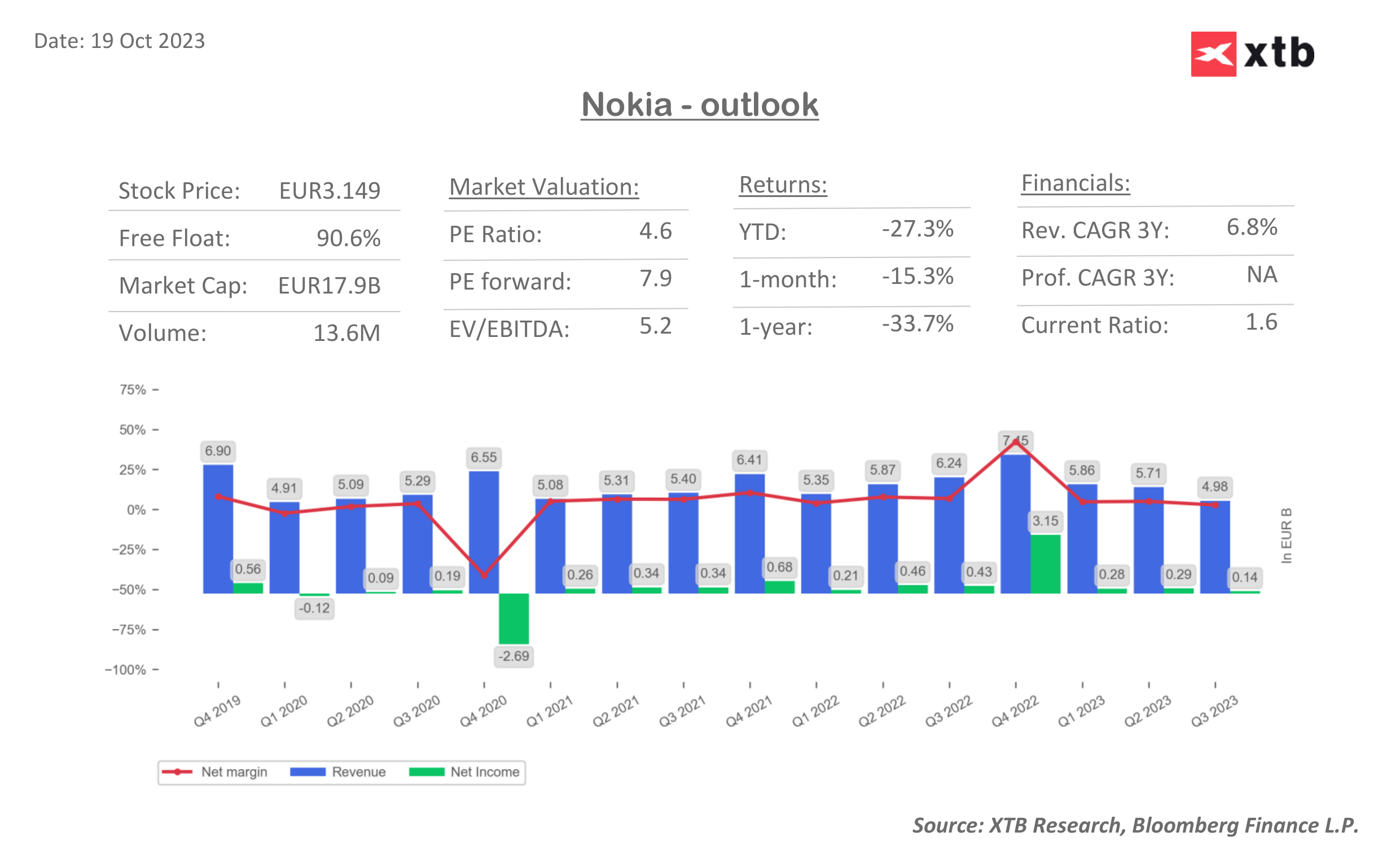

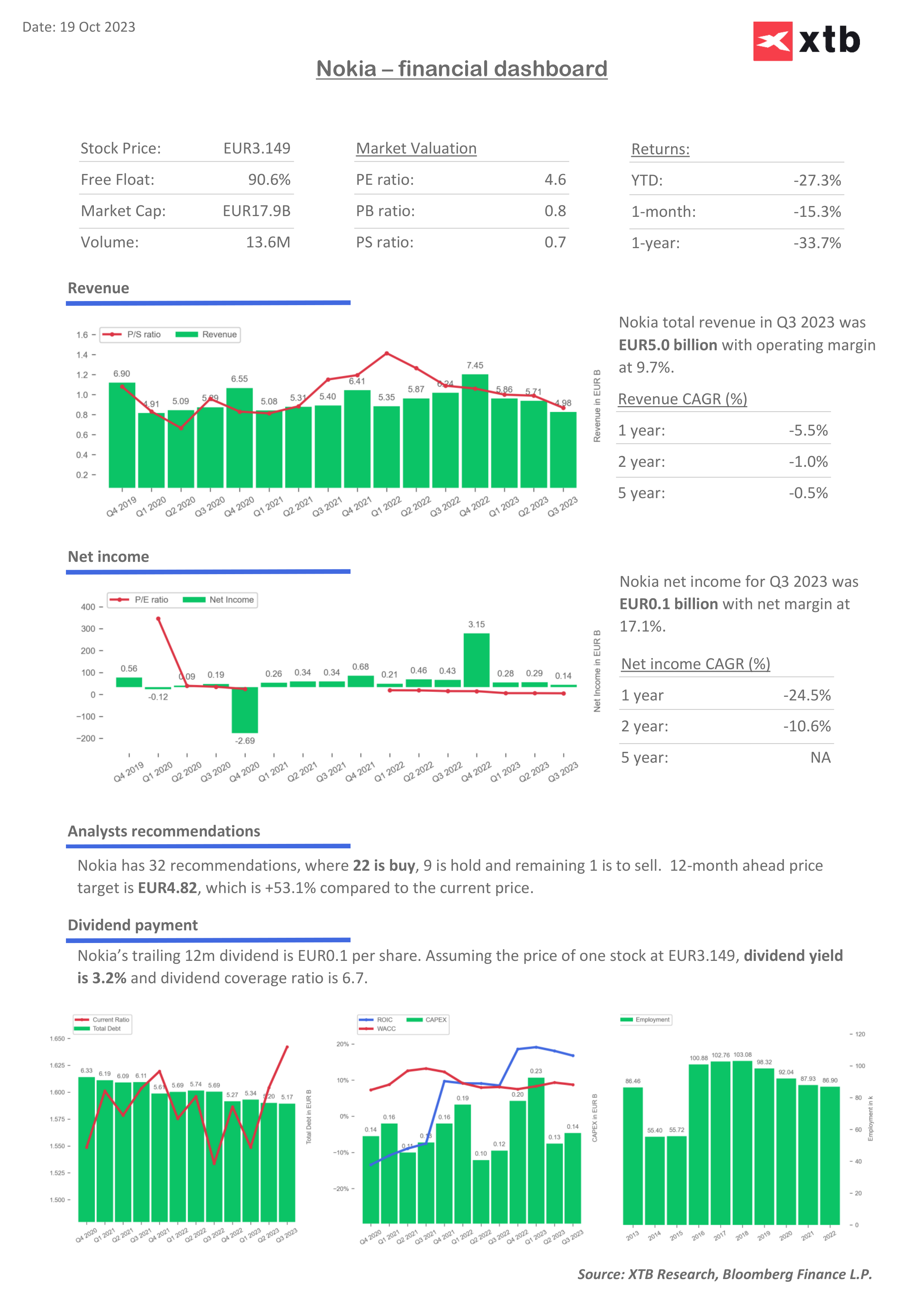

Nokia expectations and valuation

Source: XTB Research, Bloomberg Finance LP

Source: XTB Research, Bloomberg Finance LP

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.