Today, after the stock market closes, Nvidia will release its financial report for the third quarter of fiscal year 2026. This will be one of the most important events in the technology sector, as the company remains a key player in the artificial intelligence revolution, providing a significant portion of the computing power used in global data centers. Markets and analysts worldwide are eagerly awaiting the data, hoping for answers to a fundamental question: is the AI-driven tech boom still ongoing? What Nvidia reveals will not only determine its continued dominance in the rapidly growing semiconductor market but also influence the pace of the entire AI revolution. Today’s figures could either confirm the strength of the decade’s biggest technology trend or suggest that its momentum is beginning to shift.

Revenue Forecasts and Financial Expectations

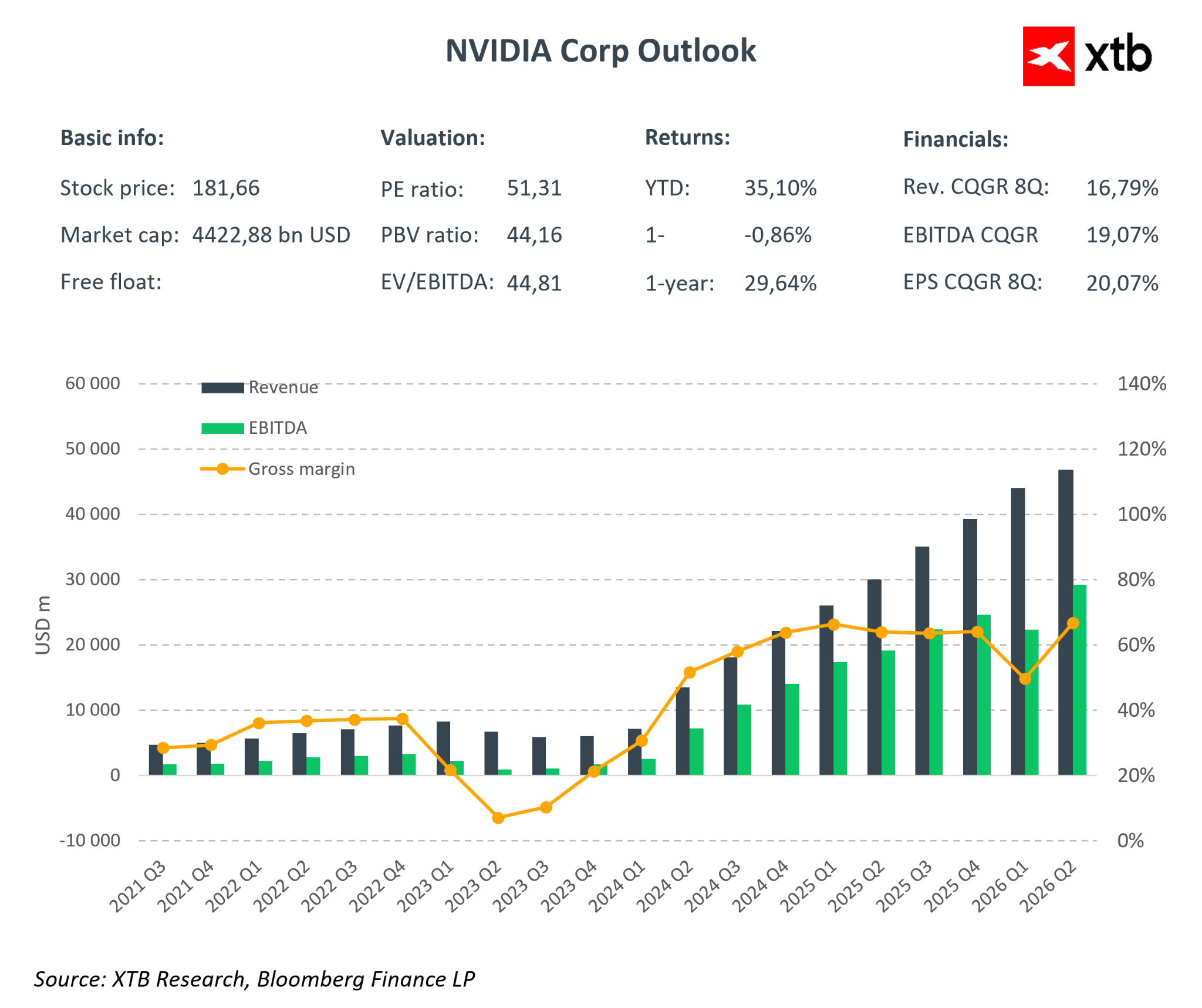

Financial results are expected to show revenue around $55.19 billion, representing a 90–94% year-over-year increase. Earnings per share (EPS) are projected at approximately $1.26, roughly a 50% increase from last year. The Data Center segment remains the core of the business, generating nearly 90% of revenue and driving rapid growth. The projected gross margin is around 73.7%, though it may be slightly lower due to increased research and development (R&D) spending and expansion.

Market expectations: Record quarter within reach

-

Estimated revenue: $55.19B (Bloomberg Consensus)

-

Data Center: $49.31B

-

Compute: $41.61B

-

Networking: $7.75B

-

-

Gaming: $4.42B

-

Professional Visualization: $612.8M

-

Automotive: $621.6M

-

OEM & other: $162M

-

-

Adjusted gross margin: 73.7%

-

Adjusted operating expenses: $4.22B

-

Adjusted operating income: $36.46B

-

R&D spending: $4.66B

-

Adjusted EPS: $1.26

-

Capital expenditures (CapEx): $1.59B

Q4 2026 projections:

-

Revenue: $61.98B

-

Adjusted gross margin: 74.6%

-

Adjusted operating expenses: $4.59B

-

CapEx: $1.66B

Fiscal Year 2026 projections:

-

Revenue: $207.95B

-

CapEx: $5.96B

Key Business Segments

The most important business segments are primarily Data Center, where Nvidia provides advanced processors and GPUs used to train and deploy AI models. The Blackwell architecture, enthusiastically presented by Jensen Huang, is the main driver of performance and profitability growth. Multi-billion-dollar contracts with major clients such as Microsoft, Meta, Amazon, and Alphabet confirm growing AI investments. The Gaming segment, while growing more slowly, remains a significant source of revenue, driven by the popularity of GeForce RTX cards and the GeForce NOW streaming service.

New Blackwell Architecture

The Blackwell architecture is Nvidia’s latest generation of GPUs, produced using TSMC’s 3nm process. It offers significantly higher transistor density, resulting in greater computing power and lower energy consumption. It enables fast AI computations and large-scale data center operations, supports advanced graphics technologies, and scales efficiently in multi-GPU systems, allowing Nvidia to maintain a competitive edge. Market attention during the earnings release will particularly focus on sales data for this architecture, seen as a key signal of demand and future performance.

Market Challenges

Despite its strength and potential, Nvidia faces significant challenges. Export controls, especially to China, limit expansion opportunities in strategic markets. Heavy R&D investment puts pressure on margins. Competition from companies like AMD and Chinese rivals has intensified recently, particularly in the growing AI and data center segments. Nvidia’s stock history also shows that even very strong financial results may not be immediately rewarded by investors, increasing share price volatility.

Market Scenarios Post-Release and Investor Reactions

Nvidia’s quarterly results are more than just numbers—they are a critical test for the entire tech market and the AI boom. The interpretation of these results could shape the sector for months, or even years.

Scenario 1: Results exceed expectations – the tech boom continues

If Nvidia reports results above analyst forecasts, the market will react enthusiastically. Higher-than-expected revenue and profits indicate that demand for AI solutions and semiconductor technology remains strong and stable. This would confirm that investments in data centers, language models, and AI infrastructure are growing faster than anticipated.

Investors would see Nvidia not only maintaining its leadership position but also leveraging its technological advantage (e.g., Blackwell architecture), giving it a significant competitive edge. This would likely boost the stock, increase capital, and drive further technology investments, enhancing the credibility of semiconductor and AI-related companies and attracting new investors.

This scenario also strengthens market confidence in tech valuations, contributing to stabilization and growth in tech indices and the broader stock market.

Scenario 2: Results miss expectations – AI bubble may deflate

If Nvidia’s results fall short—whether in revenue, profit, or margins—the market may take it as a warning sign. Concerns may arise that the AI boom, which has fueled tech and semiconductor markets in recent quarters, could lose momentum.

Investors who have relied on continuous growth in demand and stock value may begin profit-taking and risk reduction, causing a sharp price correction. This reaction could be particularly pronounced given the high valuations of tech companies, often based on expected future earnings.

Lower-than-expected R&D spending or rising operating costs may signal increasing competitive pressure and market limitations, potentially affecting the broader AI ecosystem and industry investment. In extreme cases, this scenario could trigger a wave of investor pessimism, leading to further declines and a more cautious approach to AI technology investments.

Communication and Long-Term Perspective

Regardless of the scenario, transparent and clear communication from Nvidia’s management will be crucial. Explaining discrepancies, outlining strategies for the upcoming quarters, and presenting a realistic yet optimistic outlook can significantly mitigate market reactions. Even in the case of corrections, the fundamental trends in AI and semiconductor development remain intact, and Nvidia, as a technology leader, has the potential to rebuild trust and continue growth.

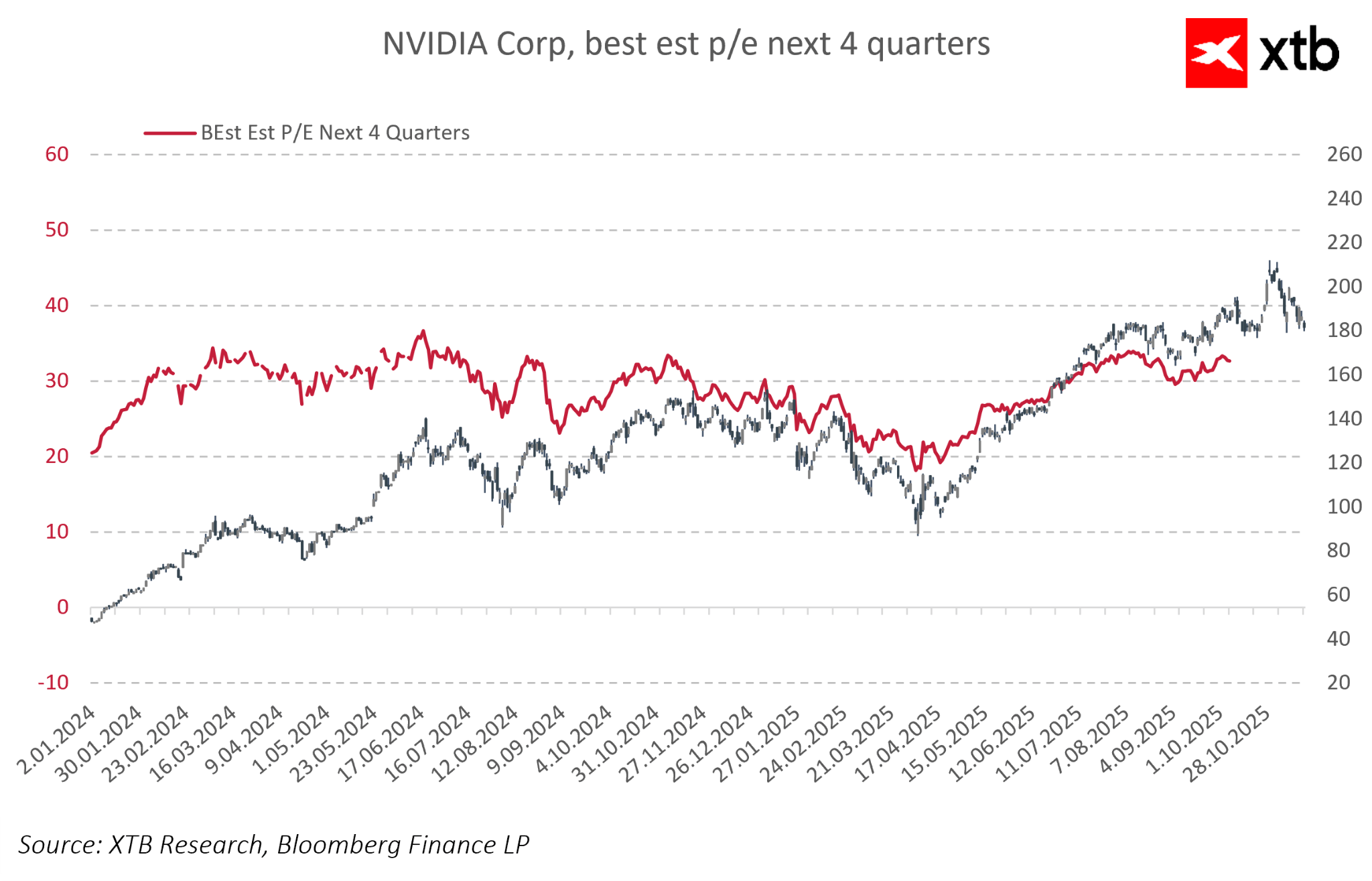

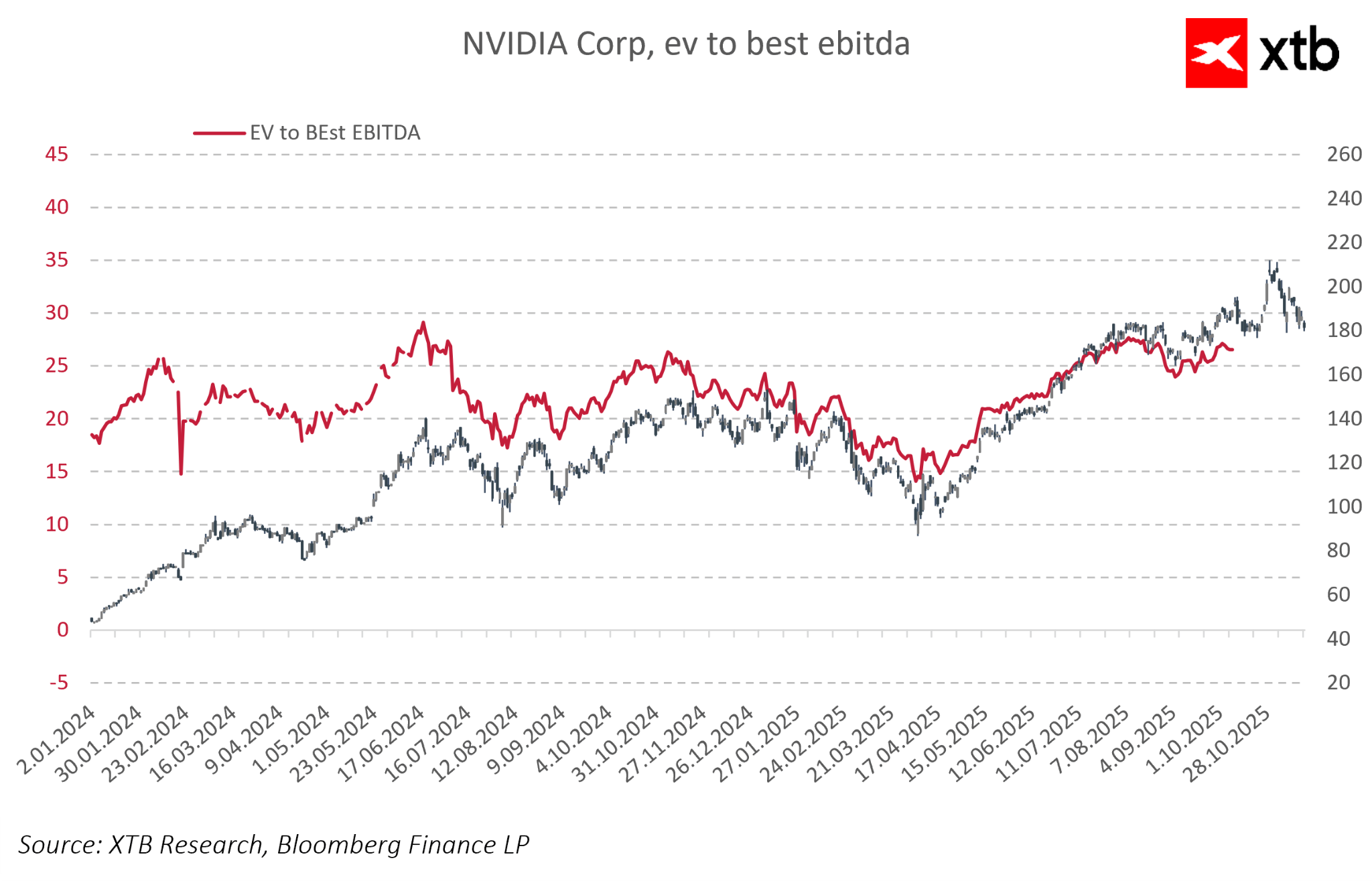

Valuation Before Earnings

Nvidia’s forward P/E ratios show a declining trend in upcoming quarters, reflecting increasing market expectations for future results. The decline is due to dynamic EPS forecasts, with the market anticipating not just historical growth but further acceleration in AI and data center profits.

The Nvidia premium over other tech companies remains, but valuations increasingly rely on projected higher future operating profits. A similar trend is seen in EV/EBITDA ratios, reflecting analysts’ expectations regarding operational efficiency and margins.

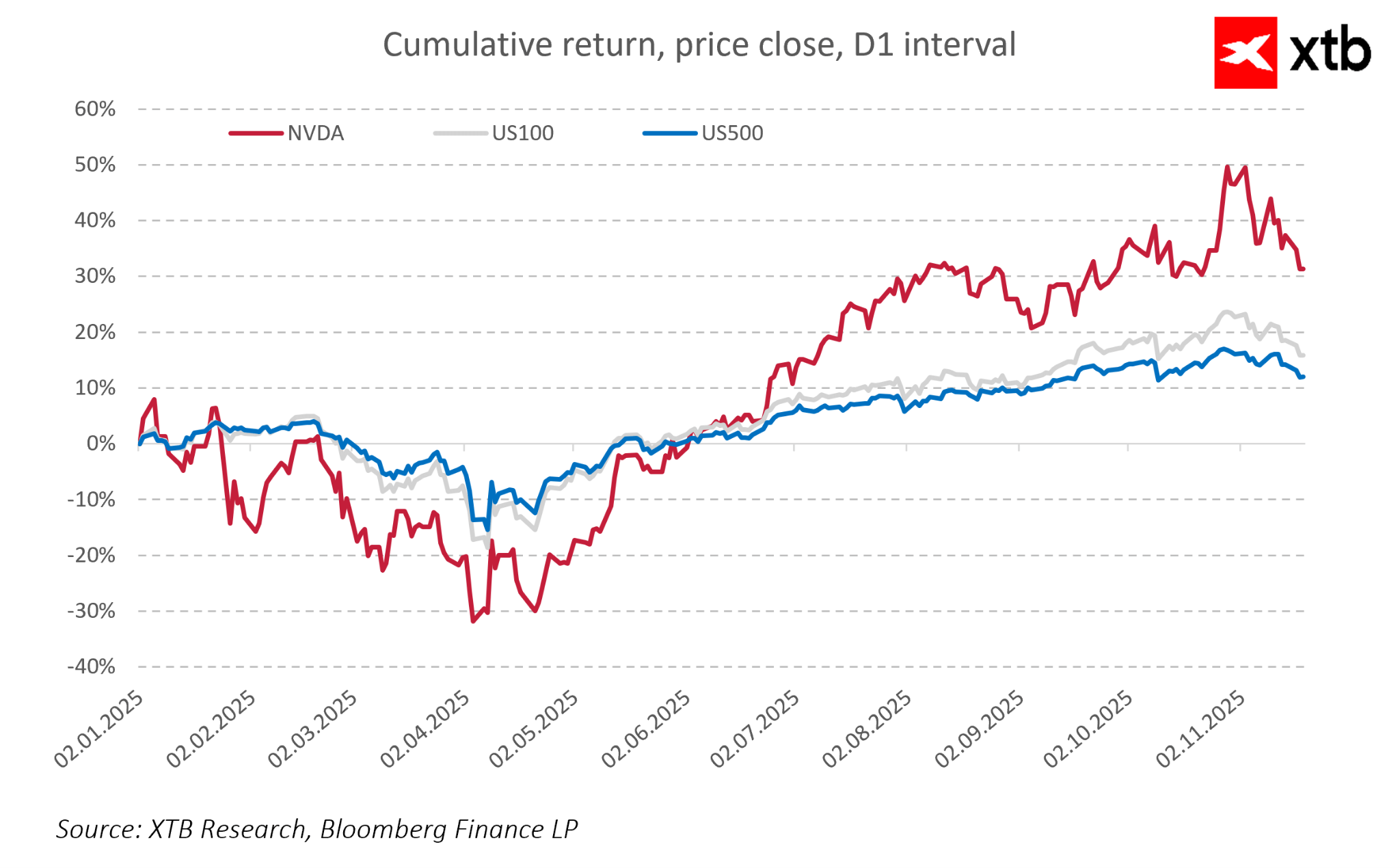

Cumulative stock returns compared to major indices highlight strong investor sentiment and Nvidia’s exceptional performance. While indices have risen 10–20% year-to-date, Nvidia stock has returned over 30%, despite recent corrections and high volatility.

This outperformance confirms high expectations for upcoming quarters, with the declining forward P/E trend illustrating investor confidence in future EPS growth and Data Center expansion. The market values not only past achievements but also Nvidia’s continued technological development and business expansion. With high revenue growth, dominance in key segments, and forward-looking expectations, the market reaction to the quarterly report is expected to be intense. Even small deviations from analyst consensus could trigger significant stock price movements, making Nvidia one of the most watched and highly valued tech companies.

Summary

Nvidia’s quarterly report is more than numbers—it is a test of the sustainability of the AI revolution and the company’s market dominance. The results’ dynamics, Blackwell technology advancements, and clarity of future outlook will influence the direction of the semiconductor and broader tech sectors for years to come. Investors should be prepared for both volatility and the recognition of Nvidia’s exceptional role as a driving force in global digital transformation.

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.