- Commodity Slump: Oil and silver prices dropped sharply after President Trump signaled a pause in potential military action against Iran and held off on imposing new tariffs on critical minerals.

- TSMC Earnings Beat: Taiwan Semiconductor Manufacturing Co. reported better-than-expected quarterly profits of NT$505.7 billion ($16 billion), boosting sentiment for technology stocks and artificial intelligence demand.

- Market Rotation: Despite the volatility in raw materials, analysts view the current price action as a rotation of capital rather than a sign of lasting trend fatigue.

- Commodity Slump: Oil and silver prices dropped sharply after President Trump signaled a pause in potential military action against Iran and held off on imposing new tariffs on critical minerals.

- TSMC Earnings Beat: Taiwan Semiconductor Manufacturing Co. reported better-than-expected quarterly profits of NT$505.7 billion ($16 billion), boosting sentiment for technology stocks and artificial intelligence demand.

- Market Rotation: Despite the volatility in raw materials, analysts view the current price action as a rotation of capital rather than a sign of lasting trend fatigue.

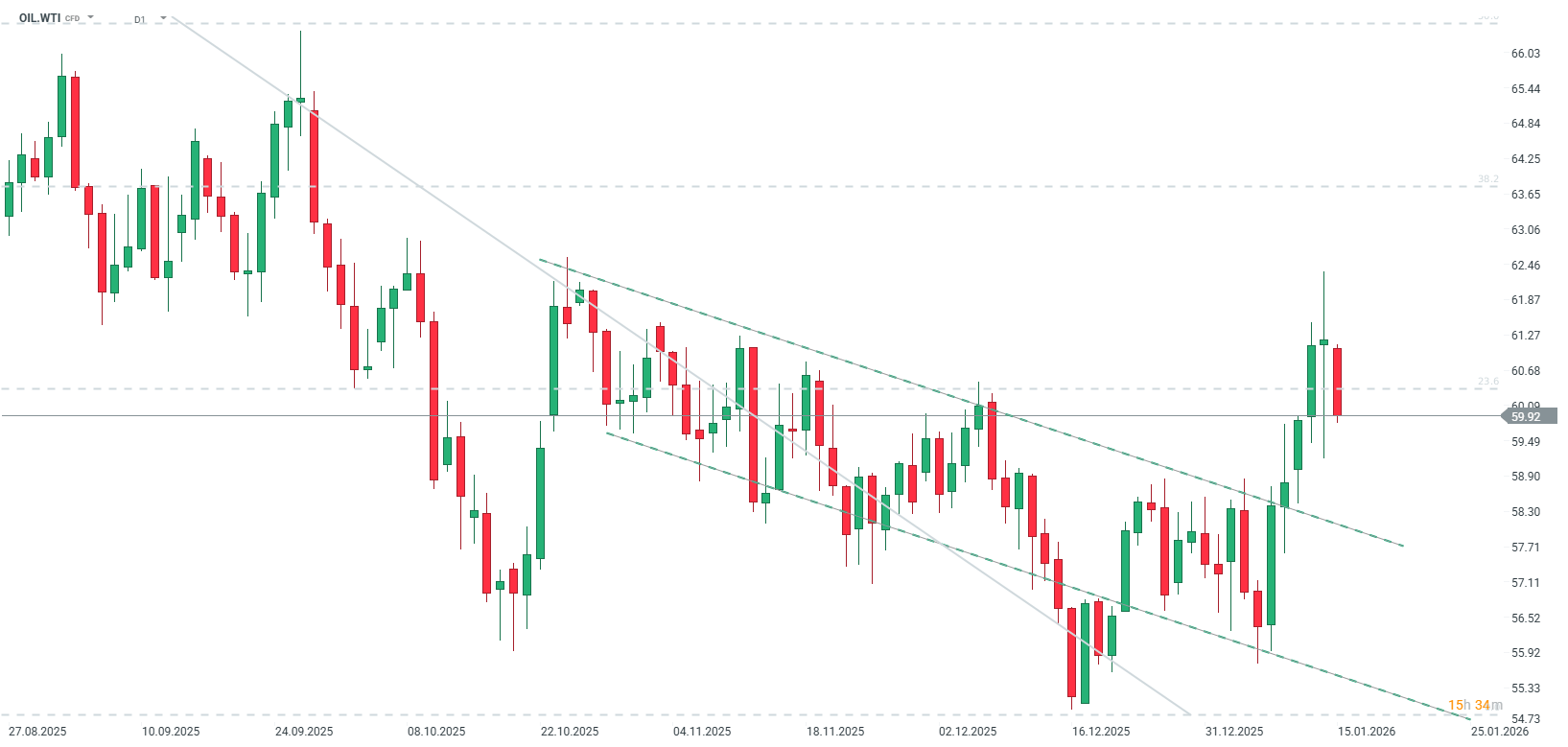

Crude Prices Slump on Easing Tensions

Oil prices have fallen for the first time in six days. This correction is primarily driven by signals from Washington regarding a potential de-escalation of geopolitical friction:

- Strategic Pause: President Trump indicated he may hold off on any military action against Iran for the time being.

- Diplomatic Assurances: The President stated he was reassured by sources that the government in Tehran would cease the killing of individuals involved in widespread protests.

- Price Action: West Texas Intermediate (WTI) crude has dropped from levels near $61 to trade below $60 per barrel. Brent crude also saw a significant decline of 2.9%.

- Market Structure: Current futures pricing shows the market in backwardation through March 2027—meaning spot prices command a premium over near-term futures—before shifting into a significant contango thereafter.

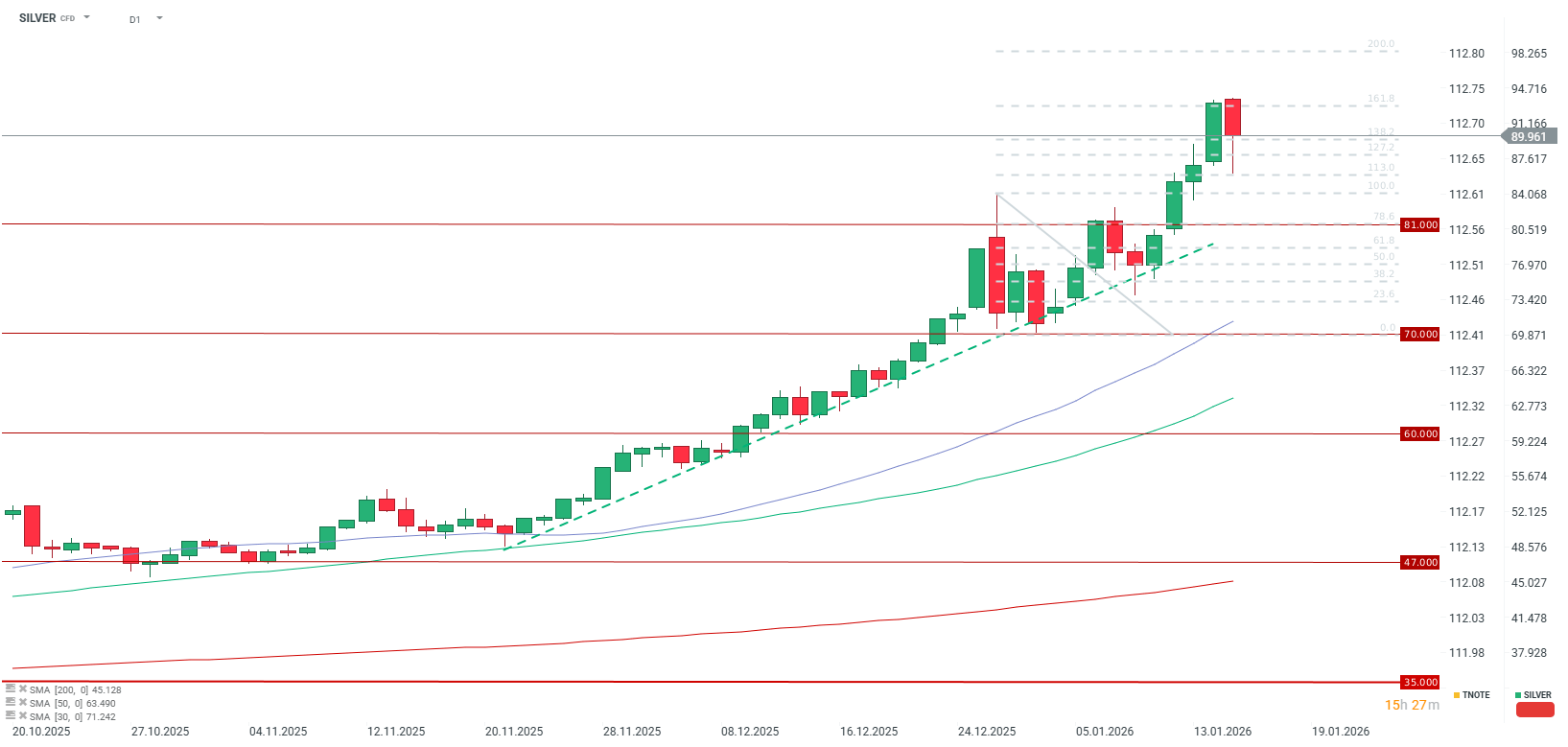

Silver Correction Follows "Frenzied" Buying

Silver, alongside other precious metals, has retreated from recent record highs. This pullback is notable as it follows a period of "frenzied" buying in both the US and China.

- Tariff Reprieve: Silver tumbled after President Trump held off on imposing new tariffs on critical mineral imports. While the immediate drop was recorded at 4%, intraday volatility saw the metal fall from near $93 toward $86 per ounce.

- Policy Shift: The administration has proposed negotiating bilateral agreements and floating "price floors" for imports rather than traditional percentage-based levies.

- Relative Performance: Silver's decline is being exacerbated by the broader reduction in geopolitical risk; meanwhile, gold has proved more resilient, losing only approximately 0.4%.

Broader Market Context: Rotation Over Fatigue

Despite Thursday's weakness, market analysts suggest these declines are currently too modest to derail the powerful bull trends established throughout 2025 and early 2026. The consensus is that the market is undergoing a capital rotation rather than a permanent trend reversal.

Investor sentiment was further bolstered by stellar results from Taiwan Semiconductor Manufacturing Co. (TSMC). The chipmaking bellwether reported net income of NT$505.7bn ($16bn) for the December quarter, easily surpassing analyst estimates of NT$467bn. While US and European equity-index futures rose on the news, TSMC shares saw a slight 1% dip in local trading following a marginal gain in US after-hours sessions.

Block Inc. lays off 40% of its workforce and rises 16% - Is this a new paradigm?

US OPEN: Wall Street holds its breath ahead of Nvidia earnings

Michael Burry and Palantir: A well-known analyst levels serious accusations

Palo Alto earnings: Is security cheap now?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.