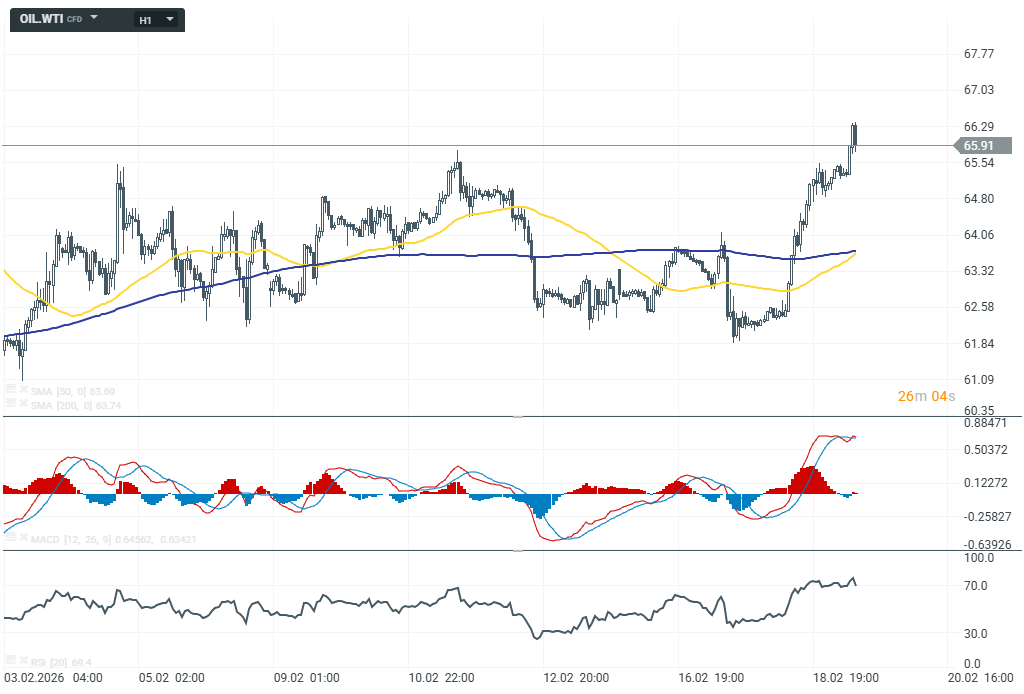

WTI crude is currently up 1.30% at 65.90 USD per barrel. Brent crude is trading above 70 USD. The escalation of tensions between the US and Iran has once again increased the geopolitical risk premium.

Reports of a deadlock in diplomatic talks and rising US military activity in the region have heightened concerns about a potential strike on Iran. Investors are building long positions ahead of the weekend, fearing that any disruption in the Strait of Hormuz could significantly constrain global supply. Although previous episodes of tension did not lead to sustained price increases, analysts warn that underestimating the current risk may be a mistake, especially as Iran signals the possibility of targeting energy infrastructure in the event of further escalation.

The macroeconomic backdrop further complicates the situation. The Fed meeting minutes showed policymakers remain cautious about rate cuts, with some even leaving the door open to renewed tightening if inflation proves persistent — supporting the US dollar and Treasury yields. At the same time, a potential upcoming Supreme Court ruling on tariffs could materially shift expectations for economic growth and oil demand. A positive pro-growth surprise — such as the removal of tariffs — could further support oil prices through improved demand prospects, while weak macro data or hawkish signals from the Fed could cap gains despite geopolitical tensions.

From a technical perspective, oil has rebounded strongly from support in the 62–63 USD area and is now testing key resistance in the 66–67 USD zone. A clear breakout above this level would open the way toward 70.50 USD and could further increase the geopolitical premium in prices. However, in the absence of a clear escalation of the conflict, the market may remain within its existing range, balancing headline risk against macroeconomic fundamentals.

Morning wrap (19.02.2026)

Fed minutes released 🗽Key takeaways

Daily summary: Wall Street and oil gain 📈 EURUSD slides 0.5%

Gold surges 2.5% nearing $5000 per ounce 📈

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.