The OPEC organization, which brings together the largest oil producers to control prices, has published its monthly report, and oil prices fell by more than 1% following the publication.

The organization points to the continuation of several trends regarding oil production and consumption worldwide.

Demand for oil continues to grow, but the growth rate is increasingly slowing down.

- By the end of 2025, it is expected to reach 105.1 million barrels of oil per day, and in 2026, it is expected to average as much as 106.5 million barrels of oil per day.

The growth is primarily visible among non-OECD countries, while the demand for oil in developed countries remains stable at 46 million barrels.

In terms of product breakdown, LPG gas is the leader in growth, followed by gasoline and so-called light oil distillates. Diesel shows meager growth, and the demand for heavy distillates is declining in nominal terms.

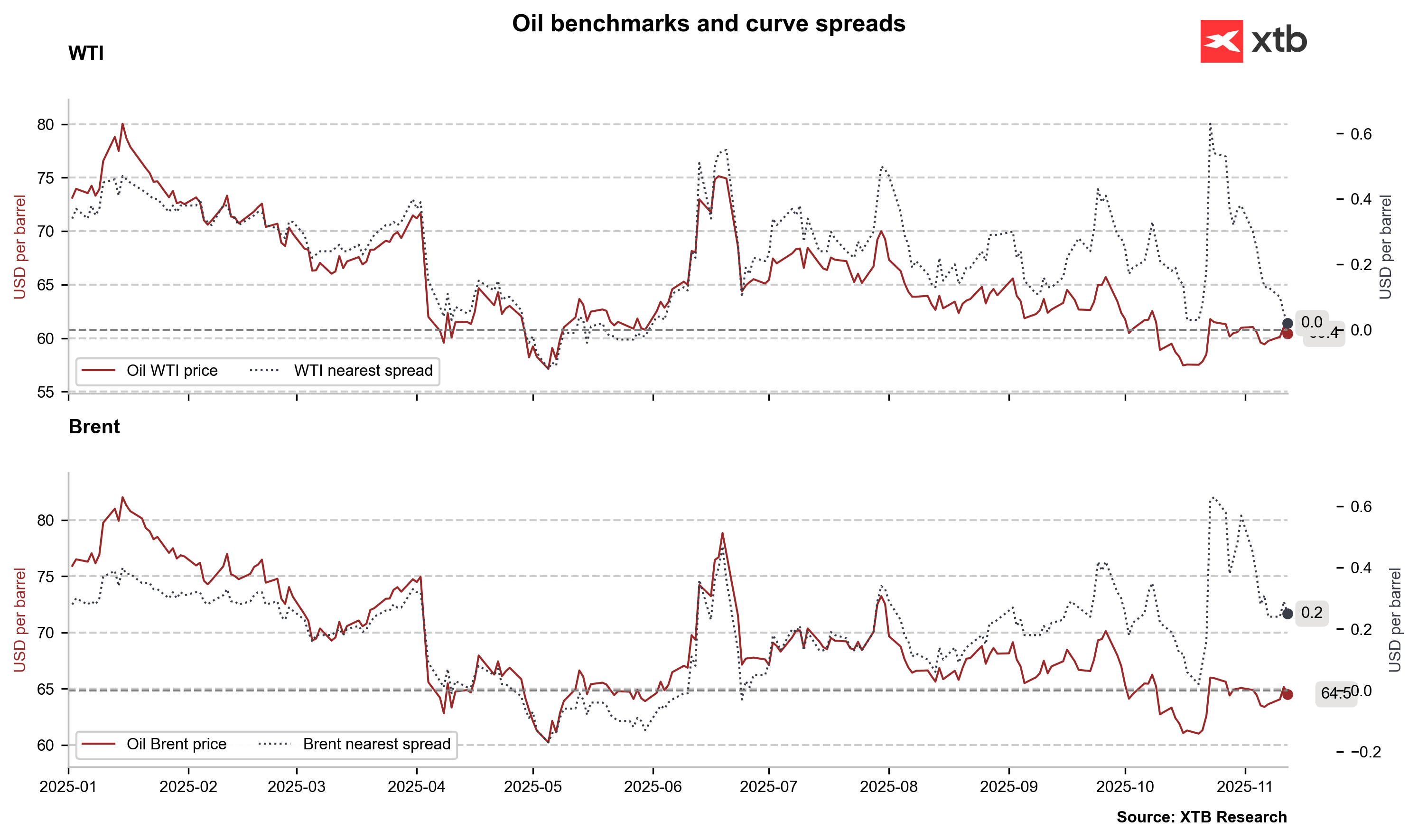

In the futures market, the number of net long positions on WTI oil continues to decline and remains at local lows. Much larger net long positioning can be observed on Brent oil.

Looking at the prices of oil varieties, the biggest losses are recorded by Zafario oil from Guinea and Ural oil from Russia.

OPEC is optimistic about the economic development forecasts worldwide in 2026.

- The organization expects an average growth of 3.1%, with India and China being the leaders in growth. OPEC also forecasts an improvement in the economic situation in the USA, a stable situation in Europe, and further slowdown in Russia.

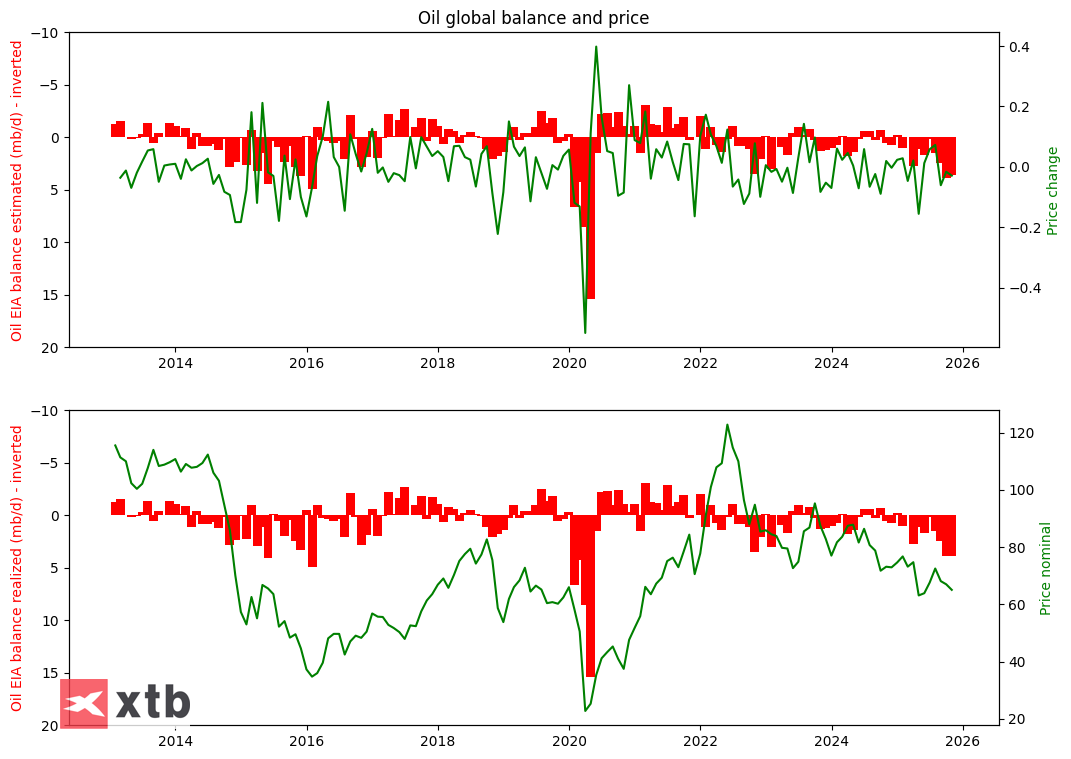

The most important part of the report in the context of the current market situation is the supply side of oil. OPEC points to significant and stable growth in oil production in non-OPEC countries.

The leader in the ranking is the USA, with an average production increase of 22.07 million barrels of oil in 2025, which represents an increase of about 300,000 barrels.

However, production is expected to slightly decline in Q4-2025. Significant increases are also registered in Latin America, mainly Brazil and Argentina.

OIL.WTI (H1)

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.