There is renewed buzz about one of the world's most important shipping lanes. The world's largest carriers like Maersk Tankers, Moller-Maersk, Hapag Lloyd, MSC and CMA CGM are indicating that their ships will avoid the canal due to recent increased attacks from pirates and increased attacks in Yemen. BP or Equinor also spoke of changes in shipping. In addition, recent storms have led to a reduction in the number of ships carrying Russian Urals oil.

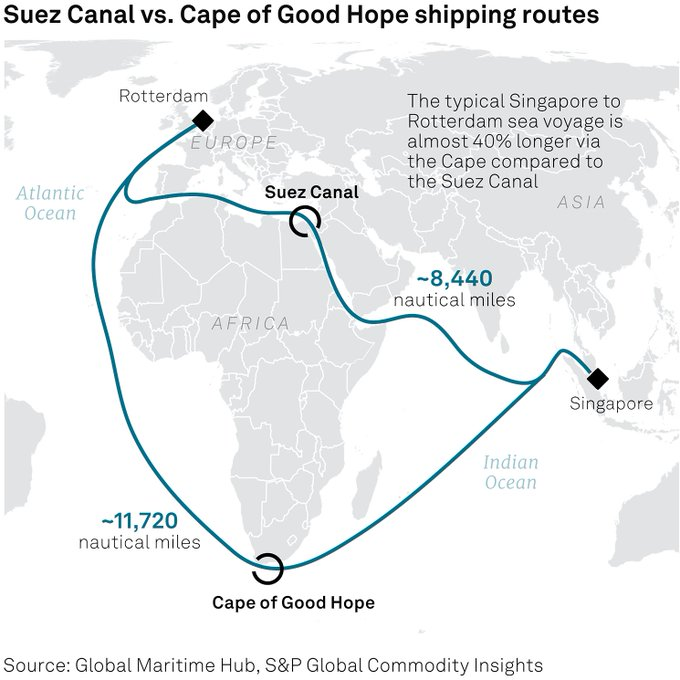

Red Sea is now largely closed to traffic. That's 8.8 million bpd of daily oil transit, and nearly 380 million tons of daily cargo transit. Global traffic now will be rerouted around Cape of Good Hope, adding 40% to voyage distance. Source: S&P Global

It's worth remembering that these are likely one-time factors, although of course indicators such as seasonality and positioning of speculative investors suggested a short-term bottom in the oil market.

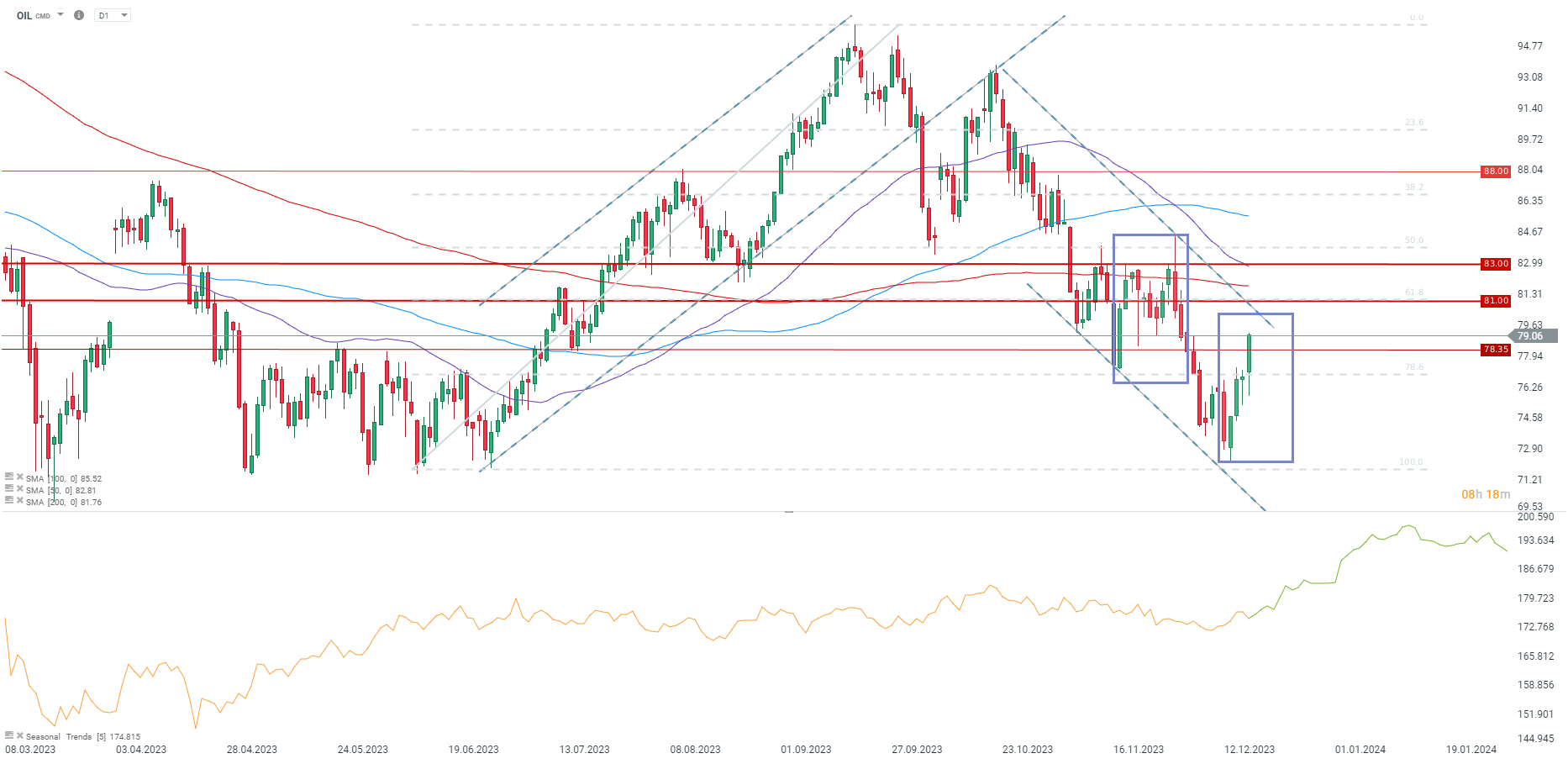

Brent crude oil has already risen nearly 10% from its local low at $72 per barrel. The nearest important resistance will be around $80.3 per barrel, followed by the area around the 200-session average at $82 per barrel. However, if the pressure from export restrictions eases, a correction from the vicinity near $80-81 per barrel is not out of the question.

Source: xStation5

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

Three markets to watch next week (09.02.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.