Oil is trading higher today, with Brent (OIL) advancing 1.2% and WTI (OIL.WTI) trading around 1.6% higher at press time. The move higher is a continuation of the rebound launched last week, and comes even in spite of OPEC lowering its global demand growth forecasts today. Growth forecast for 2024 was lower by 140 thousand barrels per day, while forecast for 2025 saw a 70 thousand barrels downward revision. Group explained that the revision was driven by deterioration in outlook for Chinese oil demand growth. However, growth is still expected to remain 'healthy'.

New OPEC global demand growth forecast

- 2024: +2.11 million barrels per day, down from previous forecast of +2.25 million bpd

- 2025: +1.78 million barrels per day, down from previous forecast of +1.85 million bpd

The move higher today can be blamed on geopolitics as tensions in the Middle East remains high and the feared Iranian response to assassination of Hamas leader in Teheran is yet to come. Fox News came out with a report today saying that Iran and its proxies in the region may launch a large missile attack on Israel within the next 24 hours. However, it should be said that there have been a number of such warnings from news outlets in recent days.

Near-term outlook for oil will depend on the scale of Iranian attack and damage it causes. If the majority of missiles are intercepted by Israel and its allies, as was the case in April, then Israeli response will likely be limited and the Middle East should avoid broader conflict, at least for now. However, if the attack causes significant damage, then it is more likely than not that Israel will retaliate with significant force as well, which would trigger an Iranian response, and the situation in the region could escalate into an all-out war between Israel and Iran.

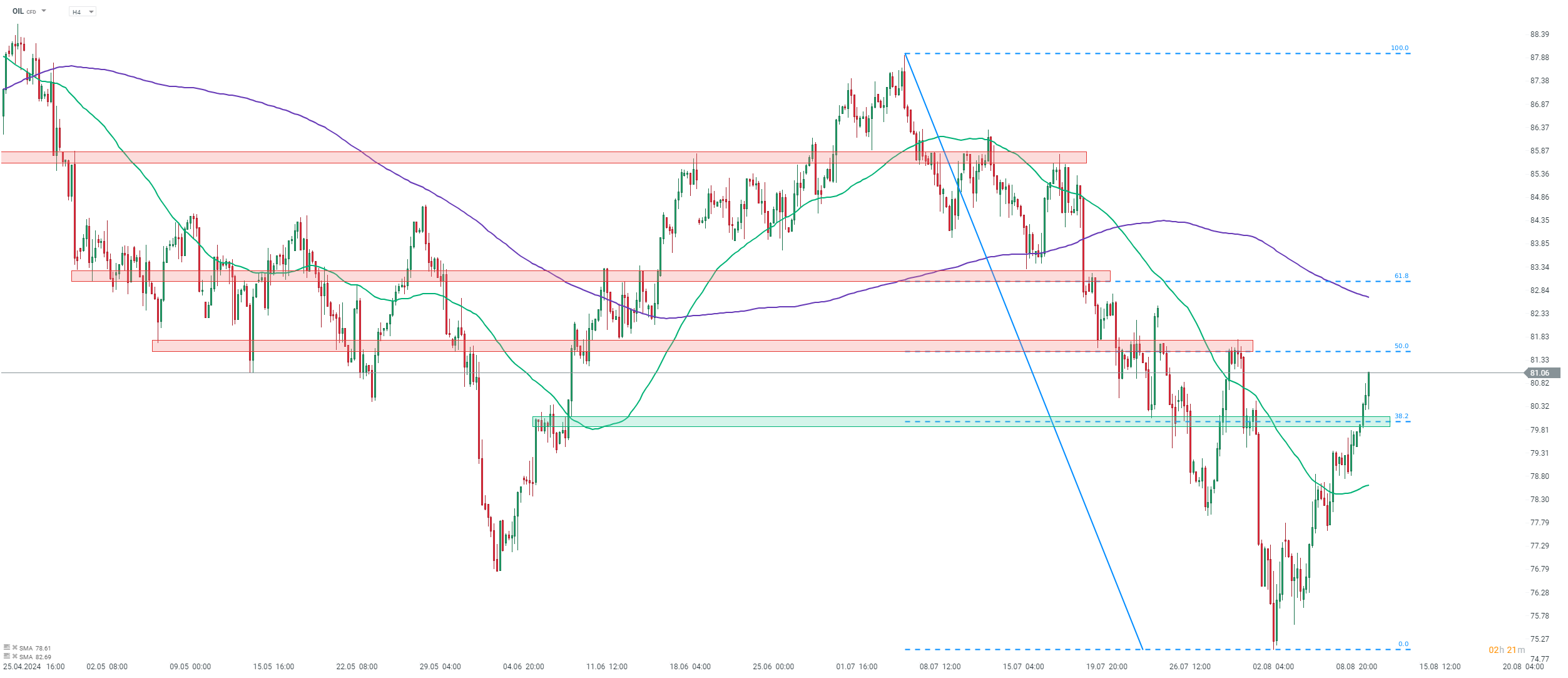

Taking a look at OIL chart at H4 interval, we can see that price is trading around 8% above last week's lows and is making a break above the $81 per barrel mark at press time. A potential near-term resistance zone to watch can be found in the $81.50 area, where the 50% retracement of the downward move launched at the beginning of July can be found.

Source: xStation5

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.