Oil prices are clearly being weighed down by a strong dollar index at 20-year highs and fears of a global recession causing a drop in demand for crude. Currently, 2022 is among the 6 most volatile years in the oil market over the past 30 years. The price of brent crude dropped below $84 per barrel today:

- The oil market will hold its breath on October 5, when OPEC and OPEC+ meet. At the previous meeting, the groups reached an agreement in the form of a small production cut. A decision to drastically reduce production could theoretically support a price increase. On the other hand, OPEC+ is still deciding below its production target, so further cuts might not have a significant impact on actual;

- Data published last week indicated that OPEC+ countries failed to produce even 3.58 million barrels per day (target) in August, indicating an even greater shortfall than in the previous month;

- Global oil stocks are still relatively low after losses in 2021, when OPEC+ producers failed to keep up with increasing production for the massive demand resurgence after the pandemic. Additionally, sanctions on Russia could further hit available supply and petroleum products. The recession in Europe and the US could also affect China and dampen demand (decline in orders) for oil even if COVID restrictions are lifted in the Middle Kingdom;

- On the other hand, this is contradicted by the Baltic Dry Index, which tracks dry freight prices on the 20 most popular trade routes. The index has risen nearly 100% since the beginning of the month, which could herald resurgent demand in the global economy and more intensive trade, which could support a potential rebound in oil prices. As a rule, the index declines when trade between countries slows, which is reflected in the falling price of freight;

- An EU sanctions package banning Russian oil sales is set to begin in December under the G7 plan, which could tighten crude supply. Bloomberg reported Monday that the EU is having trouble agreeing on a cap on the price of crude, and unanimity has not been reached on the issue;

- If oil demand is not destroyed, it appears that 'black gold' still has a solid case for a rebound toward the psychological $100 per barrel limit. The physical supplier market remains tight, with physical crude prices diverging from the futures situation.

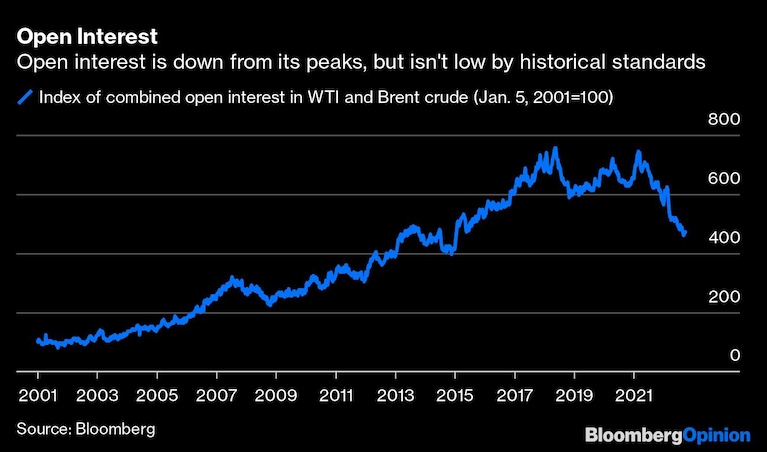

The number of open positions in the oil futures market has fallen, but historically looking is still at high levels. Source: Bloomberg

The number of open positions in the oil futures market has fallen, but historically looking is still at high levels. Source: Bloomberg

OIL chart, D1 interval. On the chart we can see how the 50-session average crossed the top of the 200-session average, which in technical analysis is referred to as a 'death cross', which usually heralds a prolonged weakening of demand and further declines. However, it is worth noting the high volatility of oil and the possible extended sanctions on Russian crude, which could further tighten supply and contribute to the rise in oil futures. Source: xStation5

OIL chart, D1 interval. On the chart we can see how the 50-session average crossed the top of the 200-session average, which in technical analysis is referred to as a 'death cross', which usually heralds a prolonged weakening of demand and further declines. However, it is worth noting the high volatility of oil and the possible extended sanctions on Russian crude, which could further tighten supply and contribute to the rise in oil futures. Source: xStation5

Daily summary: Its fear, but not panic yet. Trump has shaken the markets again.

New front in the trade war: Greenland❄️Will Gold rise further❓

Gold: escalating US–Europe tensions drive prices to new highs 💰

Daily summary: Banks and tech drag indices up 🏭US industry stays strong

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.