Oil has a stellar start of a new year. Not only prices managed to break above 2021 highs but Brent price even managed to reach the highest level since 2014. Both major grades of oil - Brent and WTI - trading over 12% year-to-date higher. Moreover, energy commodities are unquestionably the best performing class of commodities after the first two weeks of 2022. Given that expectations at the end of 2021 pointed to a completely different scenario, one may wonder what is the reason behind the latest oil price gains?

Gloomy outlook for 2022

Outlook for the oil market in 2022 is not too rosy. Almost every major institution expected that 2022 will be marked with significant oversupply. Oversupply was expected to lead to rebuilding of inventories that have been dropping for a dozen or so months and reached the lowest levels in 5 years. Impact of Omicron was seen as a basis for such expectations. Meanwhile, the market started to speculate that OPEC+ may abandon the output hike policy. However, reality turned out to be different. OPEC+ announced that it will continue to increase output and Omicron turned out not to have as big an impact on mobility and oil demand as expected.

Why are oil prices the highest in 7 years?

There are many factors behind the recent price rally, mostly one-off factors. Recent supply disruptions in Libya and Kazakhstan are perfect examples of such factors. While the situation in both countries have not been fully resolved yet, it has improved enough to trigger a short-term drop in oil prices. However, market has quickly refunnelled its focus to long-term outlook. Hit from Omicron turned out to be smaller-than-expected and OPEC+ may struggle to continue to increase output amid low spare capacity. Apart from that, tensions in the Middle East are on the rise again with Yemeni Houthis launching drone attacks on airports in the United Arab Emirates.

Brent price (OIL) reached the highest level since 2014. Source: xStation5

Brent price (OIL) reached the highest level since 2014. Source: xStation5

What's next?

Key themes in the oil markets this year will be supply and demand balance. Changes in Fed's policy will also have an impact on oil due to its impact on USD. Among top factors to watch in oil this year one can find:

-

Return of demand to pre-pandemic levels, even without full recovery in air traffic

-

When it comes to demand, market will watch closely whether consumers substitute expensive natural gas with oil derivatives

-

OPEC+ policy will have a key impact on long-term outlook

-

OPEC+ refrains to change its policy in order not to lose position of leader in the oil markets

-

In spite of leader position and the biggest impact on prices, OPEC+ may not be able to restore production to pre-pandemic levels due to inadequate investments in recent months

-

Nuclear talks with Iran continue but there is no end in sight. Majority of institutions does not expected additional supply from Iran to arrive on the markets this year

-

United States plans to continue to boost output but at a slower pace than in pre-pandemic times. Pressures from environmental groups in the United States are on the rise and a ban on new shale projects may be enacted. Ban on new drilling projects in Alaska has been already imposed

Taking factors mentioned above into consideration, earlier expectations of lower demand and much higher supply may not materialize. A previously expected oversupply may turn out to be a large deficit. Goldman Sachs expects such a scenario and boosts price forecasts for Brent and WTI in Q3 and Q4 2022 by $20 per barrel, to a psychological barrier of $100 per barrel.

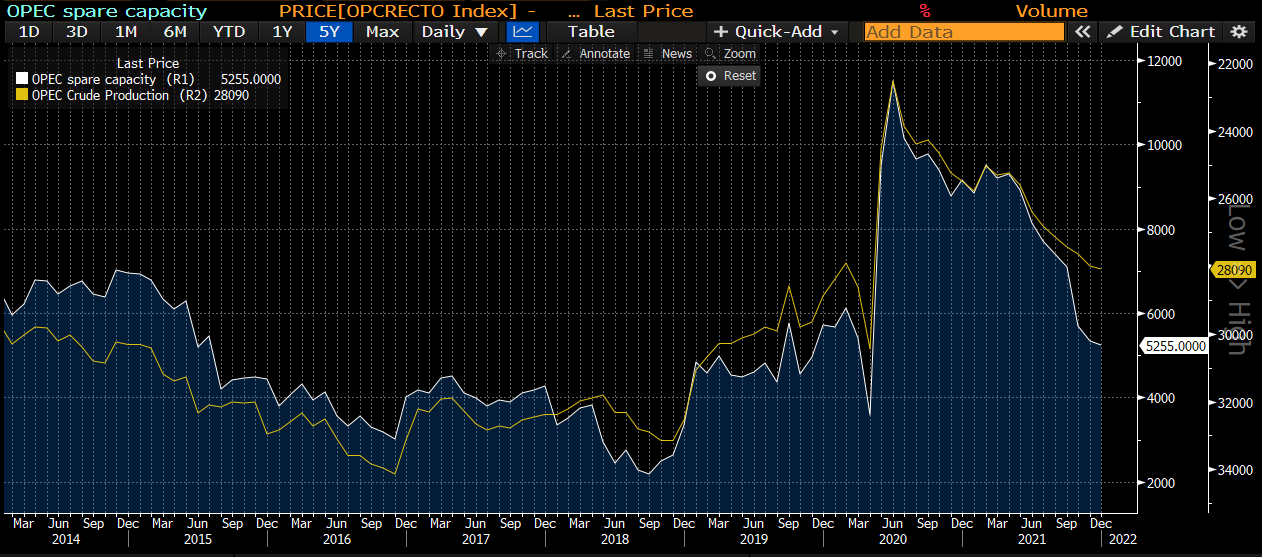

Spare production capacity in OPEC countries (white line) is in freefall and drops much faster than cartel's production is increasing (yellow line, inverted axis). Situation suggests that lack of adequate investments in recent months may make it impossible to restore production to pre-pandemic levels. Source: Bloomberg

Spare production capacity in OPEC countries (white line) is in freefall and drops much faster than cartel's production is increasing (yellow line, inverted axis). Situation suggests that lack of adequate investments in recent months may make it impossible to restore production to pre-pandemic levels. Source: Bloomberg

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.