- First BoJ decision with new chief after ultra dovish Kuroda's departure

- Ueda has repeatedly stressed recently that policy must remain accommodative

- According to commentators, Ueda is not a "fan" of the yield curve steering tool

- The BoJ believes that the banking crisis has added a lot of uncertainty and a premature rate hike could lead to a miss on the long-term inflation target

- Economic projections may be key to the reaction, in particular whether we will see inflation at the target by the forecast date

- The decision should be published at 3:00 GMT

The Bank of Japan remains the last bastion of ultra-loose monetary policy in the world. Not counting the adjustment in the yield curve steering tool, rates have remained unchanged for quite some time (they were lowered to negative levels during the pandemic). Although inflation exceeded the target, according to the BoJ, this was due to temporary factors and also the new head indicates that inflation will fall below 2% later this year.

Higher wages

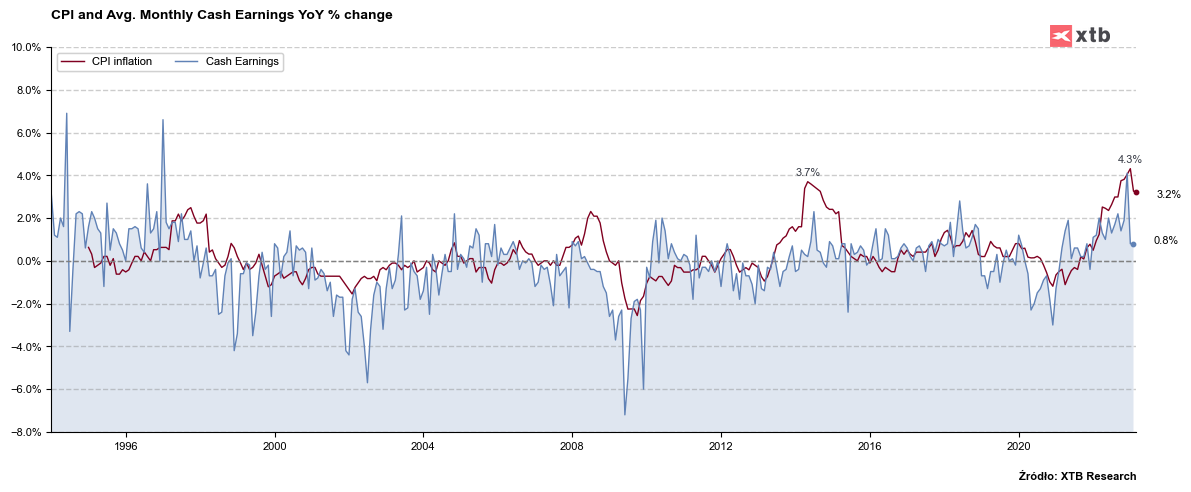

Markets were making hopes that the new BoJ chief would bring freshness to policy and make an exit from the ultralow monetary policy in which Japan has been stuck in recent decades. This was supported by wage growth, which is not only in line with the 2% inflation target, but also points to stronger upward pressure. Annual wage negotiations are expected to produce the largest wage increases in 3 decades at 3.8% y/y. Previously, it was specified that 3% wage growth was a prerequisite for starting discussions on tighter monetary policy. Despite the fact that wages are already growing much more strongly, there are no statements about tightening monetary policy.

Monthly earnings in annual growth - here we see a marked decline in the last month, but previously the pace suggested a positive impact on inflation. The wage negotiations should contribute to the strong growth in monthly wages again. Source: Bloomberg, XTB

Monthly earnings in annual growth - here we see a marked decline in the last month, but previously the pace suggested a positive impact on inflation. The wage negotiations should contribute to the strong growth in monthly wages again. Source: Bloomberg, XTB

Yield curve control

The yield curve control (YCC) program remains one of the most important factors. Last year, a two-fold increase in the volatility band for 10-year yields was made, avoiding a problem in which 8- to 9-year yields were higher than 10-year yields, and allowing a near-dead trade in 10-year bonds to unravel. The market speculated that the program might even be abandoned, particularly with the new BoJ chief expected to not be a big fan of the tool. On the other hand, the banking crisis has led to greater demand for safe debt, which has lowered yields somewhat and does not require the current correction.

Macro projections

Attention will be focused on the inflation forecast for fiscal year 2025. If the forecast here falls below 2.0%, it will indicate a dovish stance by the Bank of Japan. In the case of a forecast above 2.0%, it can be expected that changes may come later this year.

What's the future of JPY?

A surprise can't be ruled out, particularly since Ueda has announced a review of past monetary policy. This review may suggest that changes are coming, although it may be too early for them. In addition, macroeconomic projections may breathe renewed hope into the financial markets that changes will be more rapid. Some private institutions in Japan suggest that changes to the YCC will be announced in June or July. However, this will depend on whether the BoJ sees inflation at target by the forecast deadline.

If the BoJ doesn't surprise, it could even be possible to go out near 135 pt. before the Fed rate hike decision, but thereafter the pair will largely depend on the Fed overall policy and it's 'hawkishness'. We believe that despite the pro-inflationary GDP data, the US dollar should start losing in the next few days. Confirmation of this would be a move below the local minima of mid-March. Source: xStation5

⏬EURUSD softens ahead of the US CPI

Market Wrap: Dollar accelerates before CPI. Mixed earnings from French giants (13.02.2026)

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Economic calendar: US CPI in the spotlight (13.02.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.