- Oracle stock has experienced rapid growth and decline recently.

- The market expects the company to deliver tangible growth, failure might result in harsh declines

- It's paramount that the management board "reads the room" on CAPEX

- Oracle stock has experienced rapid growth and decline recently.

- The market expects the company to deliver tangible growth, failure might result in harsh declines

- It's paramount that the management board "reads the room" on CAPEX

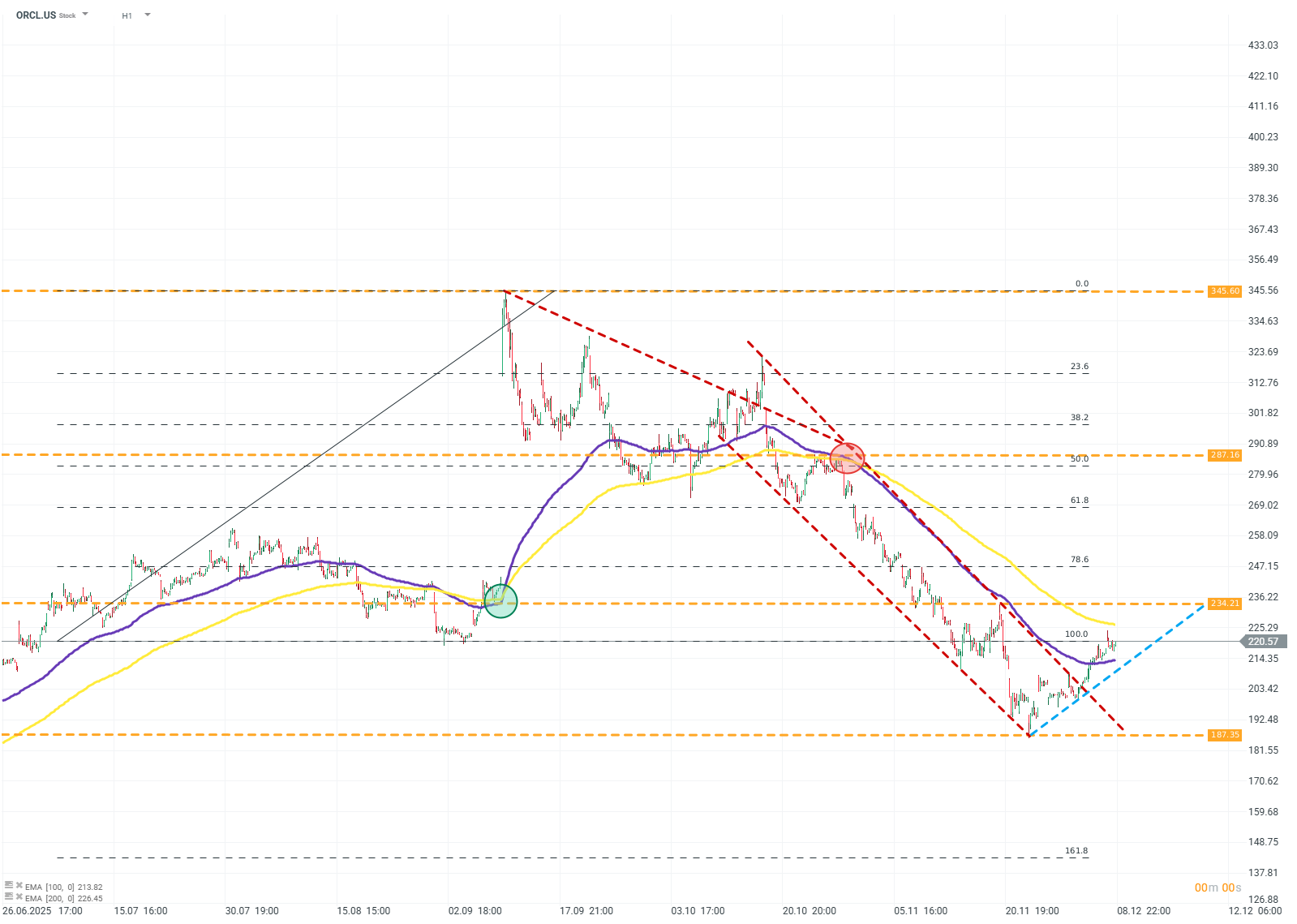

Oracle, one of the leaders in cloud services and infrastructure, will be releasing its results after the close of Wednesday's session in the USA. The company's valuations have experienced a year of dramatic changes in valuation and sentiment.

A proper increase in revenues and profits, combined with an unprecedented backlog growth driven by the agreement with OpenAI, has propelled Oracle's valuations to new heights. However, investors quickly began to scrutinize the company's planned cash flows, particularly CAPEX. The company is attempting to generate CAPEX at the level of so-called mega-caps, despite not being one itself. Additionally, it is trying to do so under conditions where Oracle is already burdened with a debt-to-equity ratio of approximately 450%. This has raised significant concerns, leading to the company losing about 30% of its valuation in recent months, along with a noticeable increase in CDS contract activity.

What are the expectations for the results?

Recent publications have often disappointed investors in terms of revenues and profits, but they have compensated with prospects, forecasts, investments, or dynamic development in key areas. This time, however, shareholders may demand the realization of at least some of these promises.

Earnings expectations are around $1.64 per share, with revenues expected to be around $16.19 billion. Another disappointment in these areas may not be received with the same patience by investors as in previous conferences. Importantly, investors will ultimately pay more attention to profitability than revenue.

What may prove absolutely critical is the proper interpretation by the company's management of the market's attitude towards CAPEX. They are no longer a value in themselves, and further increases in the current situation may provoke further devaluation.

ORCL.US (H1)

Source: xStation5

Block Inc. lays off 40% of its workforce and rises 16% - Is this a new paradigm?

US OPEN: Wall Street holds its breath ahead of Nvidia earnings

Michael Burry and Palantir: A well-known analyst levels serious accusations

Palo Alto earnings: Is security cheap now?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.