Oracle (ORCL.US), a cloud services giant, is a company that has built its position over decades primarily on databases and enterprise software, and today is increasingly focusing on the development of cloud computing and artificial intelligence. On one hand, Oracle still derives a significant portion of its revenue from traditional database systems and business applications, while on the other hand, the role of Oracle Cloud Infrastructure and SaaS services is growing. The company has become one of the beneficiaries of the AI boom, partly due to high-profile contracts with OpenAI and other partners. Today's financial results, published after the market closes, will not only be a quarterly report but also a test of how the market evaluates Oracle's strategy in the world of cloud and AI.

Source: Xstation

In the short term, the company is in a very strong upward trend – the stock price has gained over 90% from local lows in April, and several investment banks are raising their price forecasts, reaching even 300–325 USD. This is due to expectations of further revenue growth from the cloud, an increasing order backlog, and increased demand for infrastructure for AI models.

At the same time, more cautious voices are emerging – for example, RBC Capital believes that the valuation is already too high, pointing to a possible slowdown in OCI growth. In the long term, key questions concern not only further AI contracts, but also whether the company will be able to maintain margins with increasing capital expenditures on data centres and equipment.

In recent weeks, there has also been talk of large layoffs at Oracle – over 3,000 people, mainly in marketing and customer service departments, which is part of a broader wave of restructuring in the tech industry. On the other hand, the market is buzzing with reports of potential multi-billion dollar contracts with OpenAI, which would be effective from 2028 and significantly increase long-term cloud revenue. These conflicting signals mean that today's results will be analysed particularly closely.

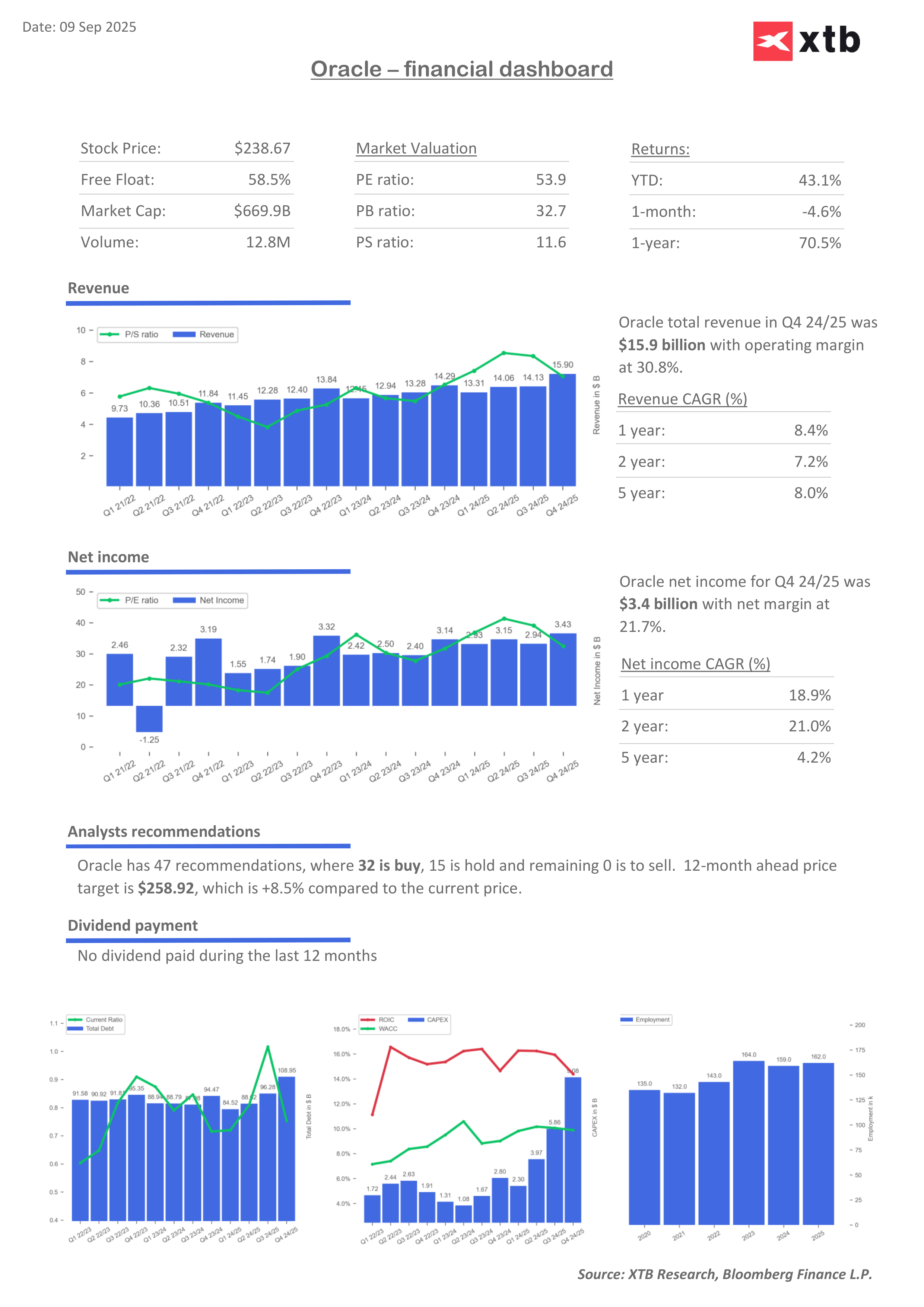

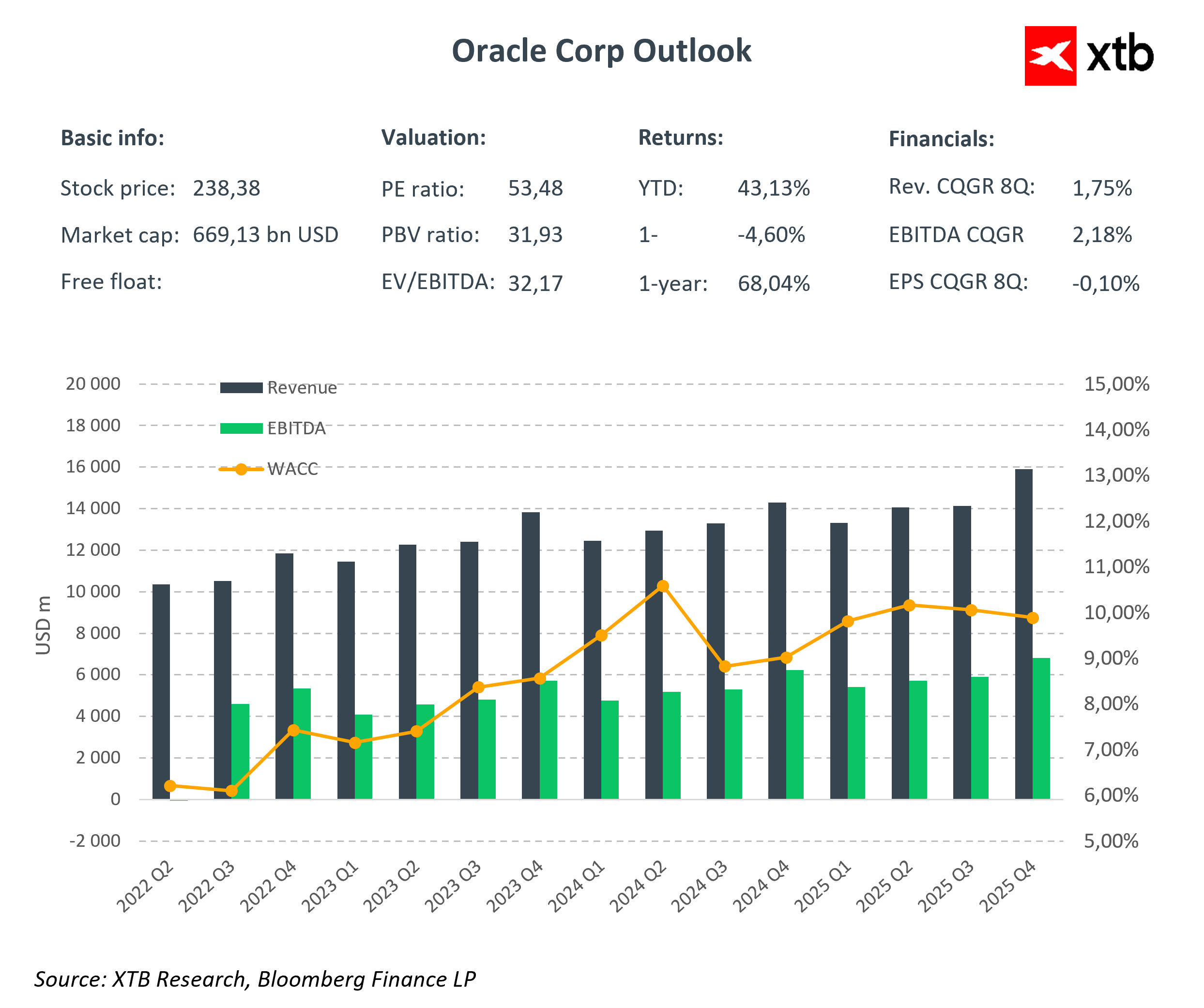

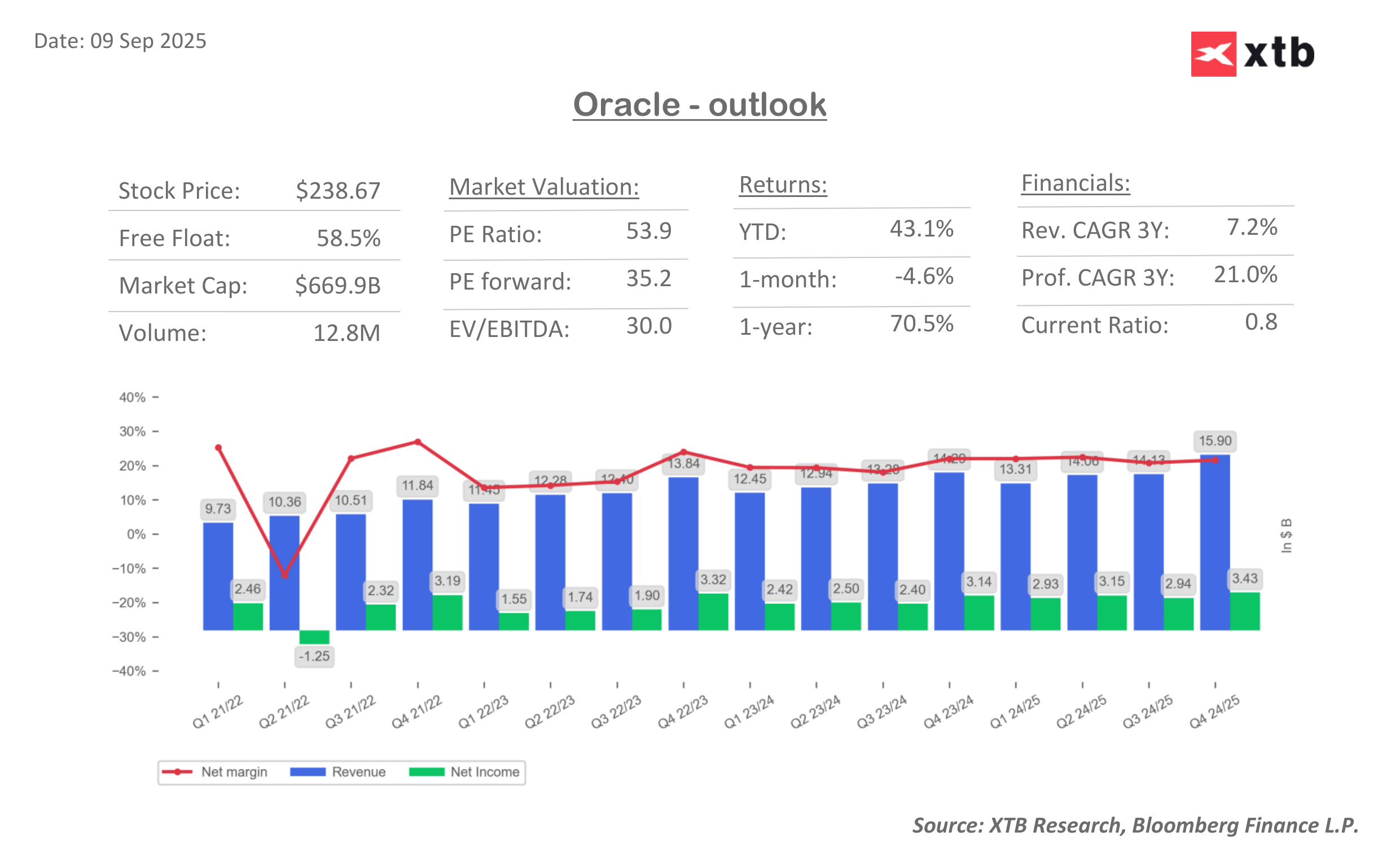

As can be seen in the revenue and valuation metrics charts, the company's growth is stable, and very high metrics are gradually normalizing.

The market's base scenario currently is that the company will exceed forecasts both in terms of EPS and revenue, show strong growth in OCI, and provide clear signals regarding the execution of the agreement with OpenAI and other partnerships. In such a case, the shares could continue their dynamic rally.

However, if the company disappoints, for example, with lower-than-expected cloud revenue, more cautious comments regarding margins and CAPEX, and a lack of specifics about large AI contracts, such a report could become a pretext for profit-taking and a correction in the stock price after such large increases in recent months.

It is worth noting that the expected results for the first quarter of the new fiscal year Q1 FY26 – which is effectively the second calendar quarter – will be weaker than those reported for the previous period, Q4 FY25. At that time, Oracle showed revenue of 15.9 billion USD and EPS of 1.70 USD, higher than current consensus estimates of around 15.0 billion USD and 1.48 EPS. However, such weakness does not necessarily mean problems right away – Q4 traditionally tends to be a stronger sales period for the company. Nevertheless, the market will be watching whether the decline is merely a seasonal effect or a signal that the growth rate of cloud and AI services is beginning to stabilize. If it turns out that the lower numbers are a temporary effect, investors may ignore the difference compared to Q4.

However, if the company does not present strong prospects for the coming quarters, there will be concern that the stock valuation – already very high – does not have sufficient foundation in real revenues. In extreme cases, this could lead to a larger correction in the sector.

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.